As of November 2025, Hawaii homeowners can access up to $9,590 in combined solar incentives, but time is critical. The 30% federal solar tax credit ($4,590 average) expires December 31, 2025, while Hawaii’s 35% state tax credit ($5,000 cap) remains available indefinitely. Hawaiian Electric customers paying $0.43 per kWh (the nation’s highest electricity rates) can achieve payback periods as short as 4.5 years when combining these incentives.

Available Hawaii solar incentives in 2025:

- Federal Tax Credit: 30% of installation costs (expires 12/31/2025, systems must be fully installed)

- Hawaii RETITC: 35% state tax credit, capped at $5,000 (no expiration)

- GEMS Financing: 5.5% APR, 20-year loans for income-qualified homeowners

- Honolulu Property Tax Exemption: 100% exemption for 25 years (City of Honolulu only)

- Hawaiian Electric BYOD Plus: Up to $2,000 battery storage rebates

Homeowners should also consider HOA regulations that may impact installation timelines and requirements.

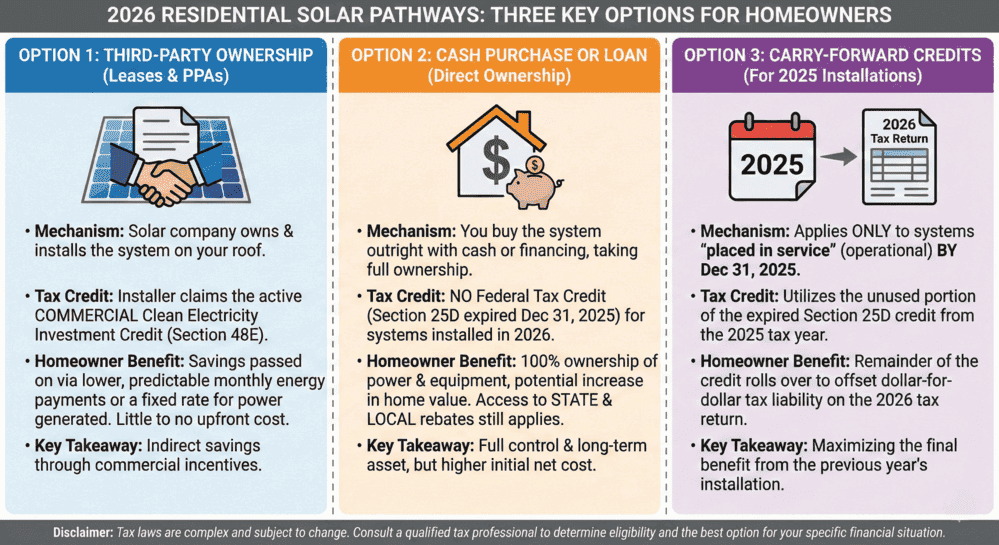

Critical deadline: Solar systems must be completely installed, permitted, and approved by December 31, 2025 to qualify for the federal tax credit. President Trump’s One Big Beautiful Bill, signed July 4, 2025, eliminated this credit nearly a decade early. Without federal incentives, payback periods extend from 7-8 years to 11-15 years, making immediate action essential for maximum savings.

Average Hawaii installation costs: $15,300 before incentives, dropping to $5,710 after applying both federal and state tax credits, a 63% reduction. Hawaiian Electric serves approximately 95% of Hawaii’s electricity customers and has achieved 36% renewable energy on its grids, streamlining the interconnection process through its Customer Interconnection Tool to help homeowners meet the 2025 deadline.

Critical 2025 Update: Federal Tax Credit Expiring

The 30% federal solar tax credit expires December 31, 2025. President Trump signed the One Big Beautiful Bill into law on July 4, 2025, which eliminated the residential solar tax credit nearly a decade ahead of its original schedule. Solar systems must be fully installed by December 31, 2025 to qualify for this credit. Homeowners considering solar should act quickly, as projects typically take several months from consultation to installation.

Are Solar Incentives in Hawaii Going Away?

The federal solar tax credit expires on December 31, 2025 for residential systems. However, Hawaii’s state-level incentives remain stable. Hawaii’s Renewable Energy Technologies Income Tax credit has no expiration date. Neither the GEMS program nor Honolulu’s property tax exemption has an end date on the horizon.

Overview of Hawaii Solar Incentives and Rebates

Solar Permit Solutions

Affordable Solar Permit Plans

Don't let permit costs slow your project. Professional plan sets at competitive prices — all 50 states, fast turnaround.

The 30% Federal Investment Tax Credit: Last Chance Before 2026

Quick Facts

- Value: 30% of solar installation costs

- Frequency: One-time tax credit, rollover for five years

- Deadline: System must be fully installed by December 31, 2025

- How to apply: File IRS Form 5695 with annual tax return

Hawaii homeowners can claim the 30% federal solar tax credit when installing solar, but only if the system is fully installed by December 31, 2025. The credit equals 30% of solar installation costs and applies to federal income tax liability.

The average solar system in Hawaii earns a federal solar tax credit of $4,590. This benefit doesn’t come as a lump sum payment. The federal tax credit reduces income tax liability, and homeowners won’t see the benefits until filing taxes for the year.

When tax liability is less than the federal solar investment tax credit value, liability gets reduced to $0, and the remaining credit value applies to the following year’s taxes. The credit can roll over for five years with no income limit.

Important: Systems must be fully installed, permitted, and approved to operate by December 31, 2025 to qualify. Signing a contract or placing a deposit is insufficient to meet the eligibility requirements.

Hawaii’s RETITC: 35% State Tax Credit With $5,000 Cap

Quick Facts

- Value: 35% of solar installation costs, up to $5,000

- Frequency: One-time tax credit

- How to apply: Hawaii Department of Taxation form N-342 with state income tax return

Hawaii’s Renewable Energy Technologies Income Tax Credit (RETITC) provides homeowners who install renewable energy systems, like solar panels, with a tax credit equal to 35% of installation costs up to $5,000.

Based on the average cost and size of solar installations in Hawaii, most homeowners earn the full $5,000 cap.

The Hawaii solar tax credit reduces state income tax liability value. Like the federal tax credit, Hawaii’s state solar tax credit won’t reduce the upfront cost of solar installation directly. Instead, homeowners see the savings on taxes for the year the clean energy system was installed.

If the credit exceeds total taxes owed in a single tax year, the credit may be carried forward. Under certain conditions, the credit may be refundable.

Low-Interest Financing Through GEMS Program

Quick Facts

- Value: 20-year solar loan, 5.5% APR

- Frequency: One-time financing

- How to apply: Hawaii Green Infrastructure Authority website or mail-in application

The Green Energy Money Saver Program helps low and middle-income Hawaii residents go solar.

The GEMS program provides homeowners a 5.5% APR, 20-year solar loan repaid through the electric bill. GEMS loan financing rates tend to be lower than conventional solar loans, and the program doesn’t require a credit check.

The monthly projected utility bill must be at least 10% lower than the current pre-solar bill. The Hawaii Green Infrastructure Authority runs the program, not Hawaiian Electric. Hawaii’s renewable energy transformation has created multiple financing pathways for homeowners.

To qualify for GEMS, applicants must:

- Be a customer of Hawaiian Electric, Maui Electric, or Hawaiian Electric Light Company

- Have an income below 140% of the area’s median income (AMI)

- Have a minimum of six months of history with the utility company and maintain an account in good standing

Property Tax Exemption For Honolulu Homeowners

Quick Facts

- Value: 100% property tax exemption

- Frequency: Annual exemption for 25 years

- How to apply: File City of Honolulu Real Property Assessment Division form E-8-10.12 on or before September 30 of the preceding year for which exemption is claimed

Honolulu’s Real Property Exemption for Alternative Energy Improvements exempts solar panel installations from property taxes for 25 years. Only residents of the City of Honolulu qualify.

A recent study found that solar can increase home resale value by 6.9% on average. Based on Honolulu’s average home value and property tax rate, the Alternative Energy Improvement property tax exemption can save taxpayers $125 per year on property taxes when installing a solar photovoltaic system.

Understanding Hawaiian Electric’s Solar Billing Programs

Quick facts:

- Electric rates average $0.43 per kWh with Hawaiian Electric in 2025

- Hawaii does not have full retail net metering

- The grid-supply billing plan credits excess solar energy exports between $0.15 and $0.28 per kWh, depending on location

- The self-supply billing does not allow for energy exports

Hawaiian Electric offers two primary solar utility billing options for solar owners to choose from:

Grid-supply (Smart Renewable Energy Export): Solar panels first supply energy to the home. Any excess energy gets sent to the Hawaiian Electric grid and valued at a rate lower than the electricity rate. In Hawaii, grid-supply utility billing plans give credits between $0.15 and $0.28 per kWh, depending on location.

Self-supply (Smart Renewable Energy Non-Export): A solar energy system is designed only to cover a home’s energy usage and cannot send electricity to the grid. Limited amounts of excess power for short periods can be sent to the grid, but customers won’t receive compensation for this energy. For complete energy independence, homeowners may also consider off-grid solar systems.

Although these plans provide lower savings than a true net metering plan, where excess solar energy is credited at the full retail electric rate, Hawaii solar owners can still see significant savings because of Hawaiian Electric’s high electric prices.

Hawaiian Electric’s Interconnection Process

Hawaiian Electric has streamlined the solar interconnection process through its Customer Interconnection Tool, which allows homeowners to submit interconnection applications electronically at any time using standardized forms. The utility’s Integrated Interconnection Queue (IIQ) enables customers to view application status and understand their position among other customers based on circuit.

In 2025, Hawaiian Electric is actively processing applications for residential rooftop solar and battery storage systems. The utility has been responsive to the surge in demand following the announcement of the federal tax credit expiration, shifting additional staff to process applications quickly to help customers install and energize systems by the year-end deadline.

Hawaiian Electric has achieved significant clean energy milestones, with rooftop solar and battery storage surpassing 1 gigawatt of installed capacity across the five islands served. The utility achieved a 36% consolidated renewable portfolio standard in 2024, with about 43% of single-family homes having rooftop solar. Hawaii’s path toward 100% renewable energy by 2045 relies heavily on distributed solar generation.

How to apply for solar buyback plans and solar savings will vary depending on the Hawaiian Electric company serving the area. Visit hawaiianelectric.com/smartprograms for more information on options for solar homeowners. Avoiding common permit mistakes can help streamline the approval process.

Battery Storage Rebates And Credits Available In 2025

Solar batteries are a popular choice for homeowners in Hawaii because of the self-supply solar billing plan and because they provide access to backup power when the grid is down. According to research, Hawaii has the highest residential battery attachment rate of any state.

Although they can provide some extra electricity bill savings in Hawaii, solar batteries have a high upfront cost. Battery rebates and incentives can make energy storage installations more affordable. Here are solar battery incentive options in Hawaii:

Federal solar tax credit (expires 12/31/25): Energy storage installations are eligible for the 30% federal tax credit when paired with solar, which helps with total costs. Systems must be fully installed by December 31, 2025. Hawaii’s clean energy transition has accelerated battery adoption statewide.

Hawaiian Electric BYOD Plus Program: Launched in May 2025, the Bring Your Own Device Plus program replaced the previous BYOD Level 1 program. BYOD Plus offers battery rebates up to $2,000 and provides incentives for installing new batteries and dispatching them during specified time periods. This program allows Hawaiian Electric to utilize customer-owned battery storage systems for grid services.

Previous Battery Bonus Program: The Battery Bonus Program provided an upfront rebate of $850 per kW of battery output and continuing monthly capacity payments. As of July 2024, the program is closed to new applicants.

What Does Solar Cost In Hawaii After Incentives?

Rooftop solar panels in Hawaii cost about $3.00 per watt installed, bringing the average cost to install a 5.1 kW solar installation in Hawaii to $15,300 before incentives. Once the federal and state solar tax credits are considered, the cost of home solar in Hawaii falls to just $5,700.

State tax credit: $15,300 x 35% = $5,333 (capped at $5,000)

Federal tax credit: $15,300 x 30% = $4,590

Total savings: $5,000 + $4,590 = $9,590

Effective system cost: $15,300 – $9,590 = $5,710

When pairing a solar PV system with a solar battery, the total system cost will be closer to $28,000. Solar battery installations still qualify for the federal tax credit through December 31, 2025, so a solar-plus-storage system in Hawaii after incentives would cost $14,810.

The cost of a solar panel installation depends on several factors, like how many solar panels get installed, the installer used, and the characteristics of the roof.

Without the federal tax credit after 2025: Starting January 1, 2026, homeowners will only receive the $5,000 Hawaii state tax credit, bringing the effective system cost to $10,300 instead of $5,710, a difference of $4,590.

How Do Solar Incentives and Rebates Impact Each Other?

The solar incentives available in Hawaii won’t affect one another. The federal solar tax credit and the Hawaii tax credit are both based on the system’s total cost before any other rebates are applied. However, tax credits may change the taxable income reported. Consult with a tax professional to learn about the effect of tax credits. Understanding Hawaii’s integrated grid planning can help homeowners make informed decisions about system sizing.

Conclusion

Hawaii stands out as one of the most financially attractive states for solar investment, combining generous incentives with the nation’s highest electricity rates. With Hawaiian Electric customers paying approximately $0.43 per kWh, more than double the national average, the potential for long-term savings makes solar an increasingly compelling choice for Aloha State homeowners.

The combination of federal and state tax credits can reduce solar installation costs by nearly 63%, bringing an average 5.1 kW system down from $15,300 to just $5,710. This dramatic cost reduction, paired with Hawaii’s abundant sunshine and high energy costs, creates payback periods as short as 4.5 years. Beyond immediate savings, solar installations increase property values by an average of 6.9% while protecting homeowners from future utility rate increases.

Time is of the essence for Hawaii homeowners considering solar. The federal tax credit’s December 31, 2025 deadline means that delaying installation could add $4,590 to the total project cost and extend payback periods from 7-8 years to 11-15 years. Hawaiian Electric has streamlined the interconnection process through its Customer Interconnection Tool and is actively processing applications to help customers meet this crucial deadline.

Whether choosing grid-supply billing to export excess energy, self-supply systems for maximum independence, or pairing solar with battery storage through the BYOD Plus program, Hawaii homeowners have multiple pathways to energy savings. The combination of state RETITC credits, GEMS low-interest financing, Honolulu’s property tax exemption, and Hawaiian Electric’s supportive billing programs ensures that solar remains a smart investment even after federal incentives expire. Getting multiple quotes from qualified installers and acting before the year-end deadline will maximize savings and accelerate the path to energy independence.

FAQs

To calculate the Hawaii solar tax credit value, multiply the system’s total cost by 35%. Remember, the tax credit cannot exceed $5,000. Here’s an example:

$15,300 solar system x 35% Hawaii tax credit = $5,355

There is a limit on the tax credit value; this example system’s credit maxes out at $5,000.

What’s the Difference Between Grid-Supply and Self-Supply Billing?

Grid-supply (Smart Renewable Energy Export) allows solar panels to send excess energy to Hawaiian Electric’s grid in exchange for credits between $0.15 and $0.28 per kWh, depending on location. This option works well for homeowners who produce more energy than they consume during daylight hours. Self-supply (Smart Renewable Energy Non-Export) systems are designed to only meet the home’s energy needs without sending power to the grid, though limited excess for short periods is allowed without compensation. Self-supply systems are often paired with battery storage to maximize energy independence and are ideal for homeowners seeking grid resilience.