Kansas solar incentives in 2025 include the 30% federal solar tax credit (ITC), a property tax exemption for solar installations, and net metering programs. The federal tax credit alone saves Kansas homeowners an average of $6,300 on a typical 7.2 kW residential solar design system.

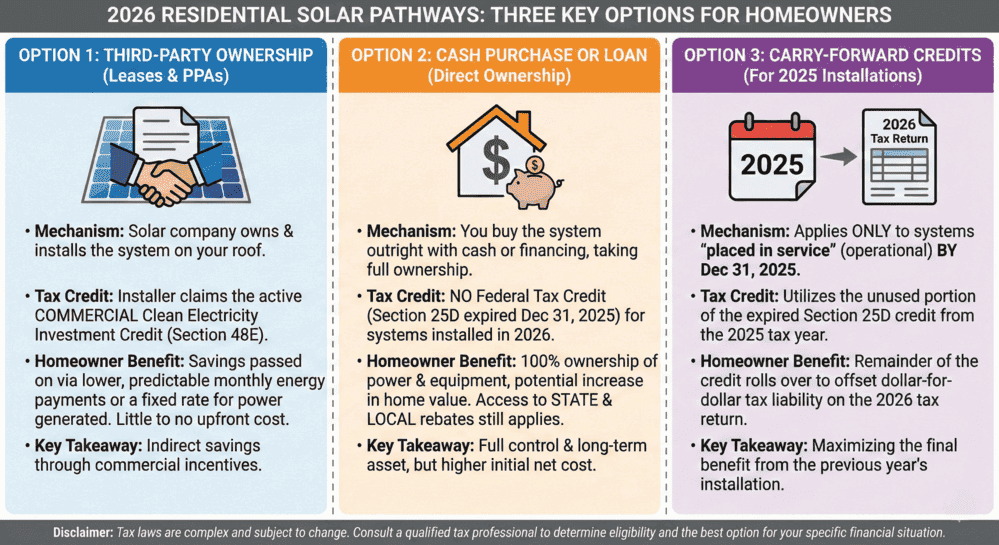

The federal tax credit ends on December 31, 2025. The One Big Beautiful Bill Act, signed into law on July 4, 2025, eliminated the ITC for residential systems installed after this date. Kansas homeowners must have their solar systems fully installed and operational by year’s end to qualify.

Kansas does not offer a state-level solar tax credit, but the federal incentive combined with the state’s property tax exemption and net metering policies can reduce the cost of a $21,000 solar installation to approximately $14,700. The average payback period for solar panels in Kansas is just over nine years.

What Changes Are Coming to Kansas Solar Programs?

While Kansas’s solar incentive landscape is relatively stable, homeowners should be aware of one key policy shift and the state’s unique approach to net metering.

Given the limited number of solar incentives in Kansas, there are not many programs at risk of changing for the worse. One notable adjustment is on the horizon, however. Customers who obtained solar installations under the previous net metering rules (before July 1, 2014) will be required to transition to the current rules as of January 1st, 2030.

Available Solar Savings Programs in Kansas

Kansas does not offer a specific state solar tax credit. However, the federal government provides the federal solar tax credit (ITC), which applies to all U.S. residents who own a home on which they install solar panels.

The credit equals 30% of the cost to install solar and can only be claimed by homeowners with sufficient tax liability. Systems must be installed and operational by December 31, 2025, to qualify, as the ITC will no longer be available for residential installations after this date.

The average solar panel system in Kansas earns a tax credit of approximately $6,300. The value of the solar tax credit varies based on system size, as shown in the following table:

Taxpayers can claim the credit in the year after their solar installation is complete. The credit applies to all solar equipment or home battery storage costs but does not include expenses like structural improvements that are not directly associated with generating solar energy.

Note: Lending companies often require paying the value of the solar tax credit toward a solar loan within 18 months to keep monthly payments low.

How the Property Tax Exemption Benefits Solar Homeowners

Quick Facts

- Value: Varies based on property value

- Frequency: Ongoing

- How to apply: Application is part of the process of going solar with an installer

Kansas offers a property tax exemption for “all property actually and regularly used predominantly to produce and generate electricity utilizing renewable energy resources or technologies.” For homeowners who install solar panels today, that exemption runs for ten years after the year in which the installation is completed. Full exemption details are available through the state revenue department.

Kansas has an average effective property tax rate of 1.34% and a median home value of $189,300. Research indicates that solar panels add 6.9% to a home’s value.

Based on these figures, the median Kansas home with solar panels is worth $13,100 more than a comparable non-solar home. With the property tax exemption, homeowners save approximately $175 per year on taxes for that added value.

Solar Permit Solutions

Affordable Solar Permit Plans

Don't let permit costs slow your project. Professional plan sets at competitive prices — all 50 states, fast turnaround.

Understanding Net Metering Policies and Energy Buyback Rates

Quick Facts

- Electric rates average 14 cents per kWh in Kansas

- Excess solar energy is valued at the utility’s system average cost, which is approximately 2.4 cents per kWh

Kansas uses a net billing structure rather than traditional net metering. Your utility tracks your energy imports and exports monthly, but you will not receive full retail credit for excess power.

Here is how it works: If you send more electricity to the grid than you use in a billing period, the utility credits you at the wholesale rate of approximately 2.4 cents per kWh, not the retail rate of 14 cents per kWh. Current Kansas net metering rules apply to customers of both major utilities in the state.

This means homeowners receive much less than retail rates if their panels generate more energy than needed for a month. Experts recommend that Kansas residents choose smaller solar panel installations sized to match their usage during the sunniest month of the year. Programs supporting rural communities can also help Kansas residents maximize energy savings.

Kansas net metering rules remain stable for now, with no major changes planned. However, there is no guarantee this will continue indefinitely. The state has experienced a somewhat turbulent history with net metering, including recent legislation and bill details that have shaped current policies.

In 2019, the largest investor-owned utility in Kansas received approval from the Kansas Corporation Commission to levy additional monthly fees on solar owners. Fortunately, that approval was struck down by the state Supreme Court in early 2020. The Court ruled that charging solar owners more than other customers constituted “price discrimination” that Kansas law “clearly prohibits.”

Current State of Battery Storage Incentives

Kansas has not implemented any solar battery incentives. In fact, the state Department of Revenue has ruled that the property tax exemption for solar panels does not apply to batteries used in residential systems.

Adding batteries to a solar installation offers many benefits regardless. Batteries provide backup power during emergencies and help lower costs for all customers by alleviating peak demand needs when used in virtual power plants. Homeowners interested in backup power may also consider off-grid systems for complete energy independence.

Kansas has an opportunity to benefit all residents by introducing smart battery incentives. The state’s renewable standards continue to evolve, and future policies may address storage solutions.

What Solar Panel Systems Cost in Kansas

The average cost of solar panels in Kansas is around $21,000 before incentives for a 7.2 kW system. After the federal tax credit, that cost reduces to $14,700.

If the average Kansas homeowner designed a solar installation to produce all the electricity used in a year, the system would be 9 kilowatts in size (approximately 23 400-watt solar panels). However, due to the state’s unfavorable net billing rules, experts recommend a system of about 75% of that size (7.2 kW, or 18 panels). This approach helps avoid exporting excess energy during the summer and compromising the system’s financial performance.

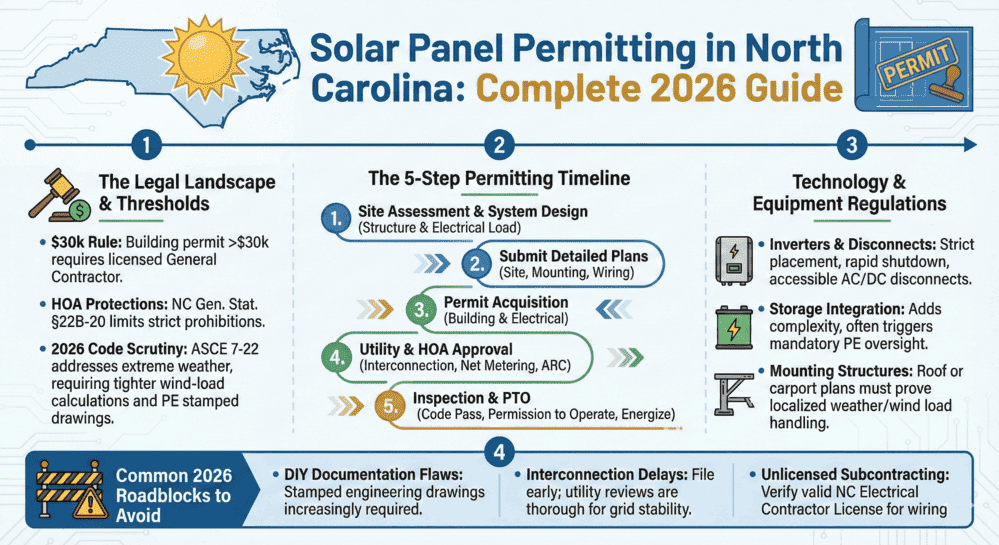

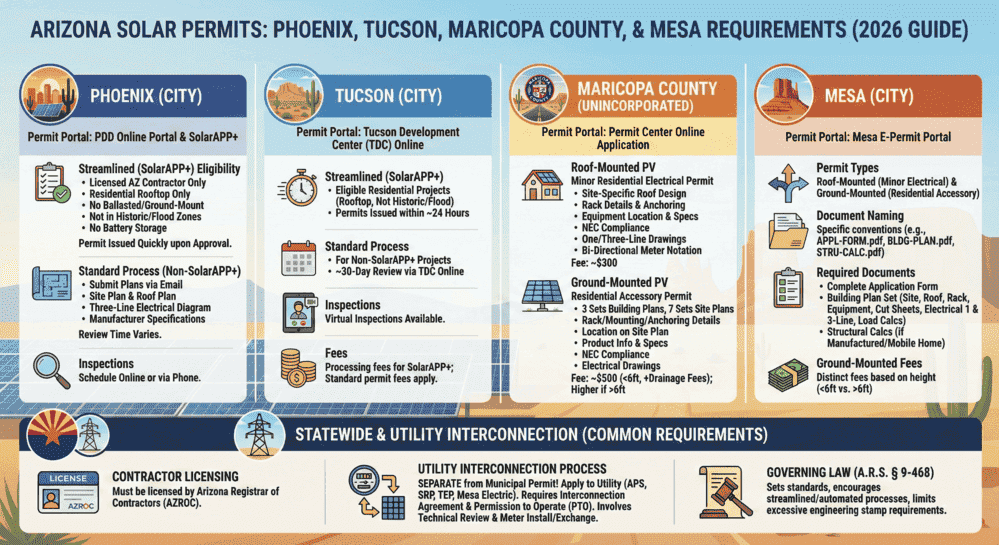

Proper equipment specifications and NEC compliance are essential for any installation. Kansas homeowners should also be aware of HOA regulations that may affect their projects.

Here is a quick breakdown of costs and savings:

- Cost before incentives: $21,000

- Federal tax credit: $21,000 x 30% = $6,300

- Effective system cost: $21,000 – $6,300 = $14,700

Conclusion

Even with limited solar incentives in Kansas, solar panels can still represent a sound investment. The state receives considerable sunshine compared to the rest of the country, and electricity prices continue to rise. With an estimated 10,944 kWh of solar energy produced in the first year, a solar installation can save the average homeowner nearly $1,500 on electricity bills.

At that rate, the installation pays for itself in slightly over nine years, leaving 15 years or more of free electricity. The combination of the 30% federal tax credit, property tax exemption, and long-term energy savings makes going solar a financially smart decision for many Kansas homeowners.

Time is running out to claim the federal tax credit. With the December 31, 2025, deadline approaching, homeowners should act quickly to secure their 30% savings. Solar installations can take several months from contract signing to completion, so starting the permit processing early is essential. Understanding installation requirements and rapid shutdown standards helps ensure a smooth approval process.

For commercial projects, additional considerations apply. Solar Permit Solutions offers comprehensive permit services to help Kansas homeowners and businesses navigate the process efficiently. Contact our team to get started.