URGENT: The federal solar tax credit ends December 31, 2025. Massachusetts homeowners installing solar panels before this deadline qualify for $7,570 in combined federal and state tax credits, plus additional incentives through the redesigned SMART 3.0 Program. The 30% federal investment tax credit (ITC) provides an average savings of $6,570 on solar installations, while the Massachusetts Residential Energy Credit adds up to $1,000 in state tax savings. After December 31, 2025, the federal credit will no longer be available, eliminating over 85% of these tax savings.

Solar installations in Massachusetts benefit from five major incentive programs. The federal ITC covers 30% of total installation costs with no maximum limit, but only for systems installed by December 31, 2025. Massachusetts offers a 15% state tax credit capped at $1,000 for primary residences. The redesigned SMART 3.0 Program, launched in October 2025, provides flat incentive rates for residential solar systems and enhanced benefits for battery storage installations. Property owners receive a 20-year property tax exemption on 100% of their solar system’s added value, averaging $510 annually. Solar equipment purchases avoid the state’s 6.25% sales tax entirely.

With average electricity rates of $0.29 per kilowatt-hour in Massachusetts, solar panels deliver faster payback periods compared to most U.S. states. The typical 7.3 kW residential system costs $21,600 before incentives but drops to $14,030 after applying federal and state tax credits. Net metering programs through Eversource, National Grid, and Unitil provide additional bill credits for excess solar production at or near full retail electricity rates. However, homeowners must act quickly to secure the federal tax credit before it expires at year end.

Will Massachusetts Solar Incentive Programs Expire Soon?

The federal solar tax credit expires on December 31, 2025, eliminating the 30% ITC that has helped homeowners save thousands on solar installations. This deadline is firm and cannot be extended. Solar permit timelines typically span several months from consultation to installation, meaning homeowners must act immediately to secure this incentive before year end.

Massachusetts state incentives remain available without imminent expiration dates. The SMART 3.0 Program launched in October 2025 with updated regulations designed to respond to market conditions annually. The Massachusetts Residential Energy Credit, property tax exemption, and sales tax exemption continue without scheduled end dates, providing ongoing value for future solar adopters even after the federal credit expires.

Overview of Massachusetts Solar Incentives and Rebates

Incentive: Federal solar tax credit

Estimated average annual savings: $6,570

Eligibility: All tax-paying U.S. citizens with systems installed by December 31, 2025

About: Tax credit equal to 30% of installation costs, applied to federal income taxes. EXPIRES DECEMBER 31, 2025

Incentive: Massachusetts Residential Energy Credit

Estimated average annual savings: $1,000

Eligibility: All tax-paying MA citizens who install solar on their primary residence

About: Tax credit equal to 15% of installation costs up to $1,000

Incentive: Solar Massachusetts Renewable Target (SMART) 3.0 Program

Estimated average annual savings: Varies significantly by configuration

Eligibility: Massachusetts residents who install solar panels in eligible utility territories

About: Performance-based incentive with flat rates set annually. Program prioritizes solar plus battery storage with enhanced incentive rates for maximum financial benefit. Program launched October 2025

Incentive: Solar installation property tax exemption

Estimated average annual savings: $510, varies with tax rate, property, and solar system value

Eligibility: All tax-paying MA citizens who install solar on their primary residence

About: 100% of the value of the solar system exempt from property taxes for 20 years

Incentive: Home solar project sales tax exemption

Estimated average annual savings: Varies with equipment cost

Eligibility: All solar energy equipment

About: 100% exemption from state sales tax for solar energy equipment

30% Federal ITC: How The Investment Tax Credit Works

Quick Facts:

- Value: 30% of solar installation costs

- Frequency: One-time tax credit, rollover for five years

- How to apply: File IRS Form 5695 with annual tax return

- CRITICAL DEADLINE: System must be installed by December 31, 2025

Massachusetts residents qualify for the federal solar tax credit for systems installed before December 31, 2025. This tax credit equals 30% of solar installation costs and reduces federal income tax liability. On July 4, 2025, President Trump signed legislation eliminating the residential solar tax credit entirely starting January 1, 2026, nearly a decade ahead of its original expiration date.

In Massachusetts, the average solar energy system earns a tax credit of $6,570, though actual amounts depend on system cost, size, and chosen installer. Solar installations financed through solar leases or power purchase agreements (PPAs) do not qualify for the federal solar investment tax credit.

The federal tax credit, often called the ITC, does not reduce upfront system costs. Property owners remain responsible for paying the full installation price but realize savings on tax liability when filing returns. Systems must be installed and operational by December 31, 2025 to qualify. Avoiding common permit mistakes during the approval process ensures projects complete on schedule.

Solar Permit Solutions

Affordable Solar Permit Plans

Don't let permit costs slow your project. Professional plan sets at competitive prices — all 50 states, fast turnaround.

State Income Tax Credit: Save Up To $1,000

Quick Facts:

- Value: 15% of solar installation costs, up to $1,000

- Frequency: One-time tax credit

- How to apply: File Schedule EC with annual tax return

Massachusetts stands among the few states offering a state solar income tax credit. The Massachusetts solar tax credit equals 15% of solar installation costs up to $1,000. Most homeowners earn the full $1,000 tax credit. Like the federal tax credit, the state tax credit reduces income tax liability.

Understanding The SMART 3.0 Program: Performance-Based Solar Payments

Quick Facts:

- Value: Flat incentive rate varies by utility and project type

- Frequency: Monthly payments for 10-20 years depending on project type

- How to apply: Apply online through utility company website

- Program launched: October 15, 2025

- Note: The SMART 3.0 Program prioritizes solar plus battery storage systems with significantly enhanced incentive rates, making combined installations the most financially advantageous option

The Massachusetts SMART 3.0 Program, launched in October 2025, functions as a performance-based solar incentive that compensates solar system owners for generated solar power. The program replaced the previous declining block structure with an annual assessment system that responds to changing market conditions.

Massachusetts completely redesigned the SMART Program in response to rising electricity rates that made the previous program’s solar-only incentives less valuable. Under SMART 3.0, the state allocates 900 MW of capacity for Program Year 2025, with projects under 25 kW and behind-the-meter installations under 250 kW exempt from capacity restrictions. This ensures residential and commercial projects always have access.

Important Update: Massachusetts has restructured the SMART Program to prioritize energy resilience and grid stability. The program now offers significantly enhanced incentive rates for solar installations paired with battery storage systems, reflecting the state’s commitment to building a more reliable energy infrastructure. While solar-only systems remain eligible, the current incentive structure makes combining solar with batteries the most financially advantageous option for homeowners.

Utility Distribution:

- Eversource receives 49% of capacity (441 MW)

- National Grid receives 45% of capacity (406 MW)

- Unitil receives 6% of capacity (53 MW)

The Massachusetts Department of Energy Resources (DOER) conducts annual assessments to set capacity allocations and incentive rates for each program year, creating a flexible framework that adjusts to market realities rather than following rigid predetermined schedules.

Boost Your SMART 3.0 Earnings With Program Adders

SMART 3.0 includes enhanced adders for solar systems meeting specific requirements, significantly increasing earning potential. Battery storage systems paired with solar installations receive the most substantial incentive benefits under the redesigned program, making solar plus storage configurations financially attractive even when solar-only incentives are minimal.

The program provides enhanced flat rates for residential systems under 25 kW, with doubled incentive rates for low-income projects. Community solar projects must allocate at least 40% of capacity to low-income customers, who receive guaranteed minimum 20% bill savings compared to retail electricity rates.

Additional adders exist for rooftop systems over 900 kW, installations on brownfields, dual-use agricultural projects, and pollinator-friendly solar arrays. These location-based incentives prioritize development in built environments and previously disturbed lands while protecting natural landscapes through mitigation requirements for large ground-mounted installations on undeveloped land.

Property Tax Break: Protect Your Solar Investment Value

Quick Facts:

- Value: 100% exemption of renewable energy system from property taxes

- Frequency: Annually for 20 years

- How to apply: Apply online through utility company website

Solar panels increase property values. Massachusetts offers a property tax exemption for renewable energy systems, including solar installations. This means property values increase with solar additions, but the added value from solar panels does not affect property tax bills.

The average effective property tax rate in Massachusetts reaches 1.12%. Using the state’s median home value and assuming solar panels add 6.9% to home value, the solar property tax exemption saves an average of $510.

Skip The Sales Tax On Solar Equipment

Quick Facts:

- Value: 100% exemption of renewable energy system equipment from state sales tax

- Frequency: One-time exemption at the time of purchase

- How to apply: File Massachusetts Tax Form ST-12 at the time of purchase

Equipment used for solar panel installations receives exemption from Massachusetts’s 6.25% sales tax. Homeowners typically do not need to file for this exemption, as installers purchase equipment in bulk. However, this exemption indirectly helps keep homeowner costs lower.

Net Metering Benefits: Earn Credits For Excess Solar Production

Quick Facts:

- Electric rates average $0.29 per kWh in Massachusetts

- Customers of Eversource, National Grid, and Unitil have access to net metering

- Actual net metering credits vary with utility and rate plan

Massachusetts requires investor-owned utilities Eversource, National Grid, and Unitil to offer net metering to solar customers. Solar energy research continues advancing net metering technologies and grid integration strategies.

Under net metering, utilities measure how much energy homes use from the grid and how much solar energy panels produce. When solar panel systems produce more electricity than homes consume, monetary credits appear on bills.

Net metering bill credits calculate differently for each utility but generally equal the same or close to the full retail rate of electricity. Check utility websites for specific net metering program details and excess energy compensation rates.

Massachusetts experiences some of the highest electricity costs in the country. Solar energy can significantly reduce electricity bills in the state.

Battery Storage Incentives: Stack Savings On Energy Storage Systems

Homeowners installing solar batteries in Massachusetts can reduce costs through various battery incentive and rebate programs.

Apply The 30% ITC To Battery Systems

The 30% federal solar tax credit applies to energy storage installations as well as solar panel installations for systems installed by December 31, 2025. Even batteries not paired with solar qualify for the solar tax credit, but only if installed before the year-end deadline.

A typical battery system costing about $15,000 fully installed would qualify for a $4,500 tax credit. This incentive expires December 31, 2025, along with the residential solar tax credit, making immediate action essential for homeowners considering battery storage.

Earn Extra With Battery Storage Add-Ons

Under SMART 3.0, battery storage systems provide exceptional incentive opportunities for residential solar installations. The program prioritizes energy resilience by offering substantially higher rates for solar with battery installations, making combined systems the clear choice for maximizing financial returns and energy independence.

The SMART 3.0 Program calculates battery adders based on storage system size and power output. Projects over 1 MW can pair with battery systems to earn additional compensation through energy storage adders, with values set during annual program assessments.

Over the 10 to 20-year program duration depending on project type, battery storage incentives could generate thousands of dollars in additional value beyond the federal tax credit and electricity bill savings.

ConnectedSolutions: Get Paid To Support Grid Stability

The ConnectedSolutions Battery Program allows customers of Eversource and National Grid to earn money by permitting utility companies to discharge batteries when grid demand peaks during summer months. This reduces utility grid stress and helps prevent blackouts and price increases.

Incentives base on how much power batteries supply during grid events. The current incentive rate equals $275 per kilowatt of power, meaning average participants save approximately $1,500 each year.

Program participation requires batteries from eligible manufacturers. Smart thermostat owners can also participate in a different ConnectedSolutions program format.

What Solar Systems Cost In Massachusetts

The average solar system in Massachusetts measures about 7.3 kilowatts (kW) in size, meaning solar installations cost approximately $21,600 on average. This calculates to about $3.00 per watt of solar installed. Proper permit documentation ensures projects qualify for federal and state tax credits, reducing total costs to about $14,030.

Calculation breakdown:

- State tax credit: $21,600 x 15% = $3,240 (incentive capped at $1,000)

- Federal solar tax credit: $21,600 x 30% = $6,570

- Total savings: $6,570 + $1,000 = $7,570

- Effective system cost: $21,600 – $7,570 = $14,030

Stacking Multiple Incentives: What You Need To Know

Massachusetts state and federal solar tax credits do not impact one another’s value. However, tax credits may change taxable income, which can affect how much of the tax credit applies in one year. Consult with a tax professional for specific guidance.

Is Going Solar Worth It With These Incentives?

Solar panels prove worthwhile in Massachusetts thanks to excellent tax incentive programs and extremely high energy costs. With proper shading analysis and system design, solar panels can pay for themselves in as little as five years, providing up to 20 years of reduced electricity costs. Recent research demonstrates solar’s growing role in renewable energy generation across Massachusetts.

Solar panels deliver value only when installed by qualified, experienced installers. Choosing a reputable installer ensures proper system design, accurate permit documentation, and reliable long-term performance. Finding professional solar services that provide confident support for the 25-year lifespan of solar panels remains essential. Massachusetts energy consortiums continue advancing renewable energy development statewide.

Research customer reviews and obtain quotes from at least three companies before signing installation contracts to ensure highest-quality installation at appropriate pricing.

Conclusion

Massachusetts homeowners must act immediately to capture the full value of solar incentives. The 30% federal solar tax credit expires December 31, 2025, eliminating the single largest incentive worth an average of $6,570. Combined with the Massachusetts state tax credit of up to $1,000, property tax exemptions, and SMART 3.0 Program benefits for battery storage, early adopters can access substantial savings that disappear in 2026.

Time is critical. Solar installations require 2-4 months from consultation to activation, and the December 31 deadline cannot be extended. Partner with qualified installers who understand SMART 3.0 requirements and can guarantee completion before year end. Compare multiple quotes, verify credentials, and meet permit requirements immediately.

Contact our team today to secure the federal tax credit before it expires forever. The window to maximize savings is closing rapidly.

FAQs

Affordable Solar Permit Plans

Don't let permit costs slow your project. Professional plan sets at competitive prices — all 50 states, fast turnaround.

Frequently Asked Questions

The federal solar tax credit expires on December 31, 2025. Solar systems must be fully installed and operational by this date to qualify for the 30% tax credit. On July 4, 2025, President Trump signed legislation eliminating this credit starting January 1, 2026, nearly a decade ahead of its original expiration. This makes 2025 the final year to claim this valuable incentive.

Yes, Massachusetts provides incentives for solar panel installations, including the SMART Program and a statewide tax credit. Massachusetts residents can also utilize the federal solar tax credit to further reduce solar installation costs.

Yes, getting solar panels in Massachusetts proves worthwhile because of high electricity rates and excellent solar incentives. Massachusetts ranks among the best states in the country for residential solar. Long-term solar projections indicate continued growth and value for Massachusetts installations.

The MA SMART 3.0 program, launched in October 2025, functions as a performance-based solar incentive that pays system owners for electricity generated. The program provides flat incentive rates set annually based on market conditions, replacing the previous declining block structure. Currently, solar-only residential systems may receive minimal or zero incentive payments due to high electricity rates, but battery storage systems paired with solar qualify for enhanced incentive rates. The program is available to all three Massachusetts investor-owned utilities: Eversource, National Grid, and Unitil.

The Massachusetts solar credit equals 15% of solar installation costs up to $1,000. Massachusetts residents can also utilize the federal residential renewable energy credit when installing solar panels.

Net metering measures the difference between electricity consumed from the grid and solar energy produced. When solar systems generate more power than homes use, utilities provide monetary credits at or near the full retail electricity rate. These credits offset future electricity bills, maximizing solar savings.

Yes, homeowners can combine the 30% federal investment tax credit with the Massachusetts state tax credit worth up to $1,000. These incentives stack together without reducing each other's value, though they may affect taxable income calculations. Consult a tax professional for specific guidance on applying both credits.

Yes, battery storage provides significant additional value under the SMART 3.0 Program. While solar-only systems currently receive minimal SMART incentives due to high electricity rates, systems paired with battery storage qualify for enhanced incentive rates that make the investment more attractive. Batteries also qualify for the 30% federal tax credit (until December 31, 2025) and can participate in the ConnectedSolutions program, earning approximately $1,500 annually by providing grid support during peak demand periods.

SPS Editorial Team

Solar Permit Solutions

Solar Permit Solutions provides professional solar permit design services for residential, commercial, and off-grid installations across all 50 states. Our team ensures permit-ready plan sets delivered fast.

Related Articles

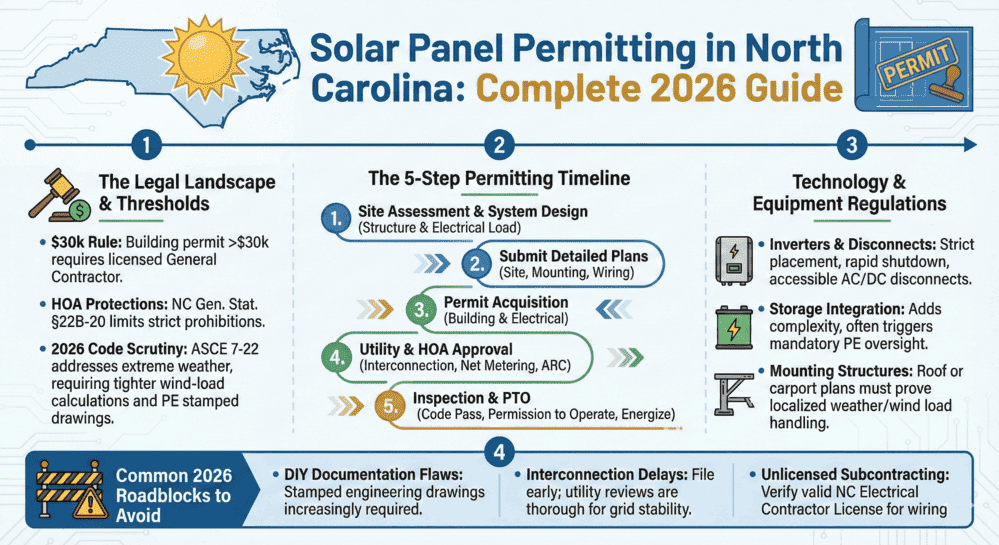

New 2026 North Carolina Solar Permit Guide: Duke Energy & Storage Rules

Learn North Carolina solar panel licensing and permitting requirements. Discover...

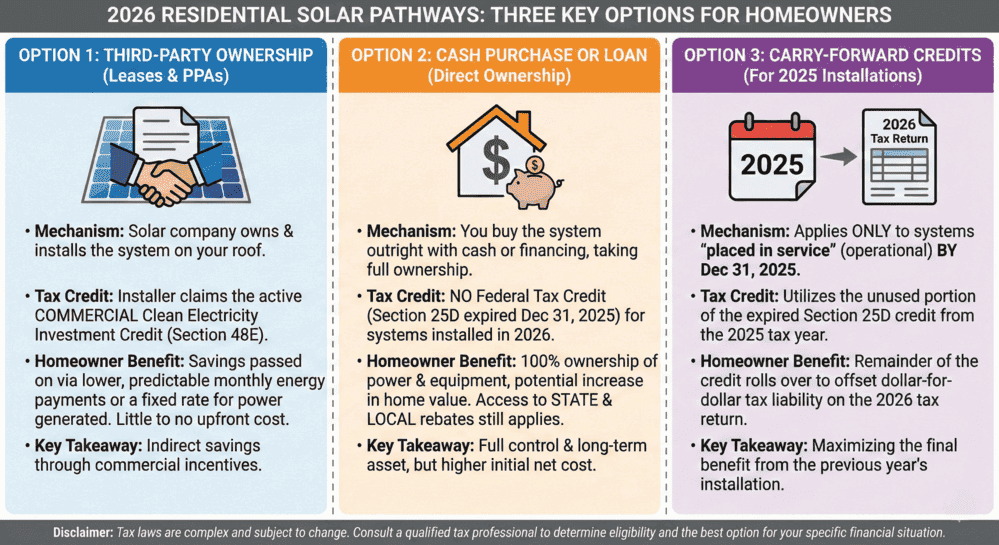

Section 25D Expiration: Homeowner Options In 2026

The Section 25D Residential Clean Energy Credit, which covered 30% of residentia...

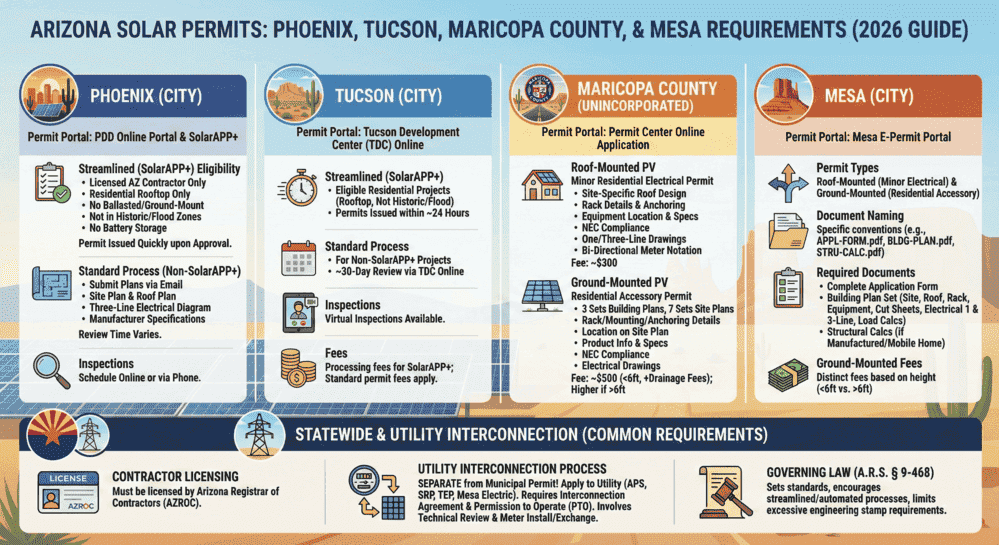

Solar Permits In Arizona: Phoenix, Tucson, Maricopa County, And Mesa Requirements (2026 Guide)

Arizona solar permitting at a glance: Arizona HB2301 now requires every municipa...