Time is running out. The federal solar Investment Tax Credit (ITC) allowing homeowners to deduct 30% of solar installation costs ends permanently on December 31, 2025, just weeks away. The “One Big Beautiful Bill Act” signed into law on July 4, 2025, terminated the residential solar tax credit with no phase-down period, making this the final opportunity to claim thousands of dollars in tax savings.

If your solar system is not fully installed and operational by the end of 2025, you will lose your eligibility for the 30% federal tax credit entirely. For a typical $20,000 residential solar installation, this represents $6,000 in lost savings. However, many homeowners who complete their installations on time still fail to claim the credit properly due to missing documentation, incorrect IRS forms, or incomplete record-keeping.

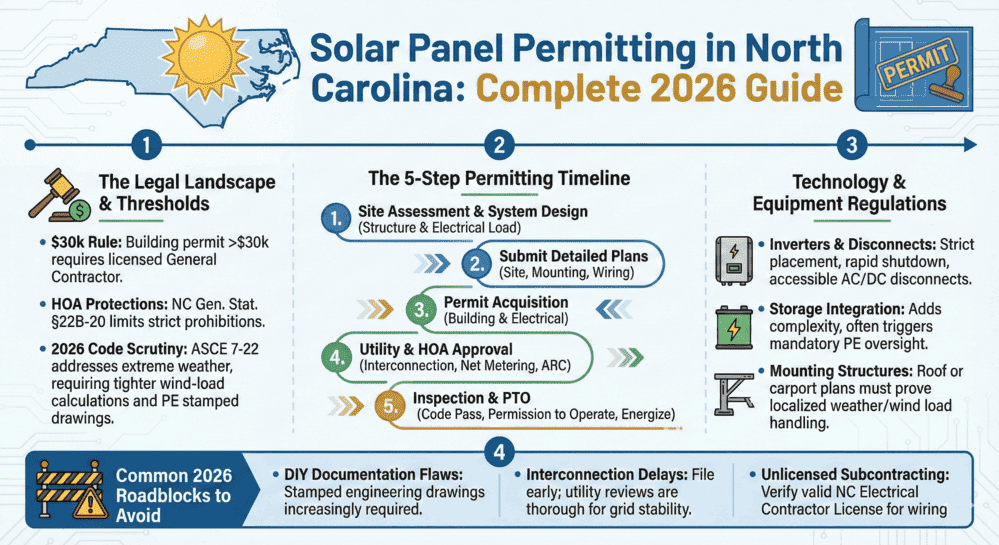

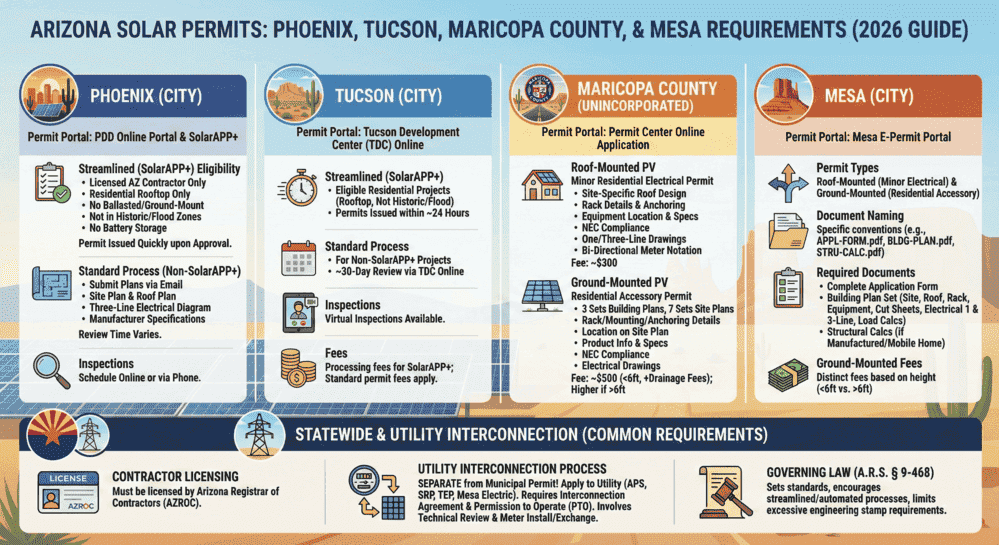

This comprehensive guide covers every document you must file with your 2025 federal income tax return, what records to maintain for IRS audits, and critical mistakes that could disqualify your claim. Whether you’re racing to complete a residential installation or managing a commercial solar project, understanding the complete documentation requirements for solar permits ensures you maximize your final opportunity to claim this substantial tax benefit.

Understanding the Solar Investment Tax Credit (ITC)

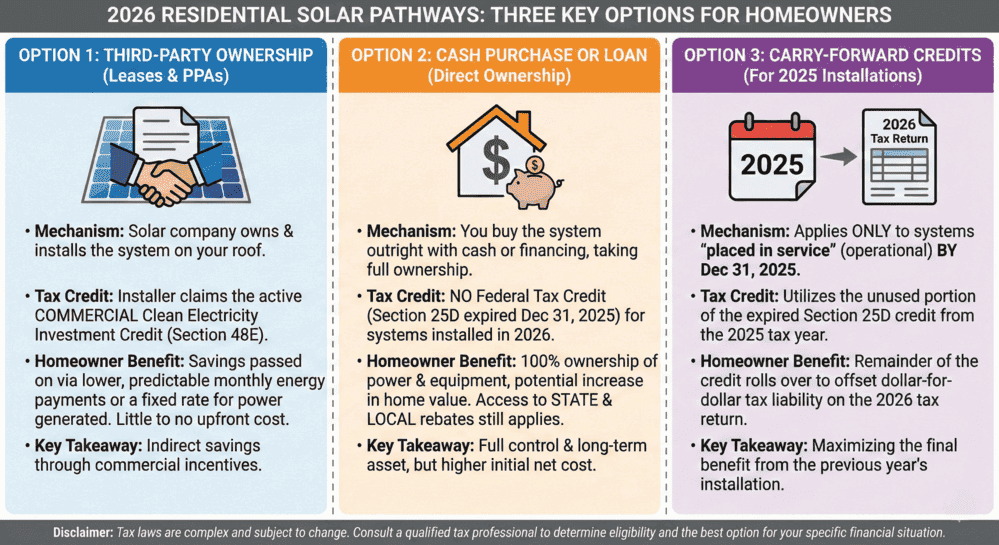

The federal Solar Investment Tax Credit (ITC), established under Section 25D of the Internal Revenue Code for residential properties and Section 48E for commercial properties, provides a dollar-for-dollar reduction in your federal income tax liability. However, the landscape has dramatically changed in 2025.

Residential Solar Tax Credit (Section 25D) – ENDS DECEMBER 31, 2025

- 30% tax credit for systems placed in service through December 31, 2025

- NO TAX CREDIT for systems placed in service January 1, 2026, or later

- No phase-down period – the credit terminates completely after 2025

Critical Timeline Alert: With solar installations typically requiring 60-90 days from contract signing to final utility approval, homeowners seeking to claim the 2025 tax credit should have already begun their projects. If you’re reading this in November 2025 and haven’t started, contact installers immediately, though many are fully booked through year-end. Understanding how solar energy works from the basics can help you make informed decisions about system specifications and requirements.

Commercial Solar Tax Credit (Section 48E) – Extended Deadline

Commercial solar projects have additional time but face strict requirements:

- 30% tax credit for projects that either:

- Begin construction by July 4, 2026 (can complete by ~2030 under safe harbor rules), OR

- Are placed in service by December 31, 2027

- Projects must meet prevailing wage and apprenticeship requirements (>1 MW AC) or credit drops to 6%

- Projects must comply with Foreign Entity of Concern (FEOC) requirements starting in 2026

What Qualifies as “Placed in Service”?

Under the modified language in the One Big Beautiful Bill, your solar system must have “expenditures made” by the deadline, which means your system must be fully installed, operational, and capable of generating electricity, not merely contracted or partially paid for. This includes:

- Complete physical installation of all equipment

- Final electrical and building inspections passed

- Utility interconnection approval and Permission to Operate (PTO) received

- System actively generating electricity

The ITC applies to total system costs, including solar panels, inverters, mounting equipment, labor, permitting fees, installation costs, sales tax, and energy storage systems installed with solar panels. For commercial installations requiring professional engineering stamps and certifications, these costs are also eligible.

Solar Tax Credit Eligibility Checklist

Before gathering documentation, verify your solar installation meets all ITC eligibility requirements:

Residential Solar Tax Credit Eligibility (IRS Form 5695)

☑ Own your solar system – Leased systems and power purchase agreements (PPAs) do NOT qualify

☑ System located at your primary or secondary residence in the United States

☑ New or first-use equipment – Used equipment doesn’t qualify

☑ System fully operational by December 31, 2025 – Contract signing date is irrelevant

☑ You have sufficient tax liability – The credit is non-refundable but can be carried forward indefinitely

☑ System meets applicable fire and electrical code requirements, including NEC Article 690

☑ Equipment meets performance and quality standards with proper certifications

☑ Utility Permission to Operate received by December 31, 2025 – This is often the final bottleneck

WARNING: Some installers are still accepting contracts for 2025 installations, but completion by December 31st is increasingly uncertain due to permitting delays, utility interconnection backlogs, and installer scheduling. Common solar permit denials can delay your timeline significantly, so proceed with extreme caution and get completion guarantees in writing.

Commercial Solar Tax Credit Eligibility (IRS Form 3468)

☑ The business owns the solar system – Must be used in a trade or business

☑ System located in the United States or U.S. territories

☑ Construction began by July 4, 2026 OR placed in service by December 31, 2027

☑ Equipment is depreciable or amortizable

☑ System meets prevailing wage and apprenticeship requirements (for projects >1 MW AC) or accepts 6% base credit

☑ Completed interconnection application with local utility

☑ Obtained all required engineering stamps and permits

☑ No prohibited Foreign Entity of Concern involvement (for projects beginning construction after 2025)

Important: Commercial projects larger than 1 MW AC must meet prevailing wage and apprenticeship requirements to qualify for the full 30% credit. Without compliance, the credit drops to 6%.

Solar Installation Documents You Must Keep

Maintaining comprehensive documentation protects your tax credit claim during IRS audits and provides proof of system costs, installation dates, and equipment certifications. Here’s what you must keep:

Required Documentation Table

IRS Audit Period: The standard IRS audit window is 3 years, but the agency recommends keeping tax-related documents for at least 7 years. For substantial underreporting (>25% of income), the audit period extends to 6 years.

2025-SPECIFIC DOCUMENTATION: Given the controversial nature of the One Big Beautiful Bill’s termination of the residential credit, the IRS may scrutinize 2025 claims more carefully. Keep especially detailed records proving your system was “placed in service” before December 31, 2025. Understanding typical solar permit approval timelines helps you plan documentation deadlines accordingly.

Solar Permit Solutions

Affordable Solar Permit Plans

Don't let permit costs slow your project. Professional plan sets at competitive prices — all 50 states, fast turnaround.

Documents You MUST File With Your Federal Income Tax Return

For Residential Solar Installations

1. IRS Form 5695: Residential Energy Credits

This is the primary form for claiming the residential solar tax credit. You must complete:

- Part I: Residential Clean Energy Property Costs

- Line 1: Solar electric property costs (include everything: panels, inverters, batteries, installation labor, permits)

- Lines 6a-6c: Credit calculation (multiply qualified costs by 30%)

- Part II: Nonrefundable Energy Property Credit (if claiming other improvements like insulation or windows)

Form 5695 attaches directly to your Form 1040 (U.S. Individual Income Tax Return). The calculated credit from Line 14 of Form 5695 transfers to Schedule 3 (Form 1040), Line 5.

Critical for 2025 Filers: Your Form 5695 for tax year 2025 (filed by April 15, 2026) is your LAST opportunity to claim the residential solar tax credit. After this filing season, the credit no longer exists. For those considering residential solar design services, proper documentation from the design phase through installation ensures all eligible costs are captured.

2. Schedule 3 (Form 1040): Additional Credits and Payments

Your solar tax credit amount from Form 5695 must be entered on Schedule 3, which then attaches to your main Form 1040.

3. Supporting Documentation (attach if requested)

While the IRS doesn’t require you to attach receipts and invoices when you file, you must have them available if audited:

- Itemized invoice showing total system cost breakdown

- Receipts proving payment completion by December 31, 2025

- Manufacturer certifications for solar panels and inverters

- Permission to Operate (PTO) letter dated 2025 – This is your proof the system was operational before the deadline

For Commercial Solar Installations

1. IRS Form 3468: Investment Credit

Commercial entities must file Form 3468 to claim the business solar ITC:

- Part II: Qualifying Advanced Energy Project Credit

- Part III: Rehabilitation Credit and Energy Credit

- Line 12a-e: Energy credit property details (solar equipment basis)

- Line 23: Calculate 30% credit amount (or 6% if not meeting prevailing wage requirements)

2. IRS Form 3800: General Business Credits

Form 3468 credits flow into Form 3800, which consolidates all business credits and determines current-year usage versus carryforward amounts.

3. IRS Form 4562: Depreciation and Amortization

Commercial solar systems can still claim 100% bonus depreciation (restored by the One Big Beautiful Bill). You can claim both the 30% ITC and bonus depreciation, though the depreciable basis must be reduced by 50% of the credit amount.

Note: The previous 5-year MACRS depreciation schedule has been eliminated for new solar projects under the One Big Beautiful Bill.

4. Prevailing Wage Compliance Documentation (Projects >1 MW AC)

For larger commercial projects claiming the full 30% credit, you must file:

- Certified payroll records demonstrating prevailing wage compliance

- Apprenticeship participation records showing 15% of labor hours

- Documentation from Department of Labor wage determinations

Common Mistakes Homeowners Must Avoid

Mistake #1: Assuming 2026 Installation Will Qualify

The Problem: Some homeowners believe they have until 2032 based on outdated information from before July 4, 2025, or think that signing a contract in 2025 qualifies them for the credit.

The Solution: The residential solar tax credit ENDS December 31, 2025, with no extensions or phase-down. Only systems that are fully installed, inspected, and receive utility permission to operate by this date qualify. Contract signing dates are irrelevant; only the “placed in service” date matters. If you’re working with utilities like SDG&E, review the complete interconnection approval process to avoid last-minute surprises.

Mistake #2: Claiming the Credit for Leased Systems or PPAs

The Problem: If you lease your solar system or have a power purchase agreement (PPA), you don’t own the equipment. Only the system owner (typically the solar company) can claim the tax credit.

The Solution: If you want to claim the federal tax credit, you must purchase your system outright or through a loan where you own the equipment. Review your contract carefully; some installers are still offering PPAs, which do not qualify homeowners for the tax credit.

Mistake #3: Not Having Permission to Operate (PTO) by December 31, 2025

The Problem: Many homeowners believe installation completion is sufficient, but the IRS considers a system “placed in service” when it’s capable of generating electricity and has received final utility approval.

The Solution: Your utility’s Permission to Operate (PTO) letter must be dated 2025. Utility interconnection can take 2-8 weeks after installation, so systems installed in late December may not receive PTO until 2026, potentially disqualifying them. Understanding whether you’ll need a different meter and securing it early can prevent delays. Ensure your installer submits interconnection applications immediately upon passing final inspection.

Mistake #4: Missing Documentation for Battery Storage Systems

The Problem: Energy storage systems (batteries) installed with solar panels qualify for the ITC, but homeowners often fail to document the battery costs separately or prove the charging source.

The Solution: Ensure your invoice clearly itemizes battery equipment and installation costs. According to IRS guidance, batteries must be charged by the solar system to qualify. Keep documentation showing:

- Battery specifications (minimum 3 kWh capacity)

- Integration with solar system

- Charging configuration demonstrating solar connection

Important: Standalone battery systems installed without solar panels do NOT qualify for the federal tax credit.

Mistake #5: Incorrect Cost Calculations

The Problem: Homeowners either underreport eligible costs (missing permits, sales tax, or installation labor) or include non-eligible costs (landscaping, roof repairs unrelated to solar installation).

The Solution: Include ALL costs directly related to solar installation:

- ✓ Solar panels, inverters, racking systems, electrical equipment

- ✓ Labor costs for installation

- ✓ Permit fees and engineering stamps

- ✓ Sales tax on equipment and labor

- ✓ Energy storage systems (batteries with 3+ kWh capacity)

- ✓ Electrical panel upgrades required for solar

- ✗ Roof repairs or replacement (unless structurally required for solar installation)

- ✗ Landscaping or tree removal

- ✗ Extended service contracts purchased separately after installation

If you’re installing in regions with specific requirements, such as Columbus, Ohio, ensure all jurisdiction-specific costs are properly documented.

Mistake #6: Not Having Sufficient Tax Liability

The Problem: The solar ITC is a nonrefundable credit, meaning it can only reduce your tax liability to zero; it won’t generate a refund beyond what you’ve already paid in taxes.

The Solution: Calculate your expected tax liability before claiming. If your 2025 tax liability is less than the credit amount, you can carry forward the unused credit to future tax years indefinitely (for residential) or up to 20 years (for commercial). Since this is the last year to generate residential solar tax credits, ensure you understand your multi-year tax planning to fully utilize carryforward provisions. Learn more about renewable energy benefits and tax implications from energy policy experts.

Mistake #7: Filing Wrong IRS Form

The Problem: Using Form 3468 (commercial) for a residential installation or Form 5695 (residential) for a commercial building.

The Solution:

- Residential property (primary or secondary home): Use Form 5695

- Commercial property or rental property: Use Form 3468

- Mixed-use property: Allocate costs appropriately and consult a tax professional

Mistake #8: Missing Manufacturer Certifications

The Problem: The IRS requires solar equipment to meet specific performance and safety standards. Missing manufacturer certification documents can delay or disqualify your credit during an audit.

The Solution: Request and save manufacturer certifications from your installer showing:

- Solar panels meet IEC 61215/61730 standards or equivalent

- Inverters are UL 1741 listed and meet IEEE 1547-2018 interconnection standards

- All equipment carries appropriate UL safety certifications

- Equipment is new (not used or refurbished)

For DIY installations, thoroughly research electrical fundamentals for solar projects and essential solar energy resources to ensure code compliance.

Mistake #9: Failing to Maintain Documentation Long-Term

The Problem: Homeowners file their tax return but discard invoices, permits, and installation documents, leaving them vulnerable if audited years later.

The Solution: Create a dedicated “Solar Tax Credit 2025” folder (physical or digital) containing all documents from the table above. Keep these records for at least 7 years after filing. Given the controversy surrounding the One Big Beautiful Bill’s termination of this credit, maintain records even longer to protect against any future challenges. If you’re in areas like Los Angeles or Riverside County, local permit documentation is equally critical for long-term system maintenance and property transactions.

Conclusion

The 30% federal solar tax credit for residential installations ends permanently on December 31, 2025, representing the final opportunity for homeowners to claim up to $6,000-$15,000 in tax savings. The One Big Beautiful Bill’s termination of this program eliminates the previous timeline extending through 2032, making immediate action critical for anyone considering solar.

By maintaining comprehensive records of your solar installation, from itemized invoices and equipment certifications to permit approvals and utility interconnection agreements with PTO dates, you protect your eligibility for this substantial tax benefit. The most critical document is your utility’s Permission to Operate letter dated 2025, which proves your system was “placed in service” before the deadline.

For 2025 installations: File your 2025 tax return by April 15, 2026 (or October 15, 2026 with an extension) to claim your residential solar tax credit. This is your last chance; the credit will not exist in 2026 or beyond. Whether you’re building your own solar system or working with professional installers, proper documentation is essential.

For commercial installations: Projects have extended timelines but must either begin construction by July 4, 2026 (to use safe harbor provisions) or be placed in service by December 31, 2027. Don’t wait; supply chain issues, permitting delays, and FEOC compliance requirements make early planning essential. For projects in specific jurisdictions like Arizona APS service territory, understanding regional requirements prevents costly delays.

External Resources:

- IRS Form 5695 Instructions

- IRS Form 3468 Instructions

- IRS Residential Clean Energy Credit Page

- Department of Energy Solar Information

- SEIA One Big Beautiful Bill Impact Analysis

- DSIRE Database of State Incentives

- Energy.gov Solar Tax Credit Updates

FAQs

Is it too late to claim the solar tax credit if I haven’t started my installation yet?

Yes, it is almost certainly too late for residential solar installations started in November 2025. Solar installations typically require 60-90 days from contract signing to receiving utility Permission to Operate, which means systems would need to be nearly complete by now to receive PTO by December 31, 2025. However, if you have an existing contract with an installer who guarantees completion and PTO by year-end, you may still qualify. Commercial projects have more time; they must either begin construction by July 4, 2026 or be placed in service by December 31, 2027. Contact installers immediately to assess your options, but understand that most reputable companies are fully booked through year-end and cannot guarantee 2025 completion for new contracts.

Can I claim the solar tax credit if I don’t owe federal income taxes?

The solar Investment Tax Credit is a non-refundable credit, meaning it can only reduce your federal income tax liability to zero; it won’t generate a refund if you don’t owe taxes. However, if your tax credit exceeds your current year tax liability, you can carry forward the unused portion to future tax years indefinitely for residential systems (this is especially important since 2025 is the last year to generate residential solar tax credits). For example, if you generate a $9,000 solar tax credit but only owe $5,000 in federal taxes for 2025, you can use $5,000 this year and apply the remaining $4,000 to your 2026 tax return, 2027 tax return, and so on until fully utilized. For commercial systems, the carryforward period is limited to 20 years.