California homeowners can save an average of $3,528 on solar panel installations through federal and state incentives in 2025, but the most valuable program expires December 31, 2025. The 30% federal Residential Clean Energy Tax Credit (formerly ITC) delivers the largest savings, reducing a typical $11,759 system to $8,231. Additional California programs include DAC-SASH (up to $15,000 for low-income households in disadvantaged communities), SGIP battery rebates ($150-$1,000 per kWh), PACE financing (zero-down payment options), and local utility rebates ($500-$1,500).

President Trump eliminated the federal solar tax credit effective January 1, 2026, making 2025 the final year to claim this 30% savings. California’s net billing system (NEM 3.0) provides export credits worth approximately 25% of retail rates, with additional adders available for PG&E and SCE customers until 2027. The Active Solar Energy System Exclusion prevents property tax increases from solar installations through 2026.

Time-sensitive deadlines include the federal tax credit (Dec 31, 2025), export rate lock-in (Jan 1, 2027), and declining export adders (ending 2028). Solar installations typically require 3-6 months from consultation to completion, requiring immediate action to maximize available incentives.

Which Solar Incentives Deliver the Best Value in California?

California homeowners can tap into several powerful incentives that dramatically boost solar investment returns. According to renewable energy data from the IEA, solar adoption continues accelerating nationwide. The following four programs offer the most significant cost reductions, though the most valuable option has a rapidly approaching deadline.

Residential Clean Energy Credit

The Residential Clean Energy Credit, previously called the federal investment tax credit (ITC), slashes your solar system cost by 30%. This incentive covers your complete installation, encompassing equipment, installation labor, permits, and applicable sales taxes.

This credit expires completely after December 31, 2025. President Trump signed legislation on July 4, 2025, removing the residential solar tax credit effective January 1, 2026-eliminating it nearly ten years before its scheduled expiration. Professional solar system design and installations generally require multiple months from initial consultation through final setup, making prompt action crucial for homeowners wanting to capture these savings.

California’s typical 5 kW solar system costs approximately $11,759. Applying the 30% credit reduces this to $8,231, delivering $3,528 in savings.

Claim this incentive as a credit against your federal tax liability when filing annual taxes. Remember that purchasing your system through cash payment or solar financing is required for ITC eligibility-leased systems don’t qualify.

Your federal tax liability must be sufficient to utilize the credit, although unused portions can carry forward annually, according to tax professionals consulted. The IRS hasn’t established a deadline for credit carryovers, suggesting indefinite rollover potential under existing regulations. However, Tax Form 5695 may become obsolete after 2025, potentially eliminating this filing method. Consult a tax advisor for personalized guidance.

Steps to Claim the ITC in California

Claiming the ITC follows a straightforward process! Complete these three steps:

- Obtain IRS form 5695 in printed format.

- Complete the form using installation documents provided by your solar contractor.

- Include the finished form with your annual tax filing.

Important: To qualify for this credit, your system installation must be completed by December 31, 2025.

DAC-SASH

Residents of a top 25% disadvantaged community who receive service from Pacific Gas & Electric (PG&E), Southern California Edison (SCE), or San Diego Gas & Electric (SDG&E) may access free or extremely low-cost solar installations. The DAC-SASH program delivers incentives valued at $3/W for solar systems ranging from 1 to 5 kW. Eligibility also requires meeting income thresholds and owning a single-family residence. Through May 31, 2025, qualifying income limits stand at $37,650 for single-person households and $51,100 for two-person households.

PACE Financing

California ranks among just three states providing property assessed clean energy (PACE) financing options for residential customers. This financing structure enables solar system installation with typically zero initial payment, repaid over an established timeframe-generally spanning 10 to 20 years.

PACE programs typically feature competitive interest rates since the debt attaches to your property rather than you personally, creating a secured loan. PACE financing payments get added to your property tax statement. Should you sell your home with an outstanding balance, the loan obligation transfers to the new property owners.

Local Rebates

Two regional utility providers offer rebate programs for qualifying solar installations:

- Rancho Mirage Energy Authority administers a Residential Battery Program supplying rebates to eligible homeowners installing battery storage systems for excess solar energy. Rebate amounts span from $500 to $1,500.

- Alameda Municipal Power operates an Income Qualified Solar Rebate Program delivering a one-time $500 rebate to homeowners earning under $106,000 annually who install new solar systems on homes constructed before 2020.

Solar Permit Solutions

Affordable Solar Permit Plans

Don't let permit costs slow your project. Professional plan sets at competitive prices — all 50 states, fast turnaround.

Are Solar Tax Exemptions Available in California?

California doesn’t provide sales or property tax exemptions but offers an Active Solar Energy System Exclusion, ensuring your solar installation isn’t assessed or factored into increased property taxes. This exclusion covers systems finished before January 1, 2027.

Does California Provide Net Metering?

Net metering is no longer available in California, but customers served by any of the three Investor Owned Utilities (IOUs)-Pacific Gas & Electric (PG&E), Southern California Edison (SCE), and San Diego Gas & Electric (SDG&E)-can access net billing benefits when connecting solar systems to the grid. Net billing functions similarly to net metering by awarding credits for surplus electricity your solar panels send to the grid. During periods without sunlight when you draw electricity from the grid, your utility applies these accumulated credits to reduce your bill.

What’s the Value of Bill Credits Under Net Billing?

The IOUs shifted to net billing, alternatively known as NEM 3, during April 2023. The California Public Utilities Commission (CPUC) developed the Avoided Cost Calculator (ACC) using wholesale electricity cost projections to establish export rates. Net billing values your excess solar energy based on your utility’s electricity purchase price (wholesale rate) rather than your electricity purchase price (retail rate). This structure reduces your potential electric bill savings.

Since wholesale electricity value fluctuates with market supply and demand, your actual compensation rate changes hourly, varies between weekdays and weekends, and shifts monthly based on when you export energy. Each utility company maintains 576 distinct export rates. Typically, wholesale credits equal approximately 25% of California’s retail electricity rates.

The CPUC refreshes the calculator biennially with nine-year projections. Solar installations during any two-year period lock in export rates for the complete nine-year span. Export rates continue adjusting annually according to wholesale electricity cost forecasts, but you’ll know the exact rate changes for all nine years from your grid connection date. Following the nine-year period, export rates remain tied to avoided costs but will fluctuate based on whichever ACC version exists then.

Lock in present export rates by completing your solar panel system interconnection before January 1, 2027.

How Long Can Bill Credits Carry Forward?

Each monthly statement includes an unavoidable fixed charge that solar export credits cannot offset, plus either a balance for unconsumed electricity not covered by solar or a carryover of additional export credits.

Given NEM 3.0’s low export credit values, you’ll probably exhaust all credits before your “true-up” date-the anniversary of your interconnection. Should leftover credits remain at this date, your utility compensates you using the Net Surplus Compensation Rate established for that specific month and year. This rate consistently falls well below your export credit value, making it essential to minimize unused credits.

Optimal strategy involves interconnecting your system during late winter or early spring (typically around March), allowing credit accumulation throughout summer months for winter usage. California’s solar radiation patterns support this timing strategy. To prevent simultaneous solar adoption statewide, the California Public Utilities Commission (CPUC) permits one true-up date modification to align with this March schedule.

Understanding Export Rate Adders

PG&E and SCE customers can increase their grid export compensation through “adders.” Like ACC export rates, these adders lock in for nine years. Your adder rate depends on your system’s interconnection year and remains constant across the nine-year period. SDG&E customers, non-residential customers, and new construction installations don’t qualify for adders.

Each year you postpone solar installation reduces the adder rate, decreasing your savings; adders become unavailable starting in 2028. Low-income customers and disadvantaged community (DAC) residents receive substantially higher adder rates. Below are the adder rates based on utility company, income level, and grid connection year:

Does California Offer Energy Storage Incentives?

Beyond solar incentives, California provides excellent battery incentive programs that reduce energy storage expenses. Proper electrical design and grounding are essential for battery system safety and performance.

The Self-Generation Incentive Program (SGIP) delivers rebates when you install batteries configured to operate during power outages. Your rebate value depends on your utility provider, battery capacity (measured in kilowatt-hours, kWh), and whether you qualify as a low-income customer or reside in a high-fire-risk zone.

Calculate your rebate amount by multiplying your battery capacity by the applicable rate from the table below:

Verify your eligibility for Residential Storage Equity or Equity Resiliency rebates by reviewing this CPUC brochure.

Rebate amounts will decline over time as battery adoption increases because SGIP operates on a tiered rate system. If you’re considering a solar-plus-battery installation, acting promptly maximizes your savings. Batteries exceeding 3 kWh capacity also qualify for the 30% federal tax credit.

Conclusion

California homeowners have access to substantial solar incentives that dramatically reduce installation costs and accelerate return on investment. The 30% federal Residential Clean Energy Credit remains the most valuable incentive available, but time is running out-systems must be installed by December 31, 2025, to qualify. Combined with state programs like DAC-SASH for qualifying low-income households, SGIP battery rebates, PACE financing options, and local utility rebates, California residents can save thousands on solar investments.

While the transition from net metering to net billing under NEM 3.0 has reduced export credit values, acting quickly still delivers significant benefits. Export rate adders decrease annually and disappear entirely after 2027, making immediate action essential for maximizing savings. Working with certified solar professionals and understanding proper solar permit procedures helps ensure your system qualifies for all available incentives. The Active Solar Energy System Exclusion protects homeowners from property tax increases, adding long-term financial value.

Whether you’re motivated by financial savings, energy independence, or environmental impact, California’s incentive landscape makes 2025 the optimal time to go solar. Commercial solar projects and off-grid installations can also benefit from many of these programs. According to NREL’s solar research and global renewable energy trends, California continues leading solar adoption nationwide. Don’t miss the opportunity to lock in the federal tax credit and secure the highest available export rates and adder values before these programs expire or diminish.

Affordable Solar Permit Plans

Don't let permit costs slow your project. Professional plan sets at competitive prices — all 50 states, fast turnaround.

Frequently Asked Questions

Your solar system must be fully installed and operational by December 31, 2025, to qualify for the 30% Residential Clean Energy Credit. President Trump signed legislation on July 4, 2025, eliminating this credit entirely starting January 1, 2026. Solar permit approval and installation typically require several months from consultation to completion, so start your solar journey immediately to secure these savings. This credit applies to your complete system cost, including equipment, labor, permits, and sales tax.

Average California solar shoppers save $3,528 through the federal tax credit alone on a typical 5 kW system. Additional savings depend on your specific situation: low-income households in disadvantaged communities can receive up to $15,000 through DAC-SASH, battery storage systems qualify for $150 to $1,000 per kWh through SGIP (depending on income and fire risk status), and local utility rebates can add another $500 to $1,500. Combined, these incentives can reduce your total solar investment by 40-60%.

California replaced net metering with net billing (NEM 3.0) in April 2023. Under net metering, homeowners received retail rate credits for excess solar energy sent to the grid. Net billing compensates at wholesale rates instead, approximately 25% of retail electricity rates. While this reduces savings potential, you still earn credits for excess energy production that offset future electricity consumption. PG&E and SCE customers can increase earnings through export rate adders, though these decline annually and end after 2027.

No. California's Active Solar Energy System Exclusion prevents your solar installation from increasing your property tax assessment. This exclusion applies to systems completed before January 1, 2027, meaning your property taxes won't rise despite the added home value from solar panels. This protection delivers ongoing savings throughout your system's 25-30 year lifespan, though California doesn't offer sales tax exemptions on solar equipment purchases.

Yes. California's Self-Generation Incentive Program (SGIP) provides substantial rebates for battery storage systems configured to operate during power outages. Standard residential storage receives $150/kWh, while low-income households qualify for $850/kWh. Low-income residents in high-fire-risk areas receive the highest rebate at $1,000/kWh. These rebates apply regardless of your utility provider (PG&E, SCE, SDG&E, or community choice aggregators). Additionally, batteries exceeding 3 kWh capacity qualify for the 30% federal tax credit, and some local utilities like Rancho Mirage Energy Authority offer additional rebates ranging from $500 to $1,500.

Interconnect your solar system to the grid before January 1, 2027, to lock in current export rates for nine years. Your export rates will still adjust annually based on wholesale electricity cost predictions, but you'll know exactly how they'll change throughout the nine-year period. Additionally, PG&E and SCE customers should act before 2028, when export rate adders disappear completely. 2025 offers the highest adder rates at 1.3-2.4 cents per kWh for standard customers and 5.4-5.6 cents per kWh for low-income or disadvantaged community residents.

California offers Property Assessed Clean Energy (PACE) financing, allowing solar installation with typically zero upfront payment. PACE loans feature competitive interest rates since the debt attaches to your property rather than you personally, and repayment occurs over 10-20 years through your property tax bill. The loan transfers to new owners if you sell your home. Alternatively, traditional solar loans qualify for the federal tax credit, while solar leases don't, making purchase options more financially advantageous. Low-income households may qualify for free or extremely low-cost installations through the DAC-SASH program.

SPS Editorial Team

Solar Permit Solutions

Solar Permit Solutions provides professional solar permit design services for residential, commercial, and off-grid installations across all 50 states. Our team ensures permit-ready plan sets delivered fast.

Related Articles

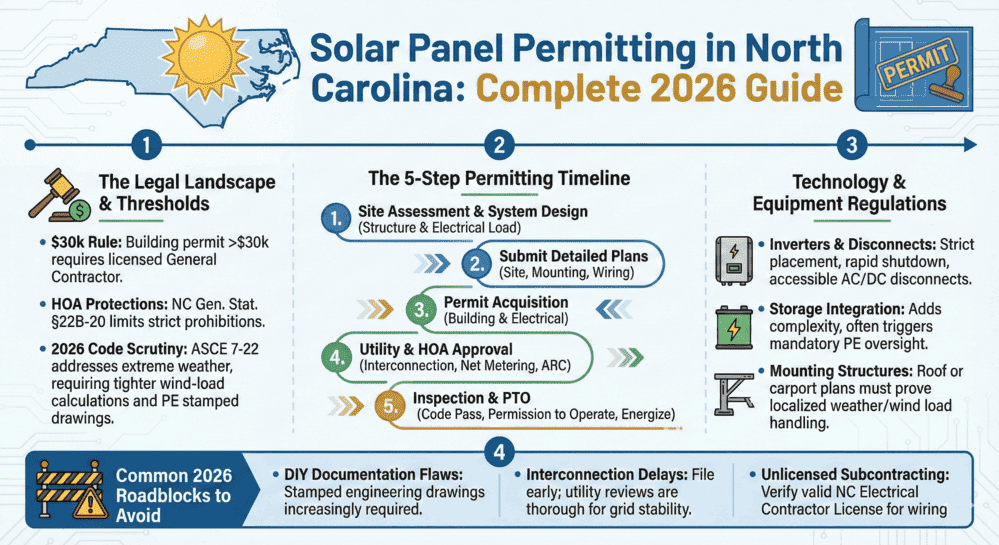

New 2026 North Carolina Solar Permit Guide: Duke Energy & Storage Rules

Learn North Carolina solar panel licensing and permitting requirements. Discover...

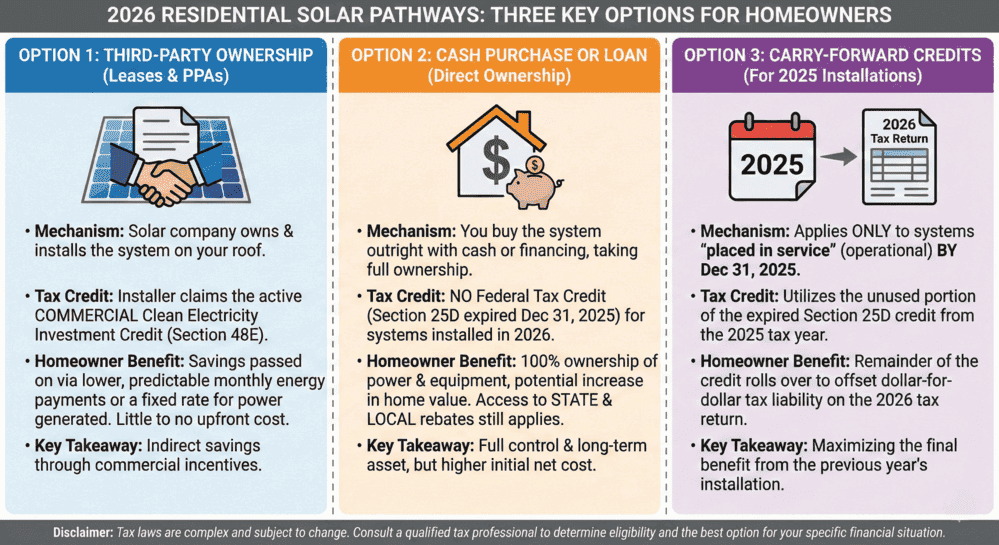

Section 25D Expiration: Homeowner Options In 2026

The Section 25D Residential Clean Energy Credit, which covered 30% of residentia...

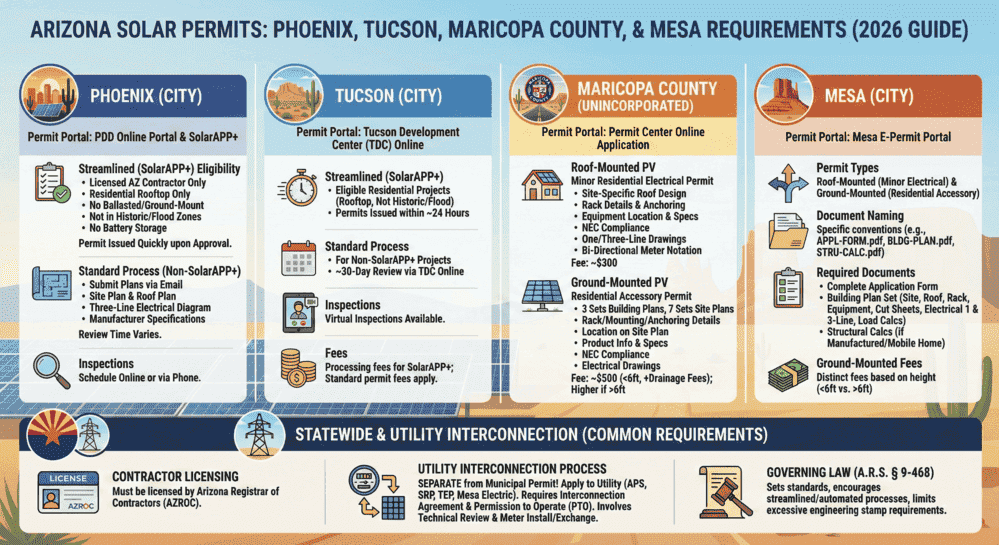

Solar Permits In Arizona: Phoenix, Tucson, Maricopa County, And Mesa Requirements (2026 Guide)

Arizona solar permitting at a glance: Arizona HB2301 now requires every municipa...