IRS Form 5695 is the federal tax form used to claim the 30% Residential Clean Energy Credit for solar panel installations and other renewable energy systems. This form allows homeowners to reduce their tax liability dollar-for-dollar by claiming residential energy credits when filing their annual tax returns.

The solar tax credit expires December 31, 2025, requiring systems to be fully installed and commissioned before this deadline. Form 5695 covers qualifying expenses, including solar panels, inverters, battery storage (minimum 3 kWh), installation labor, and permitting fees, with rebates and state incentives deducted from the total cost.

To complete Form 5695 for 2025, homeowners must:

- Verify system eligibility using the IRS checklist

- Calculate total qualified expenses (panels, inverters, racking, labor, permits)

- Document additional costs like battery storage and electrical panel upgrades

- Transfer the final credit amount to Form 1040

Form 5695 also covers the Energy Efficient Home Improvement Credit (30% of costs up to $1,200 annually) for ENERGY STAR® certified appliances, heat pumps, insulation, doors, and windows. When credits exceed tax liability, unused amounts carry forward to future years.

This guide explains Form 5695 completion steps, qualifying expenses, documentation requirements, and credit calculation methods to maximize your 2025 renewable energy tax savings.

Understanding IRS Form 5695 and Its Role in Residential Energy Credits

IRS Form 5695 represents the documentation filed alongside your income tax returns to access financial benefits from eco-friendly home improvements. This form serves as the calculation tool for claiming residential energy-efficient property credits and non-business energy property credits.

The scope of Form 5695 extends beyond solar tax credits; it encompasses geothermal heat pumps, wind turbines, fuel cells, solar water heating systems, and biomass energy systems. The IRS supplies Form 5695 instructions to guide taxpayers through proper completion and help them optimize their renewable energy tax advantages. Understanding your location’s solar potential can help you estimate system costs before claiming credits.

Completing Form 5695 for 2025: A Step-by-Step Process

Claim the Residential Clean Energy Credit by following this process when working through IRS Form 5695 for 2025. Referencing the official Form 5695 instructions guarantees accurate filing and ensures you capture the full value of your residential energy credits.

Step 1: Confirm Your Eligibility

Examine the checklist within IRS Form 5695 to verify your solar panel system or additional home energy improvements meet tax credit requirements.

Step 2: Compile Necessary Documentation

Assemble these details before completing the form:

Total system cost – Account for panels, inverters, racking systems, labor, and permitting expenses. Deduct any rebates, state credits, or incentive payments.

Associated home improvement expenses – Costs for necessary upgrades such as electrical panel replacements may qualify. Request an itemized cost breakdown from your installer.

Credit limitations – Reference page 4 of Form 5695, residential energy credits, to determine your maximum claimable credit for 2025.

Step 3: Document Additional Eligible Costs

Prepare to record supplementary qualifying expenses that could affect your total credit calculation. Options include:

- Solar battery storage systems (3 kWh minimum capacity requirement)

- Energy-efficient home upgrades (doors, windows, insulation, heat pumps, and similar improvements)

- Battery-electric vehicle (BEV) or plug-in hybrid electric vehicle (PHEV) acquisitions

- Unused credits from previous years if you couldn’t claim the complete amount earlier

Step 4: Finalize and Submit Form 5695

Apply the Form 5695 instructions for 2025 to determine your complete residential energy credits. Move the calculated credit amount to your federal tax return (Form 1040). Maintain receipts, invoices, and manufacturer certifications for potential IRS verification requests.

Form 5695 Instructions: Computing Your Renewable Energy Credits

The official IRS Form 5695 instructions establish three fundamental steps for homeowners:

- Validate eligibility for the Residential Clean Energy Credit or the Energy Efficient Home Improvement Credit.

- Record your qualifying expenditures, including solar panels, inverters, labor, and related upgrades, on the appropriate form lines.

- Determine and transfer your complete credit to your federal tax return (Form 1040).

Maintain receipts, manufacturer certifications, and installer documentation for possible IRS verification purposes. Working with professional solar permit services can help ensure all documentation meets federal requirements. For projects in California, consider exploring solar permitting in Los Angeles for localized expertise.

Solar Permit Solutions

Affordable Solar Permit Plans

Don't let permit costs slow your project. Professional plan sets at competitive prices — all 50 states, fast turnaround.

2025 Qualifying Expenses for Form 5695 Renewable Energy Credits

IRS Form 5695 enables homeowners to claim Residential Energy Credits for diverse clean energy upgrades extending beyond solar panel installations. Qualifying improvements for 2025 encompass:

Renewable Energy Systems (30% Tax Credit)

- Solar panel installations (including panels, inverters, racking, labor, and permitting)

- Solar water heaters (requiring Solar Rating and Certification Corporation (SRCC) certification)

- Battery storage systems (3 kWh minimum capacity)

- Small wind energy systems

- Geothermal heat pumps (must satisfy ENERGY STAR® requirements)

- Fuel cells (capped at $500 per 0.5 kW capacity)

Energy-Efficient Home Improvements (Maximum $3,200 Annual Credits)

ENERGY STAR® certified equipment, including:

- Natural gas, propane, and oil water heaters

- High-efficiency furnaces

- Biomass stoves and boilers

- Electric or natural gas heat pumps

- Exterior doors (ENERGY STAR® standards required) – maximum $250 per door, $500 total

- Exterior windows and skylights – maximum $600

- Insulation and air sealing materials (excluding installation costs)

- Energy-efficient roofing materials (excluding installation costs)

- Home energy audits – 30% of expense, maximum $150

Previous Year Credit Carry-Over

When you installed solar panels or other clean energy improvements in an earlier tax year but couldn’t claim the complete credit because of inadequate tax liability, you can transfer the unused credit to subsequent years.

Consult a certified solar professional to optimize your savings and identify all qualifying upgrades. Additionally, other programs offer incentives for energy efficiency and cost reduction, enhancing the advantages provided by IRS 5695.

Energy-Efficient Home Improvement Tax Credit for Homeowners

The Nonbusiness Energy Efficient Property Credit underwent expansion and rebranding as the Energy Efficient Home Improvement Credit, delivering improved advantages for homeowners spanning 2023 through 2032. Below is the operational framework, including IRS 5695 references for credit claims:

Nonbusiness Energy Efficient Property Credit (2022)

Expenses paid in 2022 allowed homeowners to claim a 10% tax credit, subject to a $500 lifetime maximum for most categories. Defined limitations include:

- Doors: $200 maximum

- Scope: Installation and acquisition costs for energy-efficient HVAC systems, water heaters, and biomass stoves, plus purchase expenses for energy-saving doors, windows, skylights, insulation, and roofing materials (excluding installation costs).

Energy Efficient Home Improvement Credit (2023–2032)

The Energy Efficient Home Improvement Credit, claimed via IRS Form 5695 for 2025, provides 30% coverage of qualifying expenditures up to a $1,200 annual maximum. This credit superseded the prior $500 lifetime restriction and accommodates diverse residential energy efficiency improvements.

Eligible upgrades encompass:

- ENERGY STAR® certified equipment

- High-performance insulation, doors, and windows

- Electric and natural gas heat pumps

- Biomass stoves and boilers

Beginning in 2025, certain products require a manufacturer-issued product identification number (PIN) for qualification. Reference the current Form 5695 instructions to confirm eligibility and maintain appropriate documentation. Through IRS Form 5695, homeowners can optimize their residential energy credits while enhancing energy efficiency and lowering utility expenses.

Federal Solar Tax Credit Summary Using IRS 5695

New legislation enacted in July 2025 established that the residential solar tax credit will conclude after December 31, 2025. Homeowners must complete solar system installation and commissioning before year-end to capture the complete 30% Residential Clean Energy Credit. Claim this credit by submitting IRS Form 5695 for 2024 or 2025, based on your project’s completion timeline.

The solar tax credit form facilitates claiming residential energy credits, which directly decrease your tax obligation rather than simply reducing taxable income. When your credit surpasses your tax liability, any remaining portion may carry forward, though this carryover provision may phase out as the credit expires. According to the latest renewable energy trends, solar adoption continues to accelerate globally despite policy changes.

Whether you’re planning a commercial solar installation or off-grid solar system, understanding proper permitting and tax documentation is essential. Avoid common permit denial mistakes by working with experienced professionals who understand both local permitting requirements and federal tax credit regulations.

Conclusion

Navigating IRS Form 5695 represents a critical step in maximizing your solar investment and accessing valuable renewable energy tax credits. With the 30% Residential Clean Energy Credit set to expire after December 31, 2025, understanding how to properly complete this form ensures you capture every dollar of available savings before the deadline.

Whether you’re claiming credits for solar panel installations, battery storage systems, or energy-efficient home improvements, accurate documentation and proper form completion make the difference between maximizing your tax benefits and leaving money on the table. The comprehensive guidelines outlined in the Form 5695 instructions provide the roadmap for calculating your credits, determining eligibility, and transferring the final amount to your federal tax return.

Take action now to gather your installation invoices, manufacturer certifications, and expense records. By following the step-by-step process and consulting with a tax professional when needed, you can confidently claim your residential energy credits and reduce your tax liability while contributing to a cleaner energy future. The window for claiming the full 30% credit is closing, make certain you’re positioned to capture these substantial savings before the opportunity ends.

For DIY solar projects or professionally installed systems, proper documentation is essential. Consider reviewing residential solar tips and understanding solar panel lifecycle regulations to ensure compliance throughout your system’s operation. If you’re interested in building your own solar system, explore essential DIY solar resources to guide your project.

FAQs

Affordable Solar Permit Plans

Don't let permit costs slow your project. Professional plan sets at competitive prices — all 50 states, fast turnaround.

Frequently Asked Questions

The 30% Residential Clean Energy Credit expires after December 31, 2025. Your solar system must be fully installed and commissioned before this date to qualify for the complete credit. File IRS Form 5695 with your tax return for the year your installation was completed to claim the credit.

Yes, you can claim the credit regardless of whether you paid cash or financed your solar installation. The credit applies to the full cost of your qualified solar system, including panels, inverters, labor, and permitting fees. However, you must deduct any rebates or state incentives from the total cost before calculating your credit.

When your calculated credit surpasses your annual tax liability, you can carry forward the unused portion to future tax years. This carryover provision allows you to apply the remaining credit against subsequent years' tax obligations, though this feature may phase out as the solar tax credit program expires.

Absolutely. Maintain all receipts, invoices, manufacturer certifications, and installer documentation for potential IRS verification. These records should include itemized cost breakdowns showing qualifying expenses, equipment specifications, and proof of installation completion. Keep these documents for at least three years after filing.

Yes, homeowners can claim both credits on the same Form 5695 filing. The Residential Clean Energy Credit covers solar panels and renewable energy systems at 30% with no annual cap, while the Energy Efficient Home Improvement Credit applies to items like heat pumps and insulation with a $1,200 annual maximum. Calculate each credit separately on the appropriate sections of Form 5695.

Qualifying expenses extend beyond panels to include inverters, racking systems, battery storage (minimum 3 kWh capacity), installation labor, permitting fees, and related electrical upgrades like panel replacements. Solar water heaters with SRCC certification, geothermal heat pumps meeting ENERGY STAR requirements, and small wind energy systems also qualify for the 30% credit when properly documented on Form 5695. Understanding proper grounding and bonding requirements ensures your system meets all qualification standards.

SPS Editorial Team

Solar Permit Solutions

Solar Permit Solutions provides professional solar permit design services for residential, commercial, and off-grid installations across all 50 states. Our team ensures permit-ready plan sets delivered fast.

Related Articles

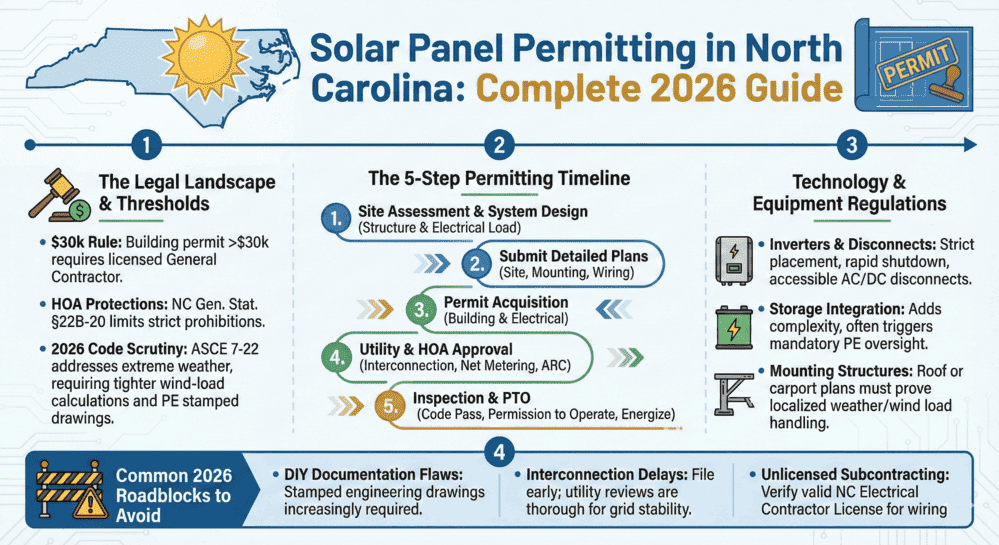

New 2026 North Carolina Solar Permit Guide: Duke Energy & Storage Rules

Learn North Carolina solar panel licensing and permitting requirements. Discover...

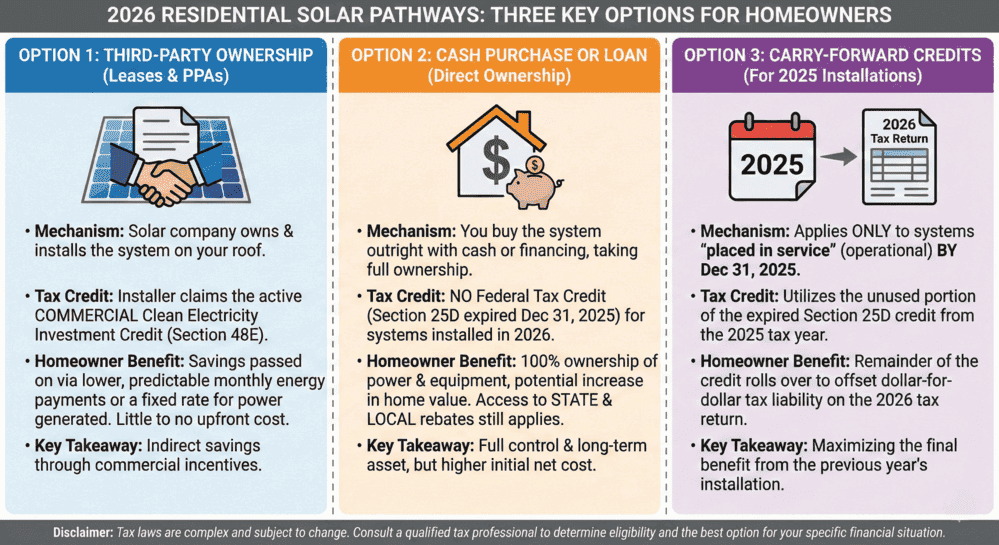

Section 25D Expiration: Homeowner Options In 2026

The Section 25D Residential Clean Energy Credit, which covered 30% of residentia...

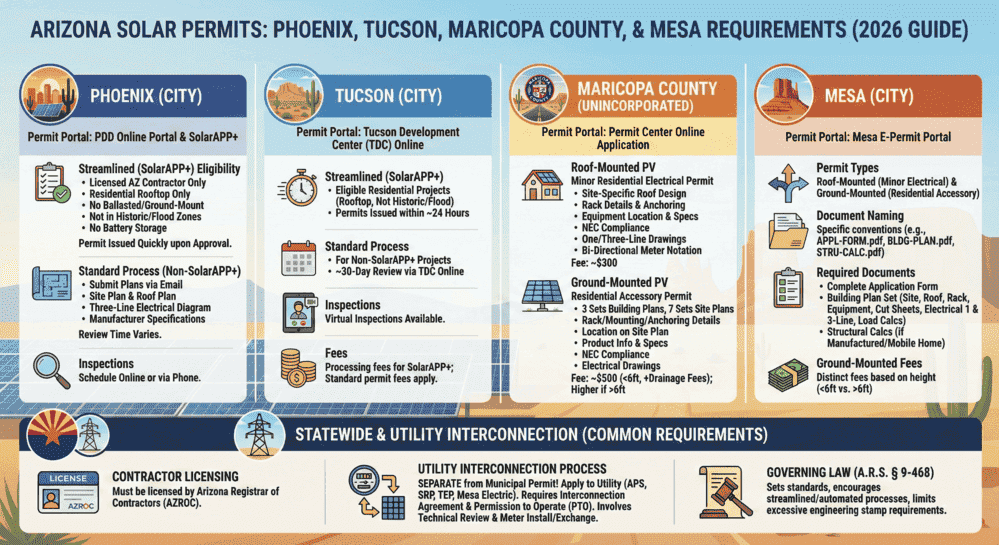

Solar Permits In Arizona: Phoenix, Tucson, Maricopa County, And Mesa Requirements (2026 Guide)

Arizona solar permitting at a glance: Arizona HB2301 now requires every municipa...