The residential solar tax credit expires December 31, 2025, with no extensions or phase-down periods. Homeowners must have their solar systems fully installed, inspected, and operational by this date to claim the 30% federal tax credit under Section 25D. This means completing all design work, permits, inspections, utility interconnection, and obtaining Permission to Operate (PTO) before year-end. Projects finished after December 31, 2025, will not qualify for any residential solar tax incentives. The IRS defines “placed in service” as systems ready and capable of generating electricity, not just purchased or partially installed. With permitting taking 2-3 months and interconnection adding 4-8 weeks, homeowners should start their solar projects at least 6-9 months before the deadline. Commercial solar projects under Section 48E remain eligible through different timelines, but residential homeowners face this firm cutoff date with significant financial implications.

For homeowners to claim the credit, their solar systems must be completely installed and fully operational before the 2025 solar tax credit cutoff date. This requires finishing all project phases, including residential solar design, permitting processes, inspection approvals, utility interconnection, and frequently securing Permission to Operate (PTO). Given this compressed timeframe, solar contractors must prioritize meticulous project scheduling; any setback could result in customers forfeiting the entire residential solar incentive.

With the solar tax credit deadline drawing near, a common concern among both property owners and installation professionals is, which requirements must be satisfied by December 31, 2025? This resource provides a detailed step-by-step roadmap and examines the broader implications of the expiring solar tax credit on the renewable energy sector. With the solar incentive’s termination date approaching, accurate project scheduling has become more crucial than ever.

When Does the Solar Tax Credit Expire?

The timeline is definitive: the residential solar panel tax credit authorized by Section 25D officially terminates on December 31, 2025. Unlike previous iterations of this legislation, there’s no step-down phase or incremental decrease. To claim the complete 30% solar panel incentive, your installation must be finished, actively functioning, and producing electricity before 2025 ends. Projects completed beyond this deadline won’t be eligible for the residential solar tax credit.

This makes 2025 a pivotal year for project coordination, permit acquisition, and grid connection. Installation companies should proactively schedule to prevent their clients from missing the cutoff, while homeowners should act promptly to lock in this financial benefit before the residential solar tax credit’s expiration becomes permanent.

Steps Homeowners Must Take Before the 2025 Solar Tax Credit Deadline

To secure the complete 30% residential solar tax credit before its expiration, homeowners need more than just a signed contract. The IRS mandates that your installation be finished and actively operating by the close of 2025. Based on IRS guidelines (Notice 2018-59), “placed in service” indicates the equipment has reached a state of preparedness and availability for its designated purpose. For solar installations, this means achieving full capability to supply electricity to your residence or the utility grid.

Across most regions, utility companies additionally mandate Permission to Operate before systems can legitimately transmit power to the electrical grid. Since the residential solar tax credit terminates after December 31, 2025, failing to complete any required phase could result in forfeiting thousands of dollars in financial benefits. Follow this action plan to maintain project momentum:

Meeting the 2025 Residential Solar Tax Credit Deadline: Step-by-Step Guide

- Executed Agreement & Initial Payment – Lock in your installation with a finalized contract and initial deposit. Installation companies are already scheduling projects months ahead for 2025. Postponing this phase could extend your timeline beyond the solar tax credit expiration date.

- Permit Approval & Design Documents – All installations require design documentation examined and authorized by your local Authority Having Jurisdiction (AHJ). This approval timeline can extend from several weeks to multiple months. Filing thorough, regulation-compliant plans promptly prevents scheduling delays.

- Grid Connection Authorization – Most utility providers mandate an interconnection request and clearance before systems can begin operation. Without securing this approval, you might have equipment installed yet still fail to meet solar panel tax credit requirements. Understanding solar permitting processes can help streamline this critical step.

- System Installation & Official Inspection – Your solar array must be placed in service, completely installed, officially inspected, and able to generate power by December 31, 2025, at the latest. Simply ordering components or executing paperwork doesn’t satisfy eligibility criteria. For those interested in building your own home solar power system, understanding these requirements is essential.

- Permission to Operate (PTO) – Although IRS standards emphasize “installed and operational,” utility companies typically mandate PTO before systems can lawfully feed electricity to the grid. This authorization is essential for validating your system’s active status. Professional services like Solar Permit Solutions can support permit-ready solar design packages and grid connection filings to maintain project progress toward PTO authorization.

Solar Permit Solutions

Homeowner Going Solar?

Get the permit-ready plan set your city requires — delivered fast so your solar project stays on schedule.

Commercial Solar ITC: Still Available but With Stricter Timeline Requirements

The commercial solar tax credit (Section 48E) continues to be accessible, though recent regulatory modifications have compressed deadlines and refined ITC qualification standards.

Installations commencing construction by July 4, 2026, remain eligible for the complete 30% solar tax credit, frequently utilizing the four-year safe harbor provision.

Nevertheless, a July 2025 executive directive instructs the Treasury to restrict what constitutes “beginning construction.” Minimal activities such as equipment down payments may no longer satisfy requirements. Instead, significant physical onsite work will probably be necessary. Commercial solar design professionals should stay informed about these evolving requirements.

Projects initiated after July 4, 2026, must achieve full operational status by December 31, 2027, to qualify for federal solar incentives. Failing to meet this timeframe results in complete forfeiture of the commercial solar ITC. Developers and EPC firms should proceed rapidly, maintain detailed documentation, and strategize around these revised specifications. The National Renewable Energy Laboratory provides valuable resources for understanding commercial solar requirements.

Understanding the Impact of the 2025 Solar Tax Credit Expiration

The solar Investment Tax Credit (ITC) has functioned as one of the most powerful mechanisms for accelerating clean energy implementation across the U.S. This incentive has enabled millions of property owners to reduce initial expenses and allowed commercial developers to broaden solar energy accessibility, as documented by renewable energy research.

Currently, with the solar tax credit terminating, both residential and commercial solar clients confront pressing deadlines. Installation professionals must move quickly to design, authorize, and finalize installations before this financial benefit vanishes. If you’re evaluating your beginner’s guide to solar energy or pursuing new commercial installations, immediate action is essential.

Solar Installer Guidelines: How to Navigate the 2025 Tax Credit Deadline

With the residential solar tax credit expiring on December 31, 2025, installation companies face one of their most demanding years in recent history. To maintain project momentum and safeguard customer solar incentives, contractors and EPCs should concentrate on four critical areas:

- Controlling Schedule Congestion – As cutoff dates draw near, every installer will experience pressure to finish assignments rapidly. Develop achievable installation timelines and incorporate contingency periods for unforeseen complications such as adverse weather, material procurement challenges, or inspection rescheduling.

- Filing Permit-Ready Design Documents Promptly – Authorization processes can require weeks or multiple months, varying by jurisdiction. Submitting solar permit requirements documentation early guarantees that approvals don’t delay installation work. Collaborating with an experienced engineering provider can help minimize soft expenses and prevent application rejections.

- Transparent Property Owner Communication – Numerous homeowners don’t understand that merely executing a contract doesn’t secure the solar panel tax credit. Communicate proactively and consistently about IRS requirements for systems to be “installed and operational” by the deadline. Establishing clear expectations now prevents eleventh-hour complications. Understanding DIY solar insurance and liability risks helps set proper expectations.

- Recording Project Progress Points – EPCs should preserve comprehensive documentation of design authorizations, permit submissions, equipment arrivals, and installation advancement. Should an IRS audit occur, thorough records will help verify that installations satisfied requirements before the solar tax credit expiration date. NABCEP certified professionals understand the importance of detailed documentation.

The Solar Industry Landscape After the 2025 Tax Credit Expires

Although the residential solar tax credit is concluding, prospects for solar expansion remain robust in alternative sectors. Installation companies seeking to sustain growth beyond 2025 can target:

- Light Commercial Installations – Educational facilities, small enterprises, and office complexes frequently possess substantial rooftop or parking area capacity for solar arrays. These installations still qualify for the commercial solar tax credit (ITC) when they satisfy Section 48E timelines. Solar permit services in Los Angeles and other major metropolitan areas continue to serve this growing market.

- Nonprofit & Government Facilities – Religious institutions, community centers, and government buildings often represent optimal solar candidates. With constrained funding, they gain from sustained energy cost reductions, and many remain eligible for incentives. Resources from state energy offices provide guidance on accessing these programs.

- Community and Shared Solar Programs – Even following the residential solar panel tax credit termination, community solar initiatives may grow as utilities and developers pursue new customer segments, as outlined in global renewable energy status reports.

For installation professionals, this transition phase presents an opportunity to expand service offerings. While the solar tax credit expiring for homeowners will decrease demand in that market segment, commercial and nonprofit installations remain viable growth channels, particularly for installers who develop the permitting and engineering capabilities to compete in these sectors. Understanding electrical fundamentals for solar projects becomes increasingly important in these complex installations.

This is where our team can help contractors transition with assurance. We deliver efficient, code-compliant commercial solar design packages, engineering assessments, and PE-stamped documentation nationwide. Whether you’re planning a 50 kW installation for an educational facility or equipping a government building, we help you manage permitting and engineering obligations effectively. We also provide specialized expertise in off-grid solar system design for unique applications.

For residential installers seeking to diversify in 2025, preparation should begin immediately, and our services facilitate this strategic shift. Understanding proper solar PV grounding and bonding requirements and staying current with IEEE renewable energy standards will position contractors for success in the evolving solar landscape. Learning about solar panel racking systems and consulting essential DIY solar energy books can enhance technical knowledge. As the industry considers end-of-life solar panel regulations, forward-thinking installers who adapt their business models will thrive in the post-tax credit environment. Understanding solar radiation mapping data helps optimize system placement for maximum efficiency.

Conclusion

The December 31, 2025, deadline represents a pivotal moment for the residential solar industry. With the 30% residential solar tax credit expiring without any phase-down period, homeowners and installation professionals must act decisively to capitalize on this final opportunity. Success depends on completing every critical milestone, from signed contracts and permit approvals to utility interconnection and Permission to Operate, before the year concludes.

For homeowners considering solar adoption, delaying action could mean forfeiting thousands of dollars in tax savings. Installation companies face an equally pressing challenge: managing unprecedented demand while maintaining project quality and timeline accuracy. Strategic planning, early permit submissions, and transparent client communication will determine which projects successfully cross the finish line before this significant incentive disappears.

Beyond 2025, the solar industry won’t disappear; it will evolve. While residential demand may shift, commercial, nonprofit, and community solar sectors offer substantial growth opportunities for contractors willing to adapt. Whether you’re a homeowner racing to meet the deadline or an installer preparing for the industry’s next chapter, the time to take action is now. The solar tax credit’s expiration marks not just an ending, but a transition point that will reshape how Americans access clean energy for years to come.

FAQs

What exactly does “placed in service” mean for the solar tax credit deadline?

“Placed in service” means your solar system must be completely installed, inspected, and actively capable of generating electricity by December 31, 2025. According to IRS Notice 2018-59, this requires the system to be in a condition of readiness and availability for its designated function. Simply signing a contract, making a deposit, or having panels delivered does not satisfy this requirement. The system must pass all inspections and, in most cases, receive Permission to Operate (PTO) from your utility company to prove it can legally supply power to your home or the electrical grid.

What options remain for homeowners who miss the December 31, 2025, deadline?

Homeowners who miss the residential solar tax credit deadline will lose access to the 30% federal incentive, but solar installation may still make financial sense depending on local conditions. Many states and utilities offer their own solar incentives, rebates, or performance-based programs that continue beyond 2025. Net metering policies in many regions still provide value by crediting excess solar generation against future electricity bills. Additionally, solar panel prices have decreased substantially over the past decade, and ongoing electricity rate increases mean long-term energy savings can still justify the investment even without the federal tax credit. Homeowners should evaluate state-specific incentives, utility programs, and their local electricity rates to determine whether solar remains economically viable in their situation.

Homeowner Going Solar?

Get the permit-ready plan set your city requires — delivered fast so your solar project stays on schedule.

Frequently Asked Questions

'Placed in service' means your solar system must be completely installed, inspected, and actively capable of generating electricity by December 31, 2025. According to IRS Notice 2018-59, this requires the system to be in a condition of readiness and availability for its designated function. Simply signing a contract, making a deposit, or having panels delivered does not satisfy this requirement. The system must pass all inspections and, in most cases, receive Permission to Operate (PTO) from your utility company to prove it can legally supply power to your home or the electrical grid.

This situation creates significant risk. While IRS guidance emphasizes that systems must be 'installed and operational,' utilities typically require PTO before systems can legally export power to the grid. If your system cannot generate or export electricity because PTO hasn't been issued by the deadline, you may have difficulty proving your system was truly operational by December 31, 2025. To avoid jeopardizing your tax credit eligibility, work with your installer to complete all interconnection requirements and secure PTO well before year-end, leaving adequate buffer time for potential delays.

Permitting and interconnection timelines vary significantly by jurisdiction and utility provider. Local permit approvals can range from 2-3 weeks in streamlined municipalities to 2-3 months or longer in areas with backlogged building departments. Utility interconnection applications may add another 4-8 weeks to the timeline, depending on the provider's review process and queue length. Given these variables, homeowners should initiate their solar projects at least 6-9 months before the December 31, 2025 deadline to accommodate unexpected delays, revision requests, or seasonal slowdowns that could push completion dates beyond the tax credit expiration.

Commercial solar projects under Section 48E remain eligible for the 30% Investment Tax Credit, but with tightened deadlines and stricter qualification criteria. Projects must begin construction by July 4, 2026, and a July 2025 executive order directs the Treasury to narrow what constitutes 'beginning construction', minimal actions like equipment deposits may no longer qualify, requiring substantial physical onsite work instead. Any project started after July 4, 2026 must be fully operational by December 31, 2027 to receive federal incentives. Commercial developers, EPCs, and installers should document all construction milestones thoroughly and plan timelines conservatively to maintain ITC eligibility.

Homeowners who miss the residential solar tax credit deadline will lose access to the 30% federal incentive, but solar installation may still make financial sense depending on local conditions. Many states and utilities offer their own solar incentives, rebates, or performance-based programs that continue beyond 2025. Net metering policies in many regions still provide value by crediting excess solar generation against future electricity bills. Additionally, solar panel prices have decreased substantially over the past decade, and ongoing electricity rate increases mean long-term energy savings can still justify the investment even without the federal tax credit. Homeowners should evaluate state-specific incentives, utility programs, and their local electricity rates to determine whether solar remains economically viable in their situation.

SPS Editorial Team

Solar Permit Solutions

Solar Permit Solutions provides professional solar permit design services for residential, commercial, and off-grid installations across all 50 states. Our team ensures permit-ready plan sets delivered fast.

Related Articles

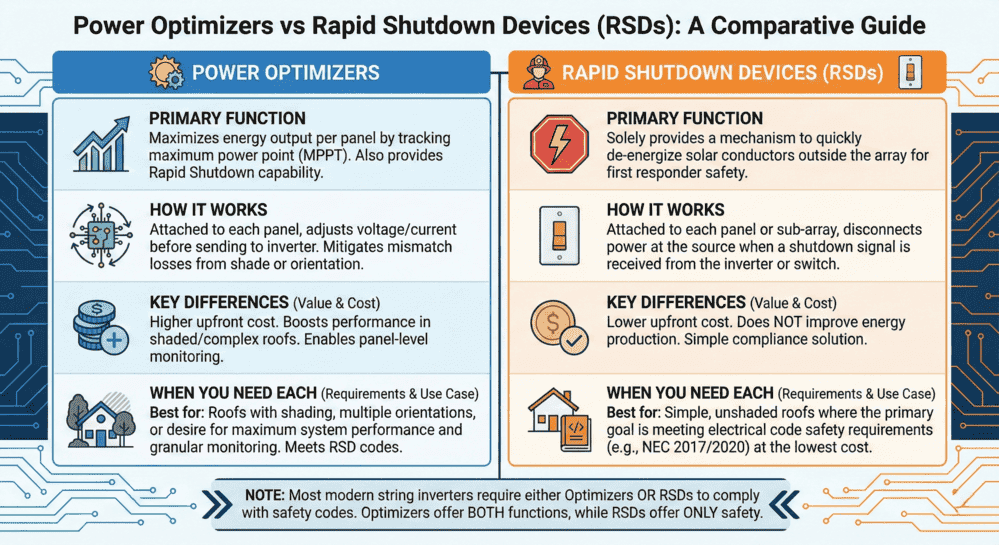

Power Optimizers vs Rapid Shutdown Devices: Differences, Requirements & When You Need Each

When planning a solar installation, understanding the difference between rapid s...

Your Complete DIY Solar Panel Installation Guide

Homeowners turn to solar energy for various motivations. Clean, renewable power ...

What Is A Commercial Solar PV System?

A commercial solar PV system is a renewable energy setup designed to help busine...