The federal solar Investment Tax Credit (ITC) provides a 30% tax credit on solar installations through December 31, 2032, but thousands of homeowners face denial each year. Solar tax credit claims are rejected for seven primary reasons: installation completed after December 31, system ownership through leases or PPAs instead of purchase, incorrect tax filing without Form 5695, incomplete placed-in-service status, missing ownership documentation, insufficient tax liability, and installer paperwork errors.

The IRS defines “placed in service” as the exact date your system passes final inspections, receives utility Permission to Operate (PTO), and becomes operational. This date determines your tax year eligibility, not your contract signing date, payment date, or equipment delivery date. A system reaching operational status on January 2nd qualifies for the next tax year, not the previous December.

To claim the federal solar tax credit, you must meet six mandatory IRS requirements: own the solar system (financed or cash purchases qualify; leases and PPAs do not), achieve placed-in-service status with complete inspections and PTO approval, install the system at a U.S. residence you own, use qualifying equipment (PV panels, inverters, mounting equipment, wiring, and solar-charged batteries), have sufficient federal tax liability (the credit is non-refundable but carries forward indefinitely), and file IRS Form 5695 with complete documentation including itemized invoices, manufacturer certifications, and PTO proof.

If your credit was denied, verify your placed-in-service date matches documentation, confirm ownership status in your contract, obtain missing paperwork from your installer or utility company, file an amended return if filing errors occurred, and consult a tax professional to protect carryforward options. Systems denied for current-year claims may qualify for the following tax year once proper permitting requirements are met.

At Solar Permit Solutions, we work with installers and homeowners to ensure proper permitting documentation, PE-stamped engineering plans, and utility interconnection compliance that supports successful federal tax credit claims.

This comprehensive guide addresses:

- Valid circumstances that disqualify the tax credit for the current tax year

- Critical IRS eligibility requirements every solar owner must understand

- Common errors and scheduling problems that delay claims or cancel them permanently

- Actionable steps when facing potential misrepresentation from your solar provider

When Does Your Solar System Qualify for the Tax Credit?

The IRS does not consider contract signing, initial payment, or equipment delivery as qualifying events. Federal tax authorities define “placed in service” as the point when your system completes final inspections, receives utility interconnection authorization, and begins producing power.

Timing matters critically here. A system finalized on January 2nd instead of December 30th shifts your eligibility to the following tax year. Permitting holdups, equipment shortages, or inspection delays will postpone your claim regardless of installer promises or expectations.

Core IRS Eligibility Requirements

Meet every IRS requirement before claiming the ITC. These regulations exist within the federal tax code, yet property owners frequently overlook essential qualifications, according to renewable energy research from the National Renewable Energy Laboratory.

Review these fundamental eligibility criteria in straightforward terms:

1. System Ownership Is Mandatory

Cash purchases and financed installations both qualify for the credit. Leases and power purchase agreements (PPAs) typically disqualify homeowners from claiming benefits.

Eligible arrangements: Cash purchases or loan-financed systems where you maintain equipment title.

Ineligible arrangements: Lease contracts or PPAs where third parties own the equipment and sell electricity to you. The actual system owner claims the credit in these scenarios.

Real-world comparison: A Texas homeowner financing their system through a solar loan maintains panel ownership and qualifies for the credit despite making monthly payments. Their neighbor who signed a zero-down lease receives no tax benefit because the installer retains system ownership and claims the credit.

2. Complete Installation and Operational Status Required

The federal credit applies exclusively to systems achieving full operational status within the claimed tax year. Required completion milestones include:

- Successful building and electrical inspections

- Utility provider Permission to Operate (PTO) approval

- Full installation of all system components, including inverters

Partially completed installations, even at 95% progress, fail to meet IRS placement requirements. Understanding how solar permitting timelines work helps homeowners plan accordingly.

3. Property Location Requirements

Eligible properties include:

- Primary residential properties

- Secondary vacation homes

Rental properties used exclusively by tenants do not qualify. Properties with partial owner occupancy may qualify under different IRS provisions requiring tax professional evaluation. HOA regulations can also impact solar installations and credit eligibility timelines.

4. Equipment Qualification Standards

The ITC covers complete costs for approved solar equipment:

- Photovoltaic panels and solar cells

- Inverter systems

- Mounting hardware and racking structures

- Electrical wiring and connection components

- Battery storage systems (when charged exclusively by solar arrays)

Aesthetic home improvements and unrelated electrical work remain ineligible. Standard roof replacement projects do not qualify unless you install integrated solar shingle roofing as part of the photovoltaic system. Structural load analysis requirements often factor into qualifying equipment installations.

5. Adequate Tax Liability Requirement

The ITC functions as a nonrefundable credit, reducing your federal tax obligation to zero but not generating refunds beyond your actual liability.

When your tax obligation falls below the credit value, carry forward the unused balance to subsequent years. Zero tax liability eliminates credit eligibility entirely.

Application example: A Florida property owner owing $1,500 in federal taxes for 2024 with a $6,000 solar credit applies $1,500 immediately and carries forward the remaining $4,500 to future tax years.

6. Proper IRS Documentation Filing

Claim the credit by submitting required forms:

- Complete IRS Form 5695 for the tax year achieving placed-in-service status

- Maintain all supporting documentation (invoices, manufacturer certifications, PTO verification) for potential IRS audits

Incomplete or incorrect filing triggers credit denial despite meeting all other qualifications. Energy comparison platforms like EnergySage provide resources on proper tax credit documentation.

Missing any single criterion (ownership, timing, qualifying equipment, tax liability, or correct filing) results in IRS denial for that tax year.

Why Was Your Solar Tax Credit Denied? 7 Common Reasons

Meeting general IRS eligibility standards does not guarantee approval. Specific obstacles can delay your claim to the following year or eliminate eligibility completely. Identify these common problems and take corrective action.

1. Installation Completed After December 31

The IRS determines eligibility based on placed-in-service dates (full installation, inspection approval, and operational status). Completion after December 31 automatically shifts claims to the next tax year.

Take action:

- Verify PTO and completion dates match official documentation

- File the credit claim for the correct tax year

- Evaluate installer accountability if mismanagement caused financial losses

2. Leased Systems or PPA Arrangements

System ownership determines credit eligibility. Leases and PPAs transfer both ownership and tax benefits to the solar company.

Take action:

- Examine your agreement to confirm ownership structure

- Address potential misrepresentation if verbal promises conflict with contract terms

Incorrect Tax Filing

Omitting IRS Form 5695, selecting the wrong tax years, or excluding eligible expenses guarantees denial.

Take action:

- Submit an amended return to correct filing errors

- Engage a tax preparer experienced with solar credits to verify documentation accuracy

3. Incomplete Placed-in-Service Status

Partial installations or systems awaiting final inspection or utility approval remain ineligible.

Take action:

- Coordinate with your installer to finalize pending requirements

- File the credit claim after achieving placed-in-service status in the next tax year

4. Missing Ownership Documentation

Unfinalized system titles or incomplete purchase agreements prevent IRS processing. This frequently occurs with homes sold with existing solar installations or builder-installed systems.

Take action:

- Complete all ownership transfer documentation immediately

- Seek professional assistance if sellers or installers withhold required paperwork

5. Insufficient Tax Liability

The ITC only offsets existing tax obligations and cannot generate cash refunds beyond your liability. Consider this analogy: your tax liability represents a $1,000 restaurant bill, while the solar tax credit functions as a $5,000 gift card. The card covers your entire bill and retains a $4,000 balance for future use (carryforward), but the restaurant will not provide $4,000 cash back.

Take action:

- Apply maximum available credit for the current year and carry forward remaining balance within IRS time limits

- Consult a tax professional to optimize carryover strategies

6. Installer Documentation Errors

Federal solar tax credit approval depends on accurate, timely installer paperwork. The IRS requires proof of system eligibility directly from the company handling sales and installation.

Essential documents include:

- Itemized invoices detailing all eligible equipment and installation expenses

- Ownership verification (sales receipts, executed loan agreements, or system titles)

- Placed-in-service completion dates matching inspection and utility records

- Equipment manufacturer certification statements

- Utility Permission to Operate (PTO) documentation

7. Incorrect, missing, or inconsistent information triggers claim denial regardless of system eligibility.

Take action:

- Request corrected or missing documents from your installer immediately

- Secure professional assistance if installers refuse or delay compliance, particularly when approaching IRS filing deadlines

Critical Timing Issues and Prevention Strategies

Solar Permit Solutions

Affordable Solar Permit Plans

Don't let permit costs slow your project. Professional plan sets at competitive prices — all 50 states, fast turnaround.

Missed Your Solar Tax Credit This Year? Here’s What to Do Next

- Verify eligibility for next year’s tax filing period

- File an amended tax return if documentation errors caused the initial denial

- Obtain corrected or missing paperwork from your installer

- Engage a qualified tax professional to protect carryforward credit options

- Pursue professional evaluation if installer misrepresentation led to eligibility loss

Conclusion

Solar tax credit denial stems from preventable issues. Understanding IRS placement requirements, maintaining proper ownership documentation, and coordinating installation timelines protect your eligibility for thousands of dollars in federal tax benefits.

Take control of your solar investment by verifying system ownership structure before signing contracts, confirming all equipment qualifies under IRS standards, and scheduling installations with adequate time buffers before year-end. Request complete documentation from your installer immediately after achieving operational status, including itemized invoices, manufacturer certifications, and utility PTO approval.

Our residential solar design services ensure proper permitting, engineering compliance, and documentation accuracy that supports successful tax credit claims. Our permit design services and PE-stamped engineering plans help installers complete projects on schedule while meeting all federal and local requirements.

Act now to secure your solar tax credit. Review your installation timeline and requirements, confirm ownership documentation, and consult qualified tax professionals before filing. Your federal tax benefit depends on completing every step correctly. Learn more about renewable energy trends and how proper planning maximizes your solar investment.

FAQs

Affordable Solar Permit Plans

Don't let permit costs slow your project. Professional plan sets at competitive prices — all 50 states, fast turnaround.

Frequently Asked Questions

Yes, but only if your system achieved placed-in-service status while you owned the property. The IRS bases eligibility on ownership at the time your system became operational (passed inspections, received PTO, and began producing power). If you sell your home after this milestone but before filing taxes, you remain eligible to claim the credit for that tax year. However, selling before the system reaches operational status transfers the credit opportunity to the new homeowner. Document your placed-in-service date with PTO approval and final inspection certificates before closing the sale.

Contact your local permitting authority and utility company directly to obtain copies of building permits, inspection reports, and PTO approval documents. These agencies maintain permanent records that satisfy IRS documentation requirements. For manufacturer certifications, reach out to the equipment manufacturers directly using model numbers from your panels and inverters. Most manufacturers provide certification letters for tax credit purposes. If your purchase agreement or itemized invoice is missing, check with your financing company (if applicable) or payment processor for transaction records. The IRS accepts alternative documentation proving system costs, ownership, and operational dates when installers become unavailable.

The federal solar ITC can be carried forward indefinitely until fully utilized. Unlike some tax credits with expiration dates, unused ITC amounts roll over to subsequent tax years without time limits under current IRS regulations. For example, if you claim a $10,000 credit but only have $2,000 in tax liability for 2024, you apply $2,000 immediately and carry forward the remaining $8,000 to 2025. This process continues each year until you exhaust the entire credit amount. Work with a tax professional to maximize annual credit utilization while maintaining carryforward balances for future years.

Yes, self-installed solar systems qualify for the federal ITC if they meet all standard eligibility requirements. You must own the equipment, install it at your primary or secondary residence, use qualifying components (certified PV panels, inverters, and mounting equipment), and achieve placed-in-service status through completed inspections and utility interconnection approval. The credit covers all eligible equipment costs and installation materials you purchased. However, you cannot claim your own labor costs. DIY installations face additional scrutiny regarding code compliance, so ensure your system passes all required electrical and building inspections. Maintain detailed receipts for all equipment purchases, manufacturer certifications, inspection approvals, and PTO documentation from your utility company. Consider consulting NABCEP-certified professionals for guidance on meeting code requirements.

Battery storage qualifies for the solar ITC only when charged exclusively by your solar array. Batteries installed simultaneously with solar panels automatically qualify as part of the complete system. For batteries added later, IRS rules allow inclusion if they meet the 100% solar charging requirement. This means you cannot charge the battery from the grid without disqualifying it from the credit. Installing battery management systems that prevent grid charging maintains eligibility. The credit percentage matches the rate in effect when you place the battery in service, not your original solar installation date. If you installed solar panels in 2023 (30% credit) and add qualifying batteries in 2025 (still 30% through year-end), the battery costs claim the 2025 credit rate separately from your original system credit.

Your placed-in-service date uses the later milestone between final inspection completion and utility PTO approval. Both requirements must be satisfied for IRS eligibility. A system receiving PTO in December but passing final inspection in January qualifies for the January tax year, not December. The IRS requires complete operational status, meaning all inspections passed AND utility interconnection approved. Coordinate closely with your installer and local inspection authorities when approaching year-end deadlines. Request expedited inspection scheduling if December completion appears uncertain. Some jurisdictions offer priority inspection services for projects facing tax credit timing constraints. Document exact completion dates for both inspections and PTO approval to file accurately for the correct tax year.

SPS Editorial Team

Solar Permit Solutions

Solar Permit Solutions provides professional solar permit design services for residential, commercial, and off-grid installations across all 50 states. Our team ensures permit-ready plan sets delivered fast.

Related Articles

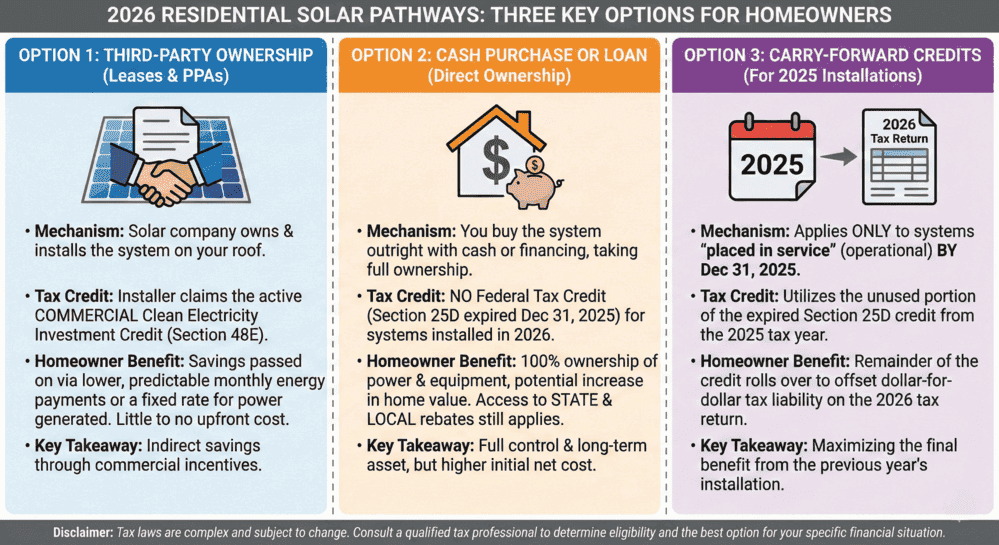

Section 25D Expiration: Homeowner Options In 2026

The Section 25D Residential Clean Energy Credit, which covered 30% of residentia...

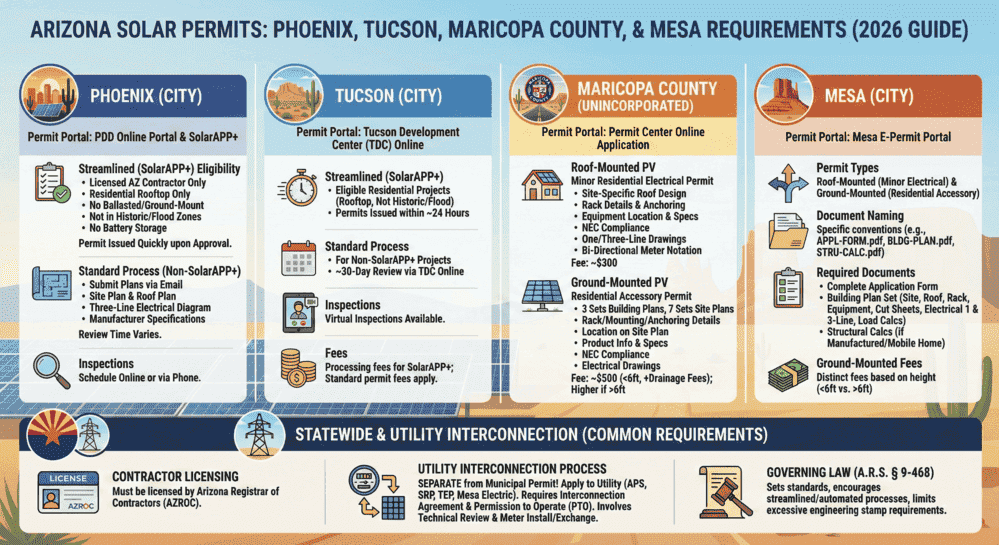

Solar Permits In Arizona: Phoenix, Tucson, Maricopa County, And Mesa Requirements (2026 Guide)

Arizona solar permitting at a glance: Arizona HB2301 now requires every municipa...

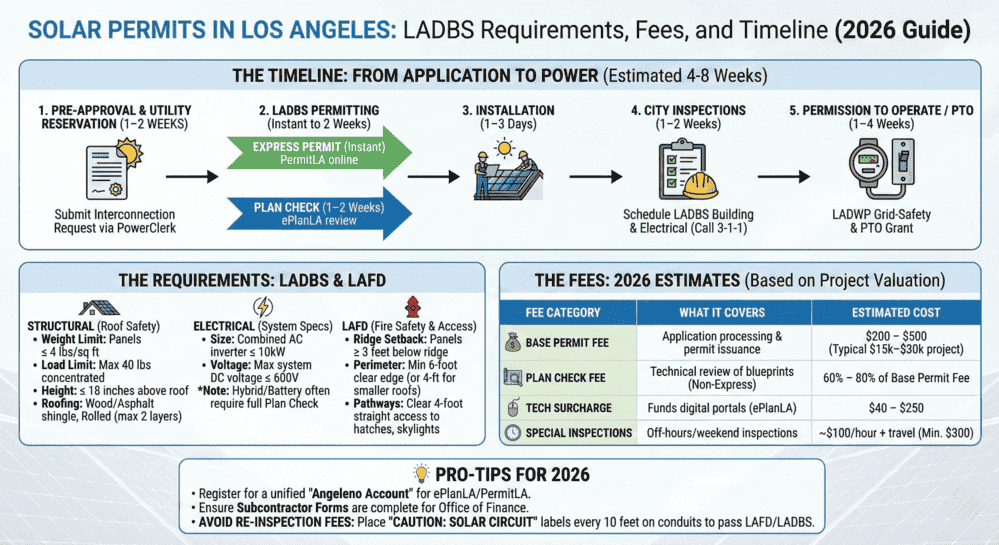

Solar Permits in Los Angeles: LADBS Requirements, Fees, and Timeline (2026 Guide)

Quick Answer: Solar permits in Los Angeles are issued by LADBS and require LAFD ...