Duke Energy ranks among the largest electric utility companies in the United States, delivering power to more than 8.2 million residential and commercial customers throughout North Carolina, South Carolina, Florida, Indiana, Ohio, and Kentucky. South Carolina residents receive service from two separate Duke Energy subsidiaries: Duke Energy Carolinas covers the Greenville region, while Duke Energy Progress operates in the Florence region.

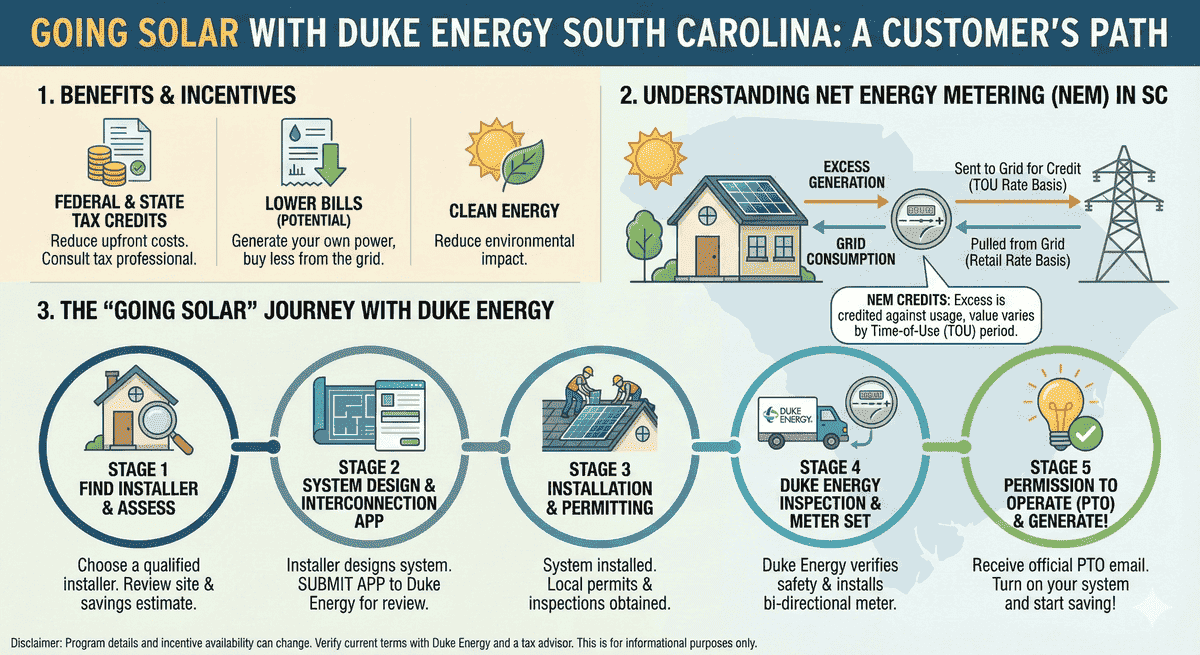

Duke Energy positions itself as a strong supporter of renewable energy initiatives. The utility is actively implementing a comprehensive clean energy strategy aimed at achieving net zero carbon emissions from all electricity generation operations by 2050. According to the IEA Renewables 2024 report, solar adoption continues accelerating globally as utilities pursue decarbonization targets.

Installing solar panels represents one effective method for transitioning a home to clean energy sources. South Carolina homeowners within Duke Energy service territories should understand the following details before pursuing a residential solar installation. Working with a professional solar permit design company can streamline the interconnection process and ensure compliance with all local regulations.

Key Takeaways

- Residential solar installation in South Carolina averages approximately $2.62 per watt, placing a typical 6 kW system at roughly $15,720 before incentives.

- Duke Energy requires all solar customers to enroll in a time-of-use rate structure, meaning electricity prices fluctuate based on the time of day.

- Duke Energy does not provide full retail net metering in South Carolina; instead, the utility compensates excess solar production through the lower Net Excess Generation Credit rate.

- Duke Energy does not currently offer solar-specific rebates or incentive programs but does provide rebates for other energy-efficient home improvements.

South Carolina Solar Installation Costs for Duke Energy Customers

A standard 6 kilowatt (kW) solar system in South Carolina typically costs around $15,720 before applying any incentives, equating to approximately $2.62 per watt installed. Homeowners pursuing residential solar permit services should factor permitting fees into their overall budget.

The following table outlines estimated costs for various solar system sizes, showing pricing both before and after applying the 30% federal tax credit.

These figures represent general estimates only. Actual solar installation costs depend on several factors, including household electricity consumption, roof configuration and condition, selected solar equipment, and chosen financing method. Resources like EnergySage provide helpful comparison tools for evaluating quotes from multiple installers. The NREL solar research database publishes updated data on solar technology costs and performance benchmarks.

Does Duke Energy Offer Net Metering in South Carolina?

Duke Energy does not provide traditional full retail net metering; however, the utility operates a solar buyback program for residential customers. Understanding solar permit requirements helps homeowners navigate utility requirements more efficiently.

Solar customers under Duke Energy must enroll in a designated time-of-use rate structure called Solar Choice Time of Use. This rate schedule adjusts electricity pricing based on both the time of day and the season.

Under this structure, solar energy value fluctuates depending on when the system generates power, when the home consumes it, and when excess electricity flows back to the grid. Solar generation during off-peak periods carries less value compared to electricity produced during on-peak hours.

When a solar system produces more electricity than the home uses during any specific time-of-use period within a billing cycle, Duke Energy credits the excess at the Net Excess Energy Rate, which falls below standard retail electricity rates.

Time-of-Use Rates

Time-of-use rate structures assign different electricity values based on the time of day. Rates reach their highest levels during on-peak hours when grid demand peaks.

Under Duke Energy’s net metering structure, solar generation only offsets electricity consumed within the same time period. Solar power produced during off-peak hours can only reduce energy costs incurred during those same off-peak hours.

Solar panels typically produce the highest output during off-peak daytime hours, which coincides with periods of lowest household energy consumption. This timing mismatch means most solar generation carries lower value, limiting the ability to offset higher electricity costs occurring later in the day.

Homeowners can maximize solar savings by shifting energy-intensive activities to off-peak hours, allowing direct consumption of solar power as it generates.

Solar Permit Solutions

Need Solar Permit Plans?

Professional, permit-ready solar plan sets delivered fast. Residential and commercial projects across all 50 states.

How Duke Energy Credits Excess Solar Production

At each billing cycle’s conclusion, Duke Energy calculates total solar generation against household consumption across all time-of-use periods.

When solar production exceeds grid consumption, Duke Energy issues a bill credit for the surplus generation. The utility values this excess electricity at approximately $0.04 per kWh, significantly below standard retail electricity rates.

Consider this scenario: A solar system generates 700 kWh during off-peak hours in one month, while the household consumes only 400 kWh during that same period. Duke Energy credits the 300 kWh surplus at $0.04 per kWh, resulting in approximately $12 applied to the monthly bill.

These credits cannot offset all charges, fees, or taxes appearing on the electricity bill.

Duke Energy Solar Grid Fees and Fixed Charges Explained

Solar customers incur fixed charges calculated based on installed solar system capacity. Monthly net excess generation credits cannot offset these charges. The fixed rate stands at $0.24 per installed kW, adding roughly $1.50 to the typical solar homeowner’s monthly bill.

Grid access fees apply exclusively to systems exceeding 15 kW in capacity. Duke Energy assesses $5.86 per kW for all capacity above the 15 kW threshold. A 16 kW system incurs a $5.86 grid access fee, while a 17 kW system triggers an $11.72 charge. Business owners considering larger installations should explore commercial solar permit design services to ensure proper system sizing and compliance.

Minimum Monthly Charges for Duke Energy Solar Homeowners

Duke Energy enforces a $30 monthly minimum bill for all solar customers, regardless of system production levels. The utility applies this minimum charge only when combined basic facilities charges, distribution energy charges, and riders total less than $30.

Even when a solar system generates enough electricity to fully offset household consumption, homeowners still receive a monthly bill from Duke Energy.

Does Duke Energy Offer Any Solar Rebates or Incentives in South Carolina?

Duke Energy currently provides no solar-specific rebates or incentives for South Carolina customers. However, Palmetto State residents can apply the 30% federal solar tax credit to substantially reduce installation costs. The IRS Residential Clean Energy Credit page provides official guidance on eligibility requirements and claiming procedures. Using this guide to claim solar tax credits simplifies the tax filing process for solar homeowners.

South Carolina remains one of the few states offering a state-level tax credit that stacks with the federal incentive. The state tax credit equals 25% of total installation costs.

While Duke Energy lacks solar incentives, the utility does provide rebates for other energy-efficient home improvements, including HVAC system installations, heat pump water heaters, variable speed pool pumps, and similar upgrades. The NC DEQ residential solar tips resource offers additional guidance for Carolinas residents considering renewable energy investments.

Duke Energy Solar Interconnection Process in South Carolina

Connecting a solar system to the electrical grid requires completing several steps through Duke Energy’s interconnection process. Understanding solar permit timelines helps South Carolina homeowners plan their installation effectively. Reviewing the state by state permit timeline guide provides useful benchmarks for comparison.

Here is what South Carolina homeowners should expect:

- Design the system: Work with a qualified solar installer to create a system design that fits the roof configuration and meets household energy production goals. The NABCEP certified installer directory helps homeowners locate credentialed professionals in their area.

- Apply for interconnection: Submit Duke Energy’s Interconnection Request Application Form after confirming the system design complies with all applicable regulations. This application provides the utility with essential details about system size and technical specifications. Following permitting best practices reduces the likelihood of application rejections.

- Install the solar system: Once Duke Energy approves the paperwork and confirms the design meets state and utility requirements, the installer proceeds with physical installation. Understanding AHJ requirements for solar ensures compliance with local building codes.

- Complete a system inspection: A local electrical wiring inspector conducts an official inspection after installation concludes. Learn why solar permits are necessary to understand inspection requirements.

- Return certificate of completion to the utility: After passing inspection, submit a certificate of completion to Duke Energy confirming the system met all inspection requirements. The utility must then approve the completed inspection.

- Install the net meter: Following inspection approval, Duke Energy verifies all documentation and installs the bidirectional net meter.

- Permission to operate: After confirming compliance with all state and utility requirements, Duke Energy grants permission to operate, allowing the system to begin generating solar electricity.

The entire interconnection process typically takes a few weeks to complete, though timelines vary based on utility responsiveness and local inspector availability. Some installations may require up to several months. Communities participating in SolSmart solar permitting programs often experience faster approval times due to streamlined processes.

Duke Energy Solar in South Carolina: Is It Worth the Investment?

Installing solar panels under Duke Energy in South Carolina remains a viable option, though potential savings fall below what homeowners achieve in other states.

Duke Energy does compensate for excess solar generation, but the buyback rate sits well below the full retail value of produced electricity. The time-of-use net metering structure adds complexity and demands strategic energy management to maximize financial benefits. Homeowners will realize electricity bill savings, just not at the level possible under traditional full retail net metering programs.

The combination of federal and state tax credits provides significant financial relief for South Carolina solar installations. Duke Energy continues advocating for clean energy initiatives, creating optimism for expanded solar incentive programs across all service territories in the future. The REN21 Global Status Report tracks worldwide renewable energy policy developments that may influence domestic utility programs.

When planning for the long term, homeowners should also consider end-of-life management for solar equipment. The EPA solar panel disposal regulations page provides guidance on proper recycling options.

Conclusion

Installing solar panels with Duke Energy in South Carolina offers homeowners a viable path toward energy independence, though the financial returns differ from states with full retail net metering policies. Duke Energy’s Solar Choice Time of Use rate structure requires strategic energy management to maximize savings, and the Net Excess Generation credit of approximately $0.04 per kWh provides lower compensation than standard retail rates.

Despite these limitations, South Carolina homeowners benefit significantly from stacking the 30% federal solar tax credit with the 25% state tax credit, potentially reducing installation costs by up to 55%. The interconnection process typically completes within a few weeks, allowing systems to begin generating clean energy relatively quickly. Understanding local solar permit requirements before starting the project prevents unnecessary delays.

Homeowners considering solar with Duke Energy should carefully evaluate their electricity consumption patterns, explore battery storage options to retain more self-generated power, and work with qualified solar installers who understand Duke Energy’s specific requirements. While monthly minimum bills and fixed charges add ongoing costs, the long-term savings combined with available tax incentives make solar a worthwhile investment for many South Carolina residents in Duke Energy service territories.

For additional resources on solar installations in other regions, explore guides on going solar with SDG&E or Texas solar permit requirements. Visit the Solar Permit Solutions blog for the latest industry updates and permitting guides.

Ready to start your Duke Energy solar project? Contact us today for expert assistance with interconnection requirements and permit design services throughout South Carolina.

FAQs

What is Duke Energy’s monthly minimum bill for solar customers?

Duke Energy charges all South Carolina solar customers a mandatory $30 monthly minimum bill, regardless of system production levels. The utility applies this minimum charge when combined basic facilities charges, distribution energy charges, and riders total less than $30. Even homeowners generating enough solar electricity to completely offset household consumption receive a monthly bill from Duke Energy. Additional non fixed charges of $0.24 per installed kW and grid access fees for systems exceeding 15 kW also apply.

How long does Duke Energy’s solar interconnection process take in South Carolina?

Duke Energy’s solar interconnection process typically takes a few weeks to complete under normal circumstances. The timeline includes system design consultation, submitting the Interconnection Request Application Form, installation, local electrical inspection, certificate of completion submission, net meter installation, and final permission to operate approval. Depending on utility responsiveness and local inspector availability, some installations may require up to several months to complete all steps and receive permission to operate.

Need Solar Permit Plans?

Professional, permit-ready solar plan sets delivered fast. Residential and commercial projects across all 50 states.

Frequently Asked Questions

Duke Energy does not provide traditional full retail net metering in South Carolina. Instead, the utility operates a solar buyback program through the Solar Choice Time of Use rate structure. Under this program, excess solar generation receives credit at the Net Excess Energy Rate of approximately $0.04 per kWh, which falls significantly below standard retail electricity rates. Solar customers must enroll in time of use billing, where electricity prices vary based on peak, off peak, and super off peak periods throughout the day.

Duke Energy compensates South Carolina solar customers approximately $0.04 per kWh for excess electricity sent back to the grid through the Net Excess Generation credit. This rate applies only when solar production exceeds household consumption within the same time of use period during a billing cycle. The credit cannot offset all charges, fees, or taxes on the electricity bill, and homeowners still pay a $30 monthly minimum bill regardless of how much solar energy their system generates.

Duke Energy charges all South Carolina solar customers a mandatory $30 monthly minimum bill, regardless of system production levels. The utility applies this minimum charge when combined basic facilities charges, distribution energy charges, and riders total less than $30. Even homeowners generating enough solar electricity to completely offset household consumption receive a monthly bill from Duke Energy. Additional nonbypassable charges of $0.24 per installed kW and grid access fees for systems exceeding 15 kW also apply.

Duke Energy does not currently offer solar specific rebates or incentives in South Carolina. However, homeowners can combine the 30% federal solar tax credit with South Carolina's 25% state tax credit to reduce installation costs by up to 55%. The state tax credit allows homeowners to claim up to $3,500 annually for up to 10 years, with unused credits carrying forward. Duke Energy does provide rebates for other energy efficient home upgrades, including HVAC installations, heat pump water heaters, and variable speed pool pumps.

Duke Energy's solar interconnection process typically takes a few weeks to complete under normal circumstances. The timeline includes system design consultation, submitting the Interconnection Request Application Form, installation, local electrical inspection, certificate of completion submission, net meter installation, and final permission to operate approval. Depending on utility responsiveness and local inspector availability, some installations may require up to several months to complete all steps and receive permission to operate.

Going solar with Duke Energy in South Carolina remains financially viable, though savings fall below states offering full retail net metering. The time of use rate structure requires strategic energy management, and the lower buyback rate reduces compensation for excess generation. However, combining federal and state tax credits can reduce installation costs by up to 55%, making the investment more attractive. Homeowners should consider adding battery storage to maximize self consumption during peak rate periods and reduce reliance on grid export credits.

SPS Editorial Team

Solar Permit Solutions

Solar Permit Solutions provides professional solar permit design services for residential, commercial, and off-grid installations across all 50 states. Our team ensures permit-ready plan sets delivered fast.

Related Articles

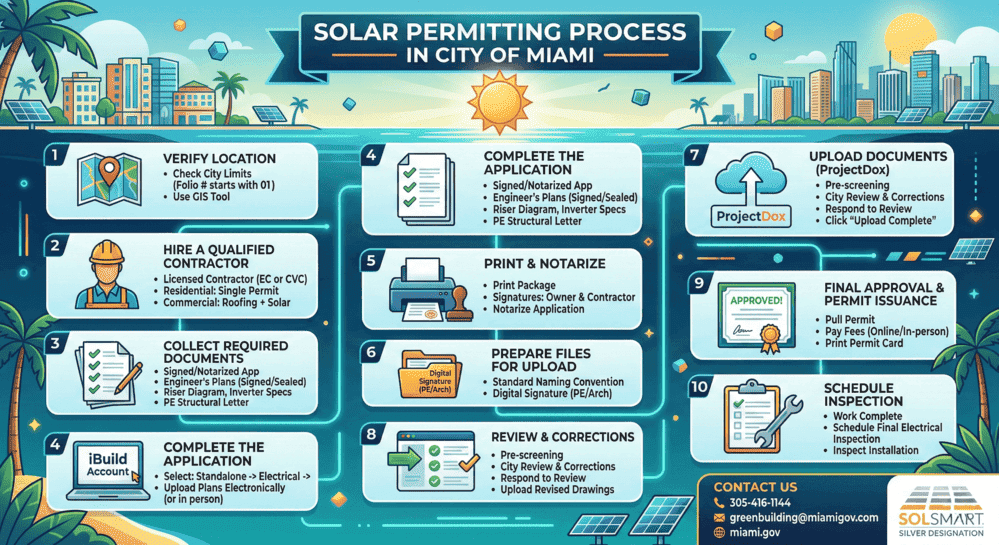

Solar Permit in Miami, FL: City of Miami vs. Miami-Dade County (2026)

Getting a solar permit in Miami requires two separate processes depending on jur...

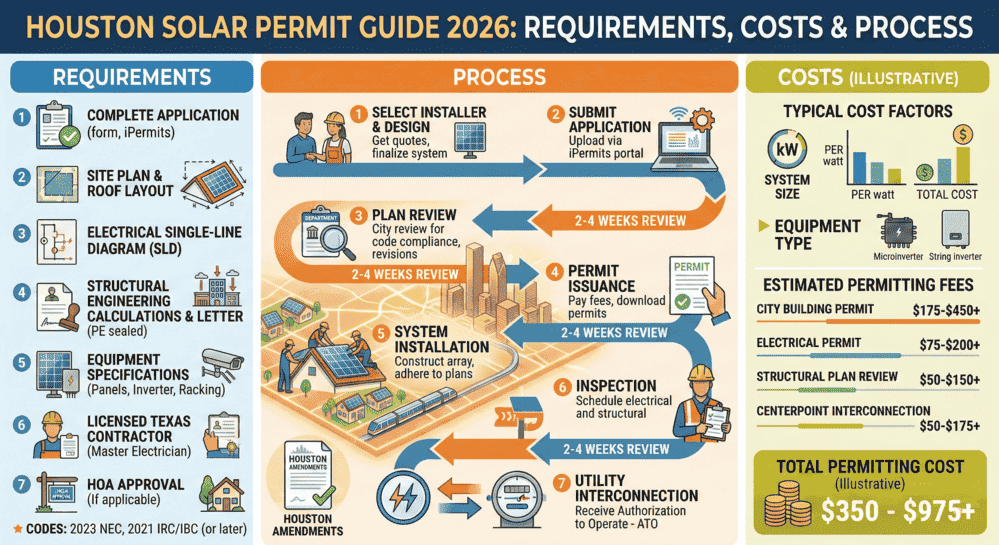

Houston Solar Permit Guide 2026: Requirements, Costs & Process

Quick Answer: In Houston, TX, solar PV installations require a building permit (...

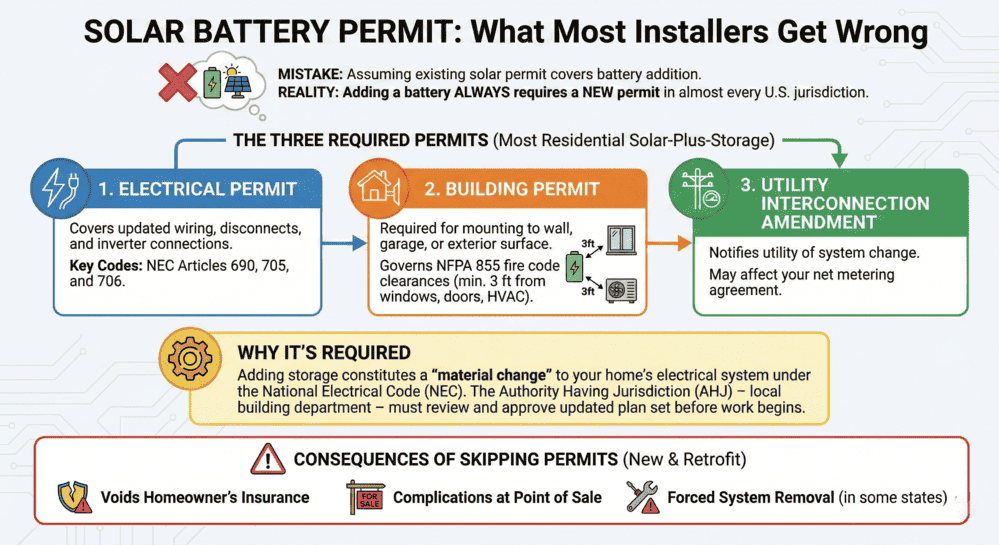

Solar Battery Permit: What Most Installers Get Wrong

Adding a battery to a solar system requires a new permit in almost every U.S. ju...