Solar incentives vary by state and can reduce your installation costs by 25% to 60% depending on where you live. With the federal solar tax credit no longer available directly to homeowners in 2026, state and local incentives have become the primary way to lower solar costs.

Key solar incentives available in 2026 include:

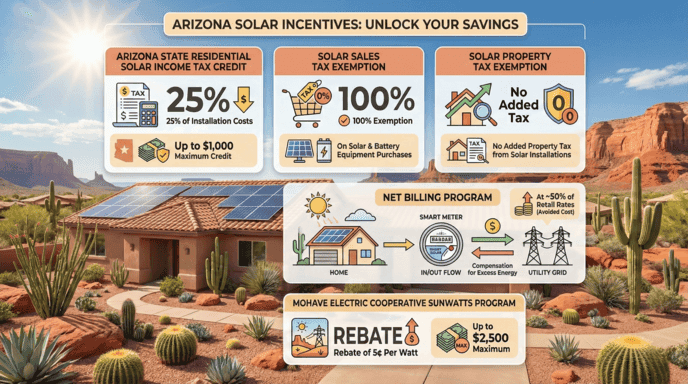

- State tax credits ranging from 15% to 25% of installation costs (up to $5,000 in New York)

- Sales tax exemptions eliminating 5% to 8% in upfront costs in most states

- Property tax exemptions preventing increased home assessments after solar installation

- Net metering programs compensating solar owners for excess electricity at retail rates

- Solar Renewable Energy Credits (SRECs) worth $4 to $85 per megawatt-hour depending on state

- Utility rebates offering $500 to $6,000 in upfront savings

States with the strongest solar incentive packages include New Jersey (SuSI program worth $10,200+ over 15 years), New York (25% state tax credit plus 15-year property tax exemption), Illinois (SREC program worth $10,000-$12,000 over 15 years), and Maryland (up to $7,500 for income-qualified residents plus SRECs). Other states like Hawaii and Nevada also offer compelling programs worth exploring.

Starting in 2026, homeowners must choose between purchasing solar outright to claim local incentives or entering Third-Party Ownership arrangements like leases and PPAs to benefit from the federal tax credit indirectly.

Acting fast pays off when it comes to solar incentives. The value of most programs decreases over time as solar adoption grows and equipment costs continue to drop.

Below you’ll find local solar incentives organized by state.

Arizona

California

Colorado

Connecticut

Florida

Illinois

Maryland

Massachusetts

Minnesota

New York

New Jersey

Ohio

Texas

Virginia

Arizona Solar Incentives

In Arizona (often called the “Sunshine State”), solar panels make perfect sense for homeowners wanting to convert sunlight into savings. Even better, Arizona provides several incentives that boost your energy cost savings. Homeowners considering going solar with SRP in Arizona can take advantage of multiple programs.