The IRS does not require upfront documentation or physical inspections to verify solar tax credit claims filed on Form 5695. Taxpayers simply complete the 2.5-page form accurately when filing their federal income tax return, and the credit applies immediately without submitting receipts, invoices, or proof of purchase. However, you must maintain all documentation, including receipts, installation contracts, and manufacturer certifications, in case of future audit. The Residential Clean Energy Credit provides 30% back on qualified solar system purchases and installations, but eligibility ends December 31, 2025, due to the One Big Beautiful Bill Act. Systems installed after this date lose federal tax credit eligibility. Deliberate tax fraud carries penalties up to $500,000 and five years imprisonment, while honest filing errors result in civil fines and interest charges.

Understanding Solar Tax Credits: The Essentials

Shifting from fossil fuel dependency to renewable energy sources like solar represents a critical global imperative for powering residential, commercial, and industrial needs.

Climate change impacts from greenhouse gas emissions manifest clearly through rising extreme weather patterns, declining biodiversity, and devastating wildfires.

To accelerate residential solar adoption for electricity generation, governments globally implement tax incentives, grants, and financial programs.

The 2022 Inflation Reduction Act created multiple clean energy tax benefits nationwide, headlined by the 30% Federal Solar Tax Credit.

While several renewable technologies qualify for the Residential Clean Energy Credit, solar panels dominate residential applications.

Photovoltaic (PV) solar systems outperform alternatives like wind turbines and hydroelectric generators for home installations due to space and feasibility constraints, plus solar qualifies you for additional state-level tax incentives.

Local municipalities and utility companies frequently provide supplementary solar benefits, including grants and net metering programs.

Grid-tied and hybrid solar panel systems with net metering capabilities let you sell surplus electricity production back to your utility provider when available in your service area.

Optimize your PV system’s generation capacity to accelerate solar payback timelines.

Claim every available tax credit and participate in programs like net metering to maximize your solar investment returns.

How Federal Solar Tax Credits Work

Federal, state, and local governments each offer distinct solar tax credit programs across the United States.

Your specific location determines which combination of federal, state, and municipal solar incentives you can access.

The Residential Clean Energy Credit delivers the largest financial impact for individual American taxpayers.

According to the Internal Revenue Service guidelines:

The Residential Clean Energy Credit provides 30% back on qualified clean energy property purchase and installation expenses for your residence. While initially extending through 2032, the One Big Beautiful Bill Act terminates eligibility on December 31st, 2025. Solar systems installed after this deadline cannot claim the 30% tax credit.

The Inflation Reduction Act originally set the Residential Clean Energy Credit (IRS Form 25D) availability through 2032. The One Big Beautiful Bill Act revised this schedule, eliminating the 30% solar tax credit starting January 1st, 2026. Homeowners must complete the purchase and installation of qualifying solar generators and whole-home battery systems (minimum 3 kWh capacity) before year-end 2025 to claim this credit. Systems installed after December 31st, 2025 lose federal income tax credit eligibility.

Taxpayers who owe federal income tax and buy qualifying clean energy equipment can subtract 30% of total expenses (including professional installation) from their tax liability through IRS Form 5695 during tax filing.

Determining Solar Tax Credit Eligibility

Can you claim the Federal Solar Tax Credit (officially the Residential Clean Energy Credit)?

Eligibility breaks into two distinct categories:

Do you personally qualify to file Form 5695?

Does your PV system or clean energy installation meet IRS standards?

Explore both requirements below.

Individual Qualification Requirements

U.S. taxpayers who pay federal income taxes typically qualify for the Residential Clean Energy Credit.

Review these mandatory criteria:

Purchase and install new photovoltaic modules (solar panels) or approved clean energy equipment at your primary U.S. residence. Used, rented, or leased systems don’t qualify.

Secondary residence installations require part-time occupancy by the owner. Rental properties fail to meet eligibility standards.

Homeowners and renters both qualify. Landlords and non-resident property owners cannot claim this credit.

Business use cannot exceed 20% of your home’s total area. Properties with more than 20% business allocation receive proportional credits based on residential use percentage. For instance, a 50/50 residential-business property qualifies for 50% of system costs. Consider exploring business clean energy credits as an alternative.

Pay federal income tax during the installation year. When your credit surpasses your tax liability or you owe no taxes that year, carry the remaining credit forward to offset future tax obligations.

Non-taxpayers receive no credit benefits.

Solar Permit Solutions

Affordable Solar Permit Plans

Don't let permit costs slow your project. Professional plan sets at competitive prices — all 50 states, fast turnaround.

Distinction: Tax Credit vs. Rebate or Deduction

Many taxpayers mistakenly categorize the Residential Clean Energy Credit as a tax rebate or deduction.

This classification is incorrect.

The program functions as a nonrefundable tax credit that reduces your federal income tax liability.

Taxpayers who never incur federal income tax obligations (currently or in future years) receive no financial benefit toward clean energy property like solar panels and balance of system components, regardless of system eligibility.

Future tax liability creates claiming opportunities. Apply your solar energy investment costs against tax obligations in subsequent years, even when the PV system installation occurred in previous tax periods.

Qualifying Clean Energy Systems

Photovoltaic solar panels represent just one category of “clean energy property” qualifying for the Residential Clean Energy Credit.

The IRS recognizes these eligible clean energy system types:

Solar electric panels, solar water heaters, wind turbines, geothermal heat pumps, fuel cells, and battery storage technology (eligible from 2023 forward)

Each technology category carries specific requirements regarding electricity generation capacity and storage specifications.

Solar Panel System Qualification Standards

Review these mandatory requirements for residential solar installations:

Install photovoltaic modules (solar panels) and balance of system components at your U.S. residence.

Complete installation between January 1, 2017, and December 31, 2034.

Use new solar PV systems or first-time installations only. Previously installed systems don’t qualify.

Maintain ownership of the PV system. Direct manufacturer financing arrangements qualify when purchase contracts establish full system acquisition over time.

Equip off-grid and hybrid PV systems with battery storage meeting minimum 3 kWh capacity requirements. Standard residential solar generators typically provide 3 kWh to 25 kWh storage capacity depending on configuration.

Covered Expenses Under the Tax Credit

Tax incentives typically impose restrictive limitations. Most programs enforce strict eligibility criteria, spending caps, and usage frequency restrictions.

The Residential Clean Energy Credit operates differently.

No spending limit exists on eligible system purchases. System costs ranging from $10,000 to $100,000 qualify for the full 30% deduction against your federal income tax liability.

Usage frequency remains unlimited: claim the credit multiple times within a single tax year if applicable.

Stack the Federal Solar Tax Credit with state government programs and private incentives without restrictions.

Qualification requires purchasing the PV system for your residence and maintaining federal income tax obligations.

Expense Categories Eligible for Credit

IRS guidelines allow individuals and households to claim 30% of these expenses through Form 5695:

Qualified solar electric property costs include expenses for equipment generating electricity from solar energy for U.S. home use. Solar panels and related property installed as roofing components maintain eligibility despite serving structural functions. Solar roofing tiles and shingles that combine traditional roofing protection with solar electricity generation qualify for credit inclusion. Purely structural elements like roof decking or rafters that provide no solar generation function remain ineligible. Primary or secondary residences both qualify.

Additional Covered Costs:

Qualified expenses encompass labor charges for on-site preparation, assembly, original installation, and connecting piping or wiring to integrate the system with your home.

Incentive Adjustments:

Calculate your credit by subtracting subsidies, rebates, and financial incentives from qualified property expenses as purchase-price adjustments.

Utility company subsidies for clean energy property purchase or installation reduce qualified expenses. This applies whether subsidies go directly to you or contractors working on your behalf. Net metering credits from selling electricity back to the grid don’t affect qualified expense calculations.

Subtract rebates from qualified expenses when these conditions exist:

Rebate calculations are base on property cost. Rebate sources are connect to the sale (manufacturer, distributor, seller, or installer). Rebates don’t represent payment for services you provide

State energy efficiency incentives generally remain separate from qualified costs unless they meet federal rebate or purchase-price adjustment definitions under tax law. Many state programs use “rebate” terminology despite failing federal definitional requirements. These incentives may count as gross income for federal tax purposes.

Nearly all installation costs (potentially 100%) qualify for Federal Solar Tax Credit coverage.

Understanding IRS Verification for Form 5695

Form 5695 spans just 2.5 pages with straightforward completion requirements for you or your tax preparer.

The form addresses both the Residential Clean Energy Credit and the Energy Efficient Home Improvement Credit since many taxpayers qualify for both programs.

Beyond accurate and truthful form completion, no additional submission requirements exist: no proof of purchase, no invoice documentation, and no physical property inspections before approval.

Residential PV systems and clean energy property don’t undergo routine physical inspections or additional verification before credit approval.

Critical requirements remain: verify your clean energy property meets all eligibility standards AND maintain receipt documentation. Avoid common design mistakes that cause permit denials, as rejected permits could jeopardize your ability to complete installation before the December 31, 2025 deadline.

Tax filing errors (including Form 5695 mistakes) trigger civil penalties, including fines and interest charges beyond actual tax obligations.

Deliberate tax fraud (such as claiming Form 5695 credits for nonexistent PV system purchases) carries penalties reaching $500,000 in fines and five years’ imprisonment.

Why Documentation and Record Retention Matter

Personal income tax filing grows complex when claiming expense deductions or non-refundable tax credits like the Residential Clean Energy Credit.

Property tax obligations add another complexity layer for homeowners.

Taxpayers claiming multiple deductions and credits typically engage certified solar professionals including accountants or attorneys.

Consult a tax professional when eligibility questions arise. Minor mistakes generate devastating financial consequences.

Consider this scenario: purchasing clean energy property that fails eligibility requirements forces you to cover 100% of PV system costs instead of receiving 30% government coverage. This single error could cost tens of thousands of dollars.

Your Documentation Responsibilities

Whether hiring professional tax preparation services or filing independently with tax software, you bear complete responsibility for preserving documents supporting ALL IRS claims.

Audit notifications trigger requirements to produce detailed records and receipts for every claimed expense. The IRS typically sends audit notices by mail and may conduct in-person interviews.

Inadequate documentation for your claims produces severe consequences (potentially criminal charges).

Suspected tax fraud cases may prompt unannounced IRS criminal inspector visits to your residence. Recognize scam attempts: legitimate IRS officers never request money in person or by phone. Request attorney contact when inspections occur.

Secure Proper Certification

Don’t avoid legitimate credit claims for eligible clean energy property, including solar panels and balance of system components.

Request certification documentation from your PV system manufacturer or installer.

According to IRS guidelines:

Manufacturer’s certification allows credit claiming based on written manufacturer confirmation that products qualify as eligible property. Don’t attach certification documents to your tax return. Retain these records for your files.

Reputable manufacturers and installers readily provide required documentation.

Universal Tax Filing Standards

These filing consequences apply universally across Form 1040 and all official tax documents (not exclusively Form 5695).

Congress enacted the Residential Clean Energy Credit to encourage taxpayers like you toward renewable electricity generation.

Follow established guidelines and maintain your receipts.

Conclusion

The IRS verification process for solar tax credits prioritizes simplicity and accessibility for honest taxpayers pursuing renewable energy adoption.

Form 5695 requires no upfront proof submissions: no receipt attachments, no invoice documentation, and no physical property inspections before approval. Complete the form truthfully, maintain comprehensive documentation, and claim your 30% credit against federal income tax liability.

The December 31, 2025, deadline creates urgency for homeowners considering solar installations. Systems installed after this date forfeit federal tax credit eligibility entirely, potentially costing tens of thousands in lost savings.

Partner with professional solar design services that provide manufacturer certifications confirming equipment eligibility. Preserve all purchase receipts, installation contracts, financing agreements, and certification documents for potential future audits.

Professional tax preparation services help navigate complex eligibility requirements and maximize credit claims while minimizing error risks. Accountants and tax attorneys ensure proper Form 5695 completion and documentation retention strategies.

The Residential Clean Energy Credit exists to accelerate renewable energy adoption across American households. Legitimate claims face minimal verification barriers (the system trusts taxpayers while maintaining audit capabilities for fraud prevention).

Install your qualifying solar system before year-end 2025, maintain thorough records, file Form 5695 accurately, and claim your rightful 30% federal tax credit without verification complications.

Affordable Solar Permit Plans

Don't let permit costs slow your project. Professional plan sets at competitive prices — all 50 states, fast turnaround.

Frequently Asked Questions

No. The IRS does not conduct routine physical inspections of residential solar installations before approving Residential Clean Energy Credit claims. You complete Form 5695 when filing your federal tax return, and the credit applies to your tax liability immediately without property inspections or verification visits. However, maintain all documentation including receipts, contracts, and manufacturer certifications in case of future audit selection. The IRS reserves audit rights but doesn't inspect every solar installation upfront.

You submit no documents with Form 5695 during initial filing. The IRS requires only the completed 2.5-page form attached to your federal income tax return. Don't attach receipts, invoices, solar permit documentation, or manufacturer certifications to your tax filing. Instead, retain these documents in your personal records for at least seven years. If the IRS audits your return, you'll need to produce detailed documentation proving your solar system purchase, installation costs, and equipment eligibility. Request written manufacturer certification confirming your system qualifies as eligible clean energy property.

IRS audits require producing comprehensive documentation supporting your Form 5695 claims. Expect to provide itemized receipts showing total system costs, installation contracts with labor charges, proof of payment, manufacturer certifications confirming equipment eligibility, and any financing agreements. The IRS typically notifies you by mail about audit selection and may conduct in-person interviews. Adequate documentation validates your claim and resolves the audit favorably. Inadequate documentation triggers penalties including repaying the claimed credit plus interest and fines. Suspected fraud cases may involve criminal investigations with penalties reaching $500,000 and five years imprisonment.

Yes. The Residential Clean Energy Credit carries forward to future tax years when your credit exceeds current-year tax liability or you owe no federal income tax during installation year. File Form 5695 for the year you installed your DIY solar power system, even if you can't use the full credit immediately. Carry unused credit balances forward and apply them against future federal income tax obligations indefinitely until exhausted. Maintain documentation from your original installation year throughout the credit carryforward period since audit selection could occur in any year you claim the credit.

Purchasing ineligible clean energy equipment represents the costliest error. Used solar panels, leased systems, unpermitted installations, and equipment failing to meet minimum capacity requirements don't qualify for the Residential Clean Energy Credit. Taxpayers who claim credits for ineligible property must cover 100% of system costs instead of receiving 30% government coverage, potentially losing tens of thousands in expected savings. Verify equipment eligibility before purchase by requesting written manufacturer certification. Consult professionals when eligibility questions arise since even honest mistakes trigger civil penalties, fines, and interest charges beyond actual tax obligations.

Retain all solar tax credit documentation for minimum seven years after filing the tax return claiming the credit. This includes itemized receipts, installation contracts, proof of payment, manufacturer certifications, financing agreements, and Form 5695 copies. The IRS typically audits returns within three years of filing, but extended seven-year retention provides additional protection. If carrying credit forward across multiple tax years, maintain documentation until you've exhausted the entire credit and three to seven years beyond the final year claimed. Digital and physical copies both serve as acceptable audit documentation.

Both purchase and installation must occur by December 31, 2025 to qualify for the 30% Residential Clean Energy Credit. The One Big Beautiful Bill Act eliminated solar tax credit eligibility starting January 1, 2026. Systems purchased in 2025 but installed in 2026 lose federal tax credit benefits entirely. Similarly, systems installed in 2025 using equipment purchased before 2025 qualify if final installation completes before the deadline. Documentation must prove both purchase and installation completion dates fall within the eligible period. Plan installation timelines carefully and understand solar permitting requirements since missing the December 31, 2025 deadline forfeits the entire 30% credit regardless of when you initiated the purchase process.

Your solar system must comply with National Electrical Code (NEC) standards and local electrical requirements to qualify for the Residential Clean Energy Credit. The system must include proper grounding, overcurrent protection, disconnect switches, and appropriate wiring sized for your system's capacity. Work with licensed electricians who understand solar electrical fundamentals to ensure code compliance. Systems failing electrical inspections may not qualify for final permits, potentially jeopardizing your tax credit eligibility. Permit approval timelines vary by jurisdiction, so factor inspection requirements into your installation schedule to meet the December 31, 2025 deadline.

While HOA regulations can impact permit approvals, they don't directly affect your Federal Solar Tax Credit eligibility. However, HOA restrictions delaying or preventing installation could cause you to miss the December 31, 2025 deadline. Many states have solar access laws limiting HOA authority to restrict solar installations. Review your HOA covenants early in the planning process and work with experienced installers familiar with local HOA requirements. Professional solar design services can help navigate HOA approval processes while ensuring systems meet both aesthetic requirements and tax credit eligibility standards.

Several authoritative resources provide comprehensive information about solar tax credits and installation best practices. The IRS website offers detailed guidance on Form 5695 and eligibility requirements. The U.S. Department of Energy provides educational materials on solar technology and incentives. For DIY enthusiasts, essential solar energy books cover installation fundamentals, system design, and electrical requirements. NABCEP-certified professionals offer expertise in system design and permit compliance. State energy offices provide localized information about additional incentives and requirements. Combining federal tax credits with state and local incentives maximizes your solar investment returns while ensuring full compliance with all regulatory requirements.

SPS Editorial Team

Solar Permit Solutions

Solar Permit Solutions provides professional solar permit design services for residential, commercial, and off-grid installations across all 50 states. Our team ensures permit-ready plan sets delivered fast.

Related Articles

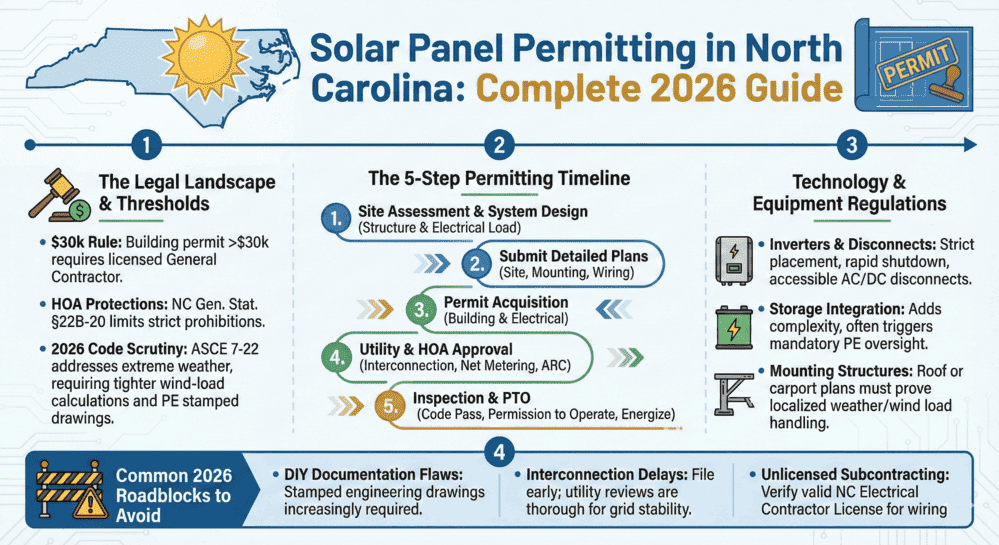

New 2026 North Carolina Solar Permit Guide: Duke Energy & Storage Rules

Learn North Carolina solar panel licensing and permitting requirements. Discover...

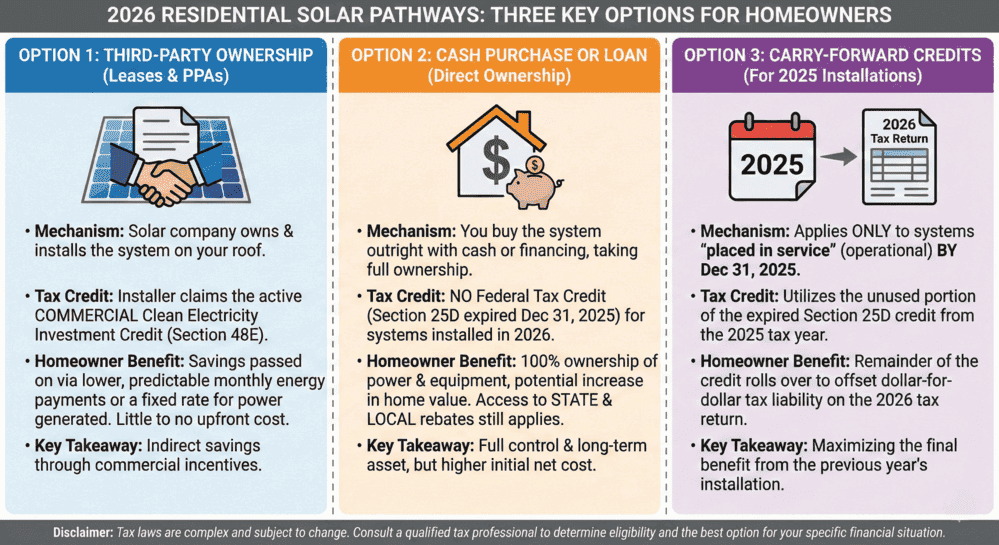

Section 25D Expiration: Homeowner Options In 2026

The Section 25D Residential Clean Energy Credit, which covered 30% of residentia...

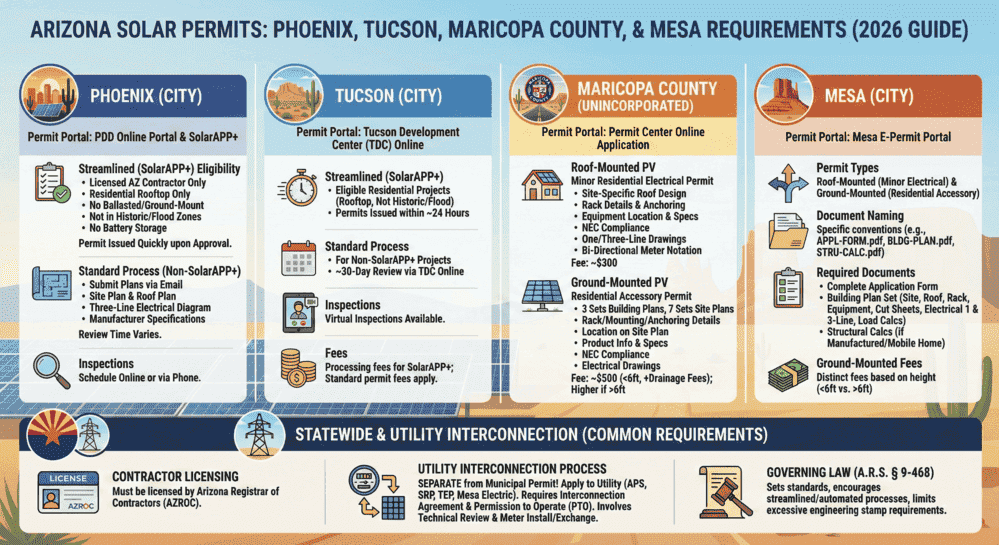

Solar Permits In Arizona: Phoenix, Tucson, Maricopa County, And Mesa Requirements (2026 Guide)

Arizona solar permitting at a glance: Arizona HB2301 now requires every municipa...