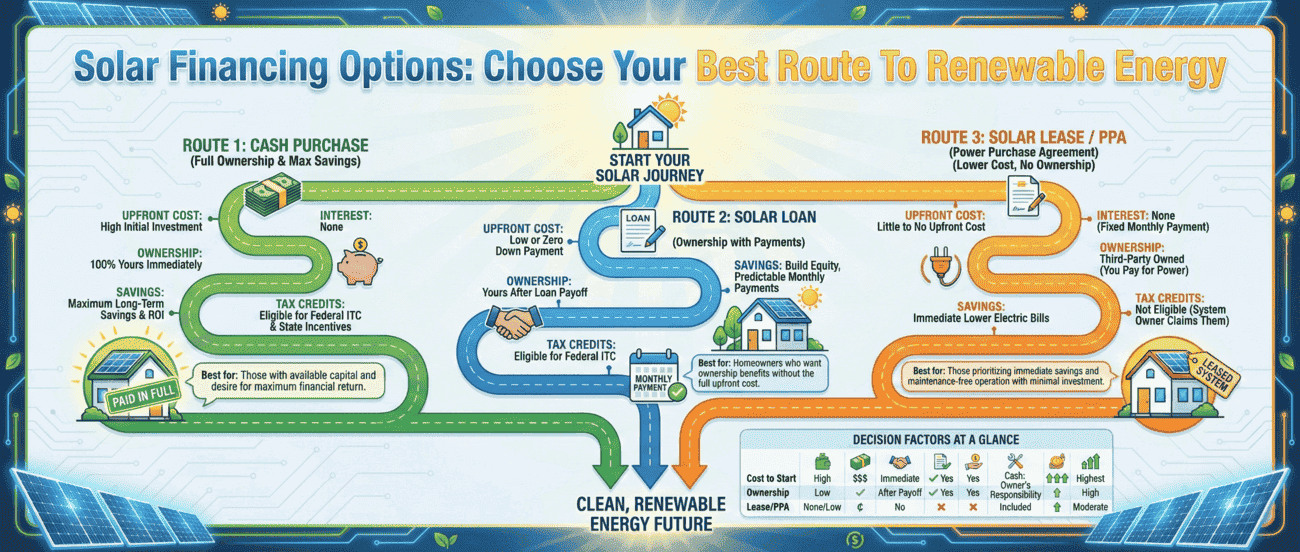

Choosing how to pay for solar panels, through leasing, financing, or cash purchase, directly impacts your total savings, ownership rights, and long-term financial benefits. Here’s what you need to know:

Three main solar financing options exist:

- Solar Leasing (Third-Party Ownership): Pay $0 upfront with fixed monthly payments for 20 years. The lease provider owns the system and handles all maintenance. Best for homeowners wanting no upfront costs and hands-off operation.

- Solar Loans: Finance your system with $0 to low upfront costs. You own the system after payoff, receive all tax credits and incentives, and gain flexibility to expand. Best for homeowners wanting ownership with manageable payments.

- Cash Purchase: Pay the full system cost upfront for immediate ownership. Delivers maximum lifetime savings (highest ROI), all tax credits, and complete energy independence, and increases property value by approximately 4%. Best for homeowners ready to maximize returns.

Key differences that matter:

- Ownership: Leasing means the provider owns it; loans and cash purchases mean you own it

- Tax credits: Only loan and cash buyers receive the federal solar tax credit (up to 30%)

- Property value: Owned systems add $15,000-$25,000 to home value; leased systems add nothing

- Maintenance: Leasing includes 20+ years of free maintenance; owners handle repairs after warranties expire

- Monthly costs: Leases have ongoing payments (sometimes with 0-3% annual escalators); cash purchases have $0 monthly costs

Cost comparison over 20 years: With utility rates increasing 2-3% annually, all three options protect against rising electricity costs. Cash purchases offer the highest lifetime savings, loans provide excellent savings after payoff, and leases deliver good savings with predictable costs.

Solar batteries integrate with any financing method to provide backup power during outages and additional savings during peak-rate periods.

Payment Structure Drives Long-Term Value

Equipment specifications matter: panel efficiency, inverter quality, and battery capacity. Yet your financing strategy matters equally. The payment method you select determines your total savings, ownership rights, warranty protection, home equity impact, and future system modification capabilities.

Electricity costs continue their upward trajectory nationwide. According to U.S. According to Energy Information Administration data, utility rates increase 2 to 3% annually on average. Arizona residents and homeowners across America face predictably higher electric bills each year without action. Securing a fixed solar payment (or eliminating payments through cash purchase) shields you from relentless rate increases while providing backup power when combined with battery storage.

Third-Party Ownership (Solar Leasing)

Third-party ownership arrangements make solar adoption remarkably accessible. Start generating savings immediately with typically zero upfront investment. You pay a predictable monthly fee to utilize the system’s power output while the provider retains ownership and handles all monitoring and maintenance throughout the agreement period, usually spanning 20 years.

Lock In Rates While Utilities Escalate

Electricity rates climb consistently upward. Modest annual increases accumulate into substantial additional costs over two decades. Solar leasing protects you by establishing a lower, fixed monthly payment for your entire agreement term. Adding battery storage to your lease delivers more than savings: it provides energy security. Keep your home powered through grid failures using stored electricity. Deploy that stored power during expensive peak-rate periods to further reduce your monthly energy costs.

Comprehensive Coverage Duration

Leasing provides extensive long-term protection. Standard manufacturer warranties typically cover solar panels for 20 to 25 years, while batteries, inverters, and supplementary components receive shorter coverage periods. Solar lease agreements include monitoring, maintenance, and repairs for the full term, often 20+ years. This extended protection covers batteries and inverters well beyond standard warranties, virtually eliminating unexpected repair expenses.

Zero-Hassle Operation

Lease providers manage performance tracking, system maintenance, and component replacements. You handle nothing. Many households value this convenience as much as the financial benefits.

Production Assurance

Most lease agreements guarantee system performance levels. When output falls below promised generation, providers resolve the issue through repairs or credit your account for the shortfall.

End-of-Term Options

Agreement conclusion brings choices. Extend your current arrangement, upgrade to newer technology, or purchase the system at current market value (sometimes available after just five years). If none suit your needs, request system removal.

Home Sale Considerations

Third-party ownership can complicate property transfers. Sellers typically pursue two paths:

Lease transfer to purchaser: Buyers must accept lease terms, satisfy credit requirements, and complete the transfer procedure to assume payment responsibility.

Lease buyout at market value: Converting to full ownership simplifies the home sale by adding the system as property value. Alternatively, arrange system removal.

Summary: Solar leasing delivers immediate savings, backup power capability, and maintenance-free operation with zero down payment. Trade-offs include limited expansion flexibility and additional complexity during home sales.

Solar Financing

Solar loans combine accessible entry costs with ownership advantages. Similar to home improvement financing, solar loans fund your panels and batteries with minimal or zero upfront costs. Once you complete repayment, you own the system completely and capture all ongoing savings.

Build Equity With Every Payment

Solar financing turns monthly payments into asset accumulation. Each payment increases your system equity, mirroring how mortgage payments build home equity. After loan completion, your solar installation becomes a lasting investment generating value for decades.

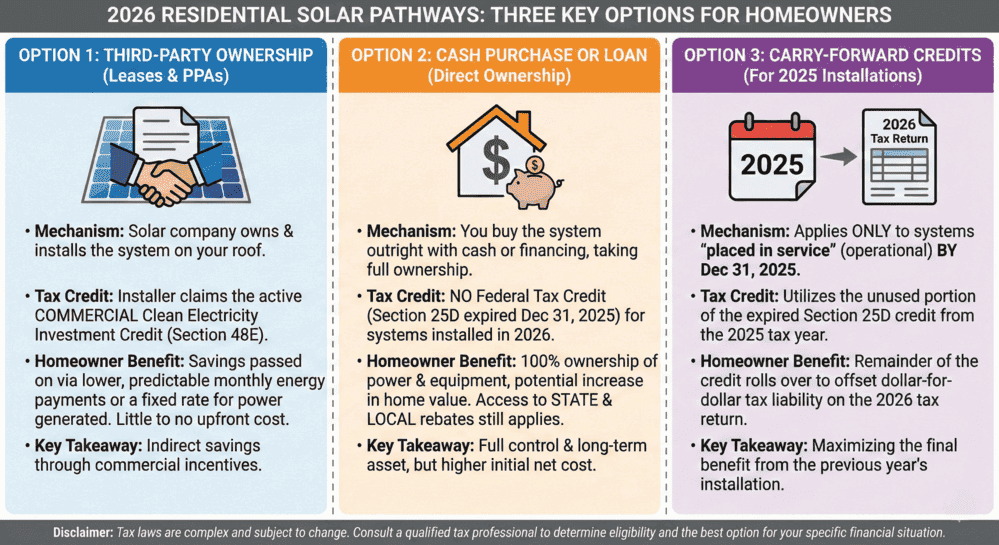

Capture All Available Incentives

Lease arrangements direct tax credits and incentives to providers. Financing ensures you receive all available incentives directly, reducing your total system cost and enhancing ownership value. Understanding the federal tax credit can significantly impact your financing decision.

Fixed Payment Stability

Solar loan payments remain consistent, avoiding the annual increases sometimes embedded in lease contracts. This stability simplifies budgeting and protects against utility rate volatility.

System Expansion Capability

Ownership provides modification freedom. When family needs evolve (adding an electric vehicle, constructing an addition, installing a pool), expand your system by incorporating additional panels or batteries. Working with experienced residential solar design professionals ensures your financing puts these decisions under your control, not a provider’s.

Simplified Property Transfer

Planning to sell? Solar loans transfer to new owners relatively easily. Since the system increases property value, many buyers view it as an advantage. Loans occupy the middle ground between leasing difficulty and cash purchase simplicity. Leases present transfer challenges and don’t boost home value.

Summary: Solar financing delivers ownership benefits through manageable, predictable monthly payments.

Solar Permit Solutions

Need Solar Permit Plans?

Professional, permit-ready solar plan sets delivered fast. Residential and commercial projects across all 50 states.

Outright Purchase

Ready for immediate investment? Cash purchase provides maximum flexibility. Full upfront payment means day-one ownership and complete system control.

Optimize Savings and Independence

Eliminate monthly financing and lease obligations. Every kilowatt-hour your system generates translates directly to savings. Cash buyers typically achieve the highest lifetime return on investment. You retain all applicable tax credits and incentives, further reducing total costs. NREL research confirms that cash purchases deliver the strongest financial returns over system lifetime.

Enhance Property Value and Appeal

Owned solar and battery systems increase home value. Unlike leases that add no property value, ownership registers as a property upgrade comparable to kitchen remodels or roof replacements. This enhancement attracts buyers when you sell. Additionally, owned systems transfer seamlessly. No third-party involvement means solar panels pass cleanly to new owners as integral property components. For commercial properties, commercial solar design considerations can further maximize property value.

Unrestricted Expansion Freedom

Ownership equals autonomy. Planning to add battery capacity in five years? Considering additional panels for EV charging? Cash purchase grants complete independence to expand and modify your system as lifestyle demands change. Whether you’re exploring off-grid solar system design or simple expansions, ownership provides unlimited flexibility.

Summary: Cash payment represents the most cost-effective method to secure decades of clean, reliable energy while increasing property value.

Solar Financing Comparison: Side-by-Side Analysis

Quick Decision Guide

Choose Solar Lease if you:

- Want zero upfront investment

- Prefer hassle-free maintenance included

- Plan to stay in your home long-term

- Value predictable monthly costs over maximum savings

Choose Solar Loan if you:

- Want to build equity and own your system

- Need low upfront costs with ownership benefits

- Want to capture all tax credits and incentives

- Value flexibility to expand your system later

Choose Cash Purchase if you:

- Can afford the upfront investment

- Want maximum lifetime savings and ROI

- Plan to maximize property value increase

- Desire complete energy independence

Conclusion

Selecting the right solar financing option is a personal decision that depends on your financial situation, homeownership plans, and energy goals. Whether you prioritize immediate savings with zero upfront costs through leasing, prefer building equity through solar loans, or want maximum returns via cash purchase, each path leads to meaningful utility bill reduction and greater energy independence.

The common thread across all three options? You gain protection from escalating electricity rates while contributing to a cleaner energy future. Solar batteries enhance any financing choice, providing backup power during outages and additional savings through strategic energy storage.

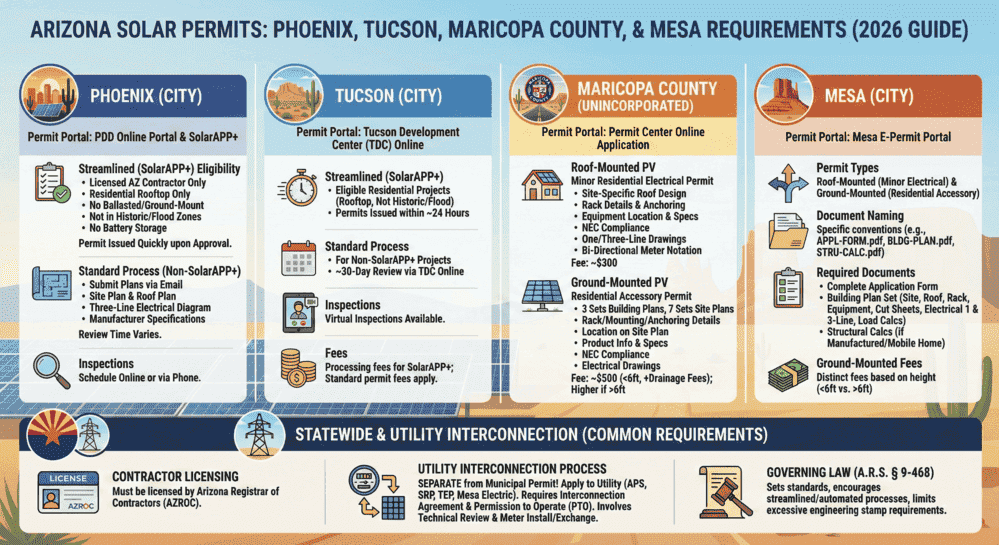

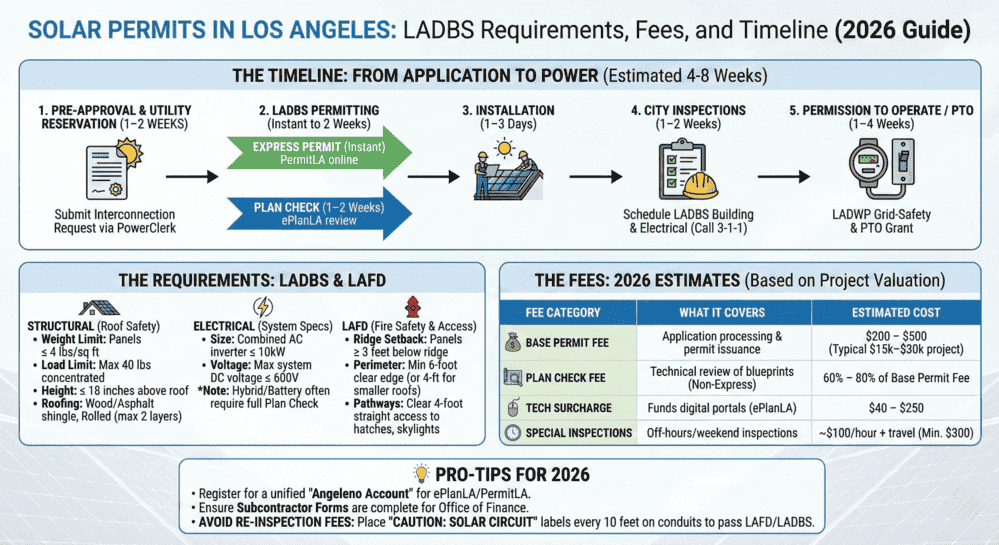

Take time to evaluate your priorities. Consider your budget, how long you plan to stay in your home, whether you want ownership benefits, and how much involvement you prefer in system maintenance. Consult with reputable solar permit solutions providers who can analyze your specific situation, explain local incentives, and present customized proposals across all financing options. Understanding solar permitting requirements is crucial regardless of your chosen financing method, and knowing how long solar permits take helps you plan your installation timeline effectively.

The best time to go solar is when you’ve found the financing method that aligns with your goals. Whether you need solar permit services in Houston, permit services in Los Angeles, or anywhere across the country, professional guidance makes the process smoother. Solar permit expediting services can help accelerate your project timeline when you’re ready to move forward. Understanding essential solar permit equipment requirements ensures your installation meets all regulatory standards.

Armed with the knowledge from this guide, you’re ready to make an informed decision that will serve your household for decades to come. For more insights on renewable energy trends, explore resources from the International Energy Agency and visit the ENERGY STAR website for additional energy-saving tips.

FAQs

Can I add battery storage to my solar system later if I don’t install it initially?

Yes, you can add battery storage after your initial solar installation regardless of your financing method. However, the process varies by financing type. With cash purchases, you have complete freedom to add batteries whenever you choose. Solar loan owners can typically add batteries through additional financing or cash payment. Lease customers must receive approval from their lease provider and may face restrictions or additional fees. Installing batteries alongside your panels initially often proves more cost-effective due to combined installation labor and permitting. Learning about electrical fundamentals for solar projects helps you understand integration requirements, and understanding solar panel racking systems is essential for proper installation.

Do solar panels really increase my home’s value, and by how much?

Yes, owned solar systems consistently increase property values. Studies show that homes with owned solar panels sell for approximately 4% more than comparable homes without solar, though this varies by location and system size. A solar installation that saves $1,200 annually on electricity might add $15,000 to $25,000 to your home’s value. However, leased systems typically add little to no value because the new homeowner doesn’t own the equipment and must assume lease payments. The property value boost applies only to financed or cash-purchased systems that the homeowner owns outright or is actively paying off. Resources like Green Building Advisor provide additional insights on sustainable home improvements.

For DIY enthusiasts interested in learning more, essential books on DIY solar energy provide comprehensive knowledge, and guides on building your own home solar power system can be valuable resources. Organizations like the American Solar Energy Society and IEEE Power & Energy Society offer technical resources, while the EPA provides guidance on end-of-life solar panel management. For broader context on global renewable energy initiatives, the World Bank offers valuable perspective.

Explore more topics on our solar blog or review our full range of services to support your solar journe