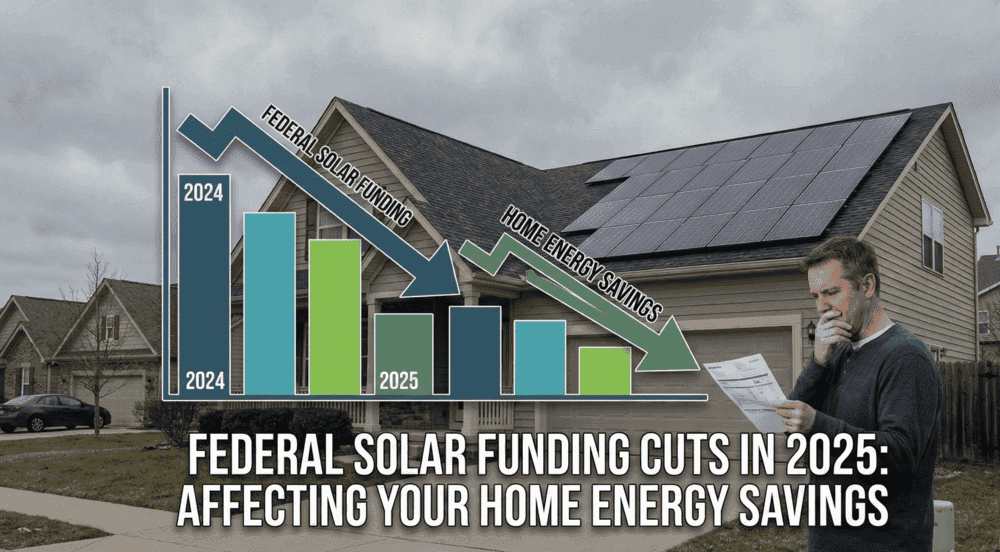

How Federal Solar Funding Cuts In 2025 Affect Your Home Energy Savings

In 2025, federal solar funding cuts eliminated the Solar for All program and accelerated the phase-out of the 30% federal solar tax credit through the One Big Beautiful Bill Act (OBBB). These policy changes directly impact approximately 900,000 households who were planning solar installations, with the EPA terminating the Solar for All initiative in August 2025 due to budget constraints. The average residential rooftop solar installation now costs $15,000 to $30,000 without federal subsidies, substantially higher than previous costs with the 30% tax credit reduction. However, homeowners still have access to state-level incentives in California, New York, and other states, plus alternative financing options, including solar leases and power purchase agreements (PPAs). The funding cuts affect low- and moderate-income families most significantly, though private sector innovation, declining equipment costs, and community solar programs are emerging as viable alternatives. Although these adjustments create concerns regarding solar affordability and accessibility, they represent a pivotal shift in the nation’s renewable energy landscape. This guide explains what changed in 2025, who is impacted, current costs without federal support, available state and local alternatives, and actionable steps homeowners can take to make solar energy affordable despite reduced federal assistance.

Understanding the 2025 Federal Solar Support Reductions

Solar for All Initiative & The 30% Tax Credit Program

The Inflation Reduction Act (IRA), enacted in 2022, established funding for numerous renewable energy programs, including residential rooftop solar installations. A critical component was the Solar for All Initiative, created to make solar systems accessible for lower-income families. Nevertheless, in August 2025, the Environmental Protection Agency (EPA) abruptly terminated this program, referencing budget constraints and policy realignments.

Beyond direct subsidy reductions, federal tax incentives for home solar installations, previously set at 30%, started phasing out more rapidly than anticipated. The One Big Beautiful Bill Act (OBBB) expedited the removal of these credit programs and restricted eligibility requirements.

Effects on Families with Limited and Moderate Incomes

Federal assistance for solar installations is crucial for numerous families, particularly those with constrained budgets. The Solar for All Initiative was structured to assist approximately 900,000 households nationwide. Following its termination, countless families planning solar installations now confront substantially higher expenses.

Without these subsidies, residential solar installation costs may become prohibitive for many homeowners. This situation is particularly problematic since numerous low- and moderate-income families already face elevated utility expenses. When solar technology becomes less financially accessible, it weakens initiatives promoting equitable clean energy adoption.

Residential Solar Decline: Financial & Local Grid Consequences

While household impacts are most visible, broader ramifications exist. Residential rooftop solar installations help decrease dependence on fossil fuel energy sources. Reducing support mechanisms may decelerate rooftop solar growth and diminish progress toward cleaner energy generation, according to the International Energy Agency’s renewable energy reports.

From an economic perspective, reduced rooftop solar demand may impact the solar sector, including installation professionals and equipment manufacturers. This translates to potential employment reductions and business contractions.

Regarding energy reliability, declining rooftop photovoltaic adoption will naturally reduce residential energy storage system deployment (solar panels + hybrid inverter + 48V battery storage). These configurations provide home backup electricity during grid failures while simultaneously reducing strain on local power infrastructure through grid interconnection. Decreased adoption may increase pressure on conventional centralized power grids, making them more susceptible to service interruptions.

Solar Permit Solutions

Homeowner Going Solar?

Get the permit-ready plan set your city requires — delivered fast so your solar project stays on schedule.

Wider Policy Environment & Solar Industry Transformations

These funding reductions must be evaluated within federal budget discussions and political dynamics. The OBBB legislation accelerated the elimination timeline for tax credits supporting established clean technologies like solar power. Proponents maintain that since solar technology has matured, subsidies should decrease to manage federal expenditures. Opponents argue that premature support withdrawal could hinder innovation and damage the clean-energy transformation tracked by organizations like REN21.

Industry Pivot Toward Commercial Applications

Responding to these policy changes, the solar sector is adjusting its approach. Numerous companies are redirecting efforts from residential rooftop installations to community solar developments, which depend less on residential subsidies. State-level incentive programs remain available in various locations, though they vary considerably by jurisdiction, meaning households in robust-incentive states may experience better outcomes than those in limited-incentive regions.

Additionally, alternative financing structures, such as solar leasing or power purchase agreements (PPAs), may gain prominence. These options enable homeowners to obtain solar with reduced initial investment but typically involve extended contracts and may deliver less financial benefit than system ownership.

State and Municipal Responses

With diminished federal assistance, state and local authorities become increasingly important. States including California and New York maintain robust solar incentive programs and rebates for homeowners. Local governments can also establish community solar initiatives that allow residents to access solar benefits without installing panels on individual rooftops.

Understanding local solar permitting requirements is essential when navigating state programs. Whether you’re in Spokane, WA or another location, working with professionals who understand solar permit regulations can streamline your installation process.

Private Sector Innovation

The private sector must expand its contributions. Solar installation companies and financing providers can develop innovative approaches to enhance solar affordability, including streamlined installation processes, reduced-cost panels, and comprehensive financing packages. As solar technology advances and prices decline, according to National Renewable Energy Laboratory research, decreasing costs and improved business strategies may partially compensate for lost subsidy support.

Homeowners considering DIY solar installation options should be aware that proper equipment specifications and electrical fundamentals remain critical. For those seeking comprehensive learning resources, essential solar energy books can provide valuable guidance. Additionally, understanding what happens if you install solar without a permit can help you avoid costly mistakes.

Future Federal Policy Opportunities

Moving forward, federal policymakers may need to reconsider clean-energy incentive structures, particularly for lower-income households. Achieving climate objectives while ensuring equitable access requires developing methods to support household solar adoption without creating unsustainable financial burdens. Solutions might include focused incentives, innovative financing mechanisms, or policies specifically targeting disadvantaged communities.

If you’re concerned about solar tax credit denials, working with NABCEP-certified professionals can help ensure your installation meets all requirements. Common issues like design mistakes that lead to permit denials can be avoided with proper planning. Understanding how long solar permits take and whether you’ll need a different meter after going solar are important considerations during your planning phase.

The recent reductions in rooftop solar funding signify a substantial shift in U.S. energy policy, carrying significant implications for households, the solar industry, and the broader energy transition. For many low- and moderate-income families, losing federal support threatens their capacity to adopt solar technology and reduce utility costs. As the nation navigates this policy transformation, the challenge involves balancing fiscal accountability with the pressing need for a clean, equitable energy future. State policies, private sector innovation, and future federal programs will prove critical in maintaining solar accessibility for all households. Resources like EnergySage can help homeowners compare options and find the best solutions for their situations.

Conclusion

The 2025 federal solar funding cuts represent a turning point for American homeowners considering rooftop solar installations. While the elimination of programs like Solar for All and the accelerated phase-out of the 30% federal tax credit create significant financial challenges, particularly for low- and moderate-income households, the solar industry continues to adapt and evolve. State-level incentives, innovative financing options like PPAs and solar leases, and declining equipment costs are helping to fill the gap left by reduced federal support. As you evaluate your solar options, focus on exploring available state and local incentives in your area, comparing financing alternatives, and consulting with qualified solar installers who can identify the most cost-effective solutions for your specific situation. The path to solar adoption may require more research and planning than before, but the long-term benefits of energy independence, reduced utility bills, and environmental impact make it a worthwhile investment for many homeowners. Stay informed about evolving policies at both state and federal levels, as the renewable energy landscape continues to shift in response to economic and political factors. Understanding end-of-life solar panel regulations and whether HOA regulations impact solar permits can also help you make informed decisions.

FAQs

Will solar funding cuts affect my home’s resale value?

Solar installations generally increase home resale value regardless of federal incentive availability, though the impact may vary. Homes with owned solar systems typically see higher property values because buyers benefit from reduced electricity costs without the initial investment. However, homes with leased systems or PPAs may be less attractive to some buyers due to contract transfer requirements. The recent funding cuts don’t directly affect the value proposition of existing solar installations, but they may influence future buyers’ decisions about installing solar on homes without existing systems. If you’re considering solar primarily for resale value, owned systems typically provide better returns than leased arrangements.

Homeowner Going Solar?

Get the permit-ready plan set your city requires — delivered fast so your solar project stays on schedule.

Frequently Asked Questions

The 30% federal solar tax credit has been significantly impacted by the One Big Beautiful Bill Act (OBBB), which accelerated its phase-out timeline and tightened eligibility requirements. While some homeowners may still qualify for reduced credits depending on when their installation is completed and their specific circumstances, the generous 30% incentive is no longer universally available as it was under the original Inflation Reduction Act provisions. Check with a tax professional and your solar installer to determine what federal tax benefits, if any, apply to your installation timeline and financial situation.

The Solar for All program, which was designed to help approximately 900,000 low- and moderate-income households afford solar installations, was terminated by the Environmental Protection Agency (EPA) in August 2025. The cancellation was attributed to budget constraints and policy changes under the new administration. Families who were counting on this program to make solar affordable now face significantly higher upfront costs without federal subsidies. However, many states have their own programs that may provide similar support, so it's worth researching state-level incentives in your area.

Yes, several alternatives exist even without federal incentives. State-level programs in places like California and New York offer robust rebates and tax credits for solar installations. Many local governments and utilities provide additional incentives or community solar programs that allow you to benefit from solar energy without installing panels on your roof. Additionally, financing options such as solar leases and power purchase agreements (PPAs) enable you to go solar with little to no upfront cost, though you won't own the system outright. These arrangements can still provide savings on your electricity bills while avoiding the high initial investment.

Without federal subsidies, the average cost of a residential rooftop solar installation typically ranges from $15,000 to $30,000 or more, depending on system size, equipment quality, and installation complexity. This represents the full cost without the 30% tax credit that previously reduced expenses by thousands of dollars. However, actual costs vary significantly based on your location, energy needs, roof characteristics, and available state or local incentives. Many solar companies now offer competitive pricing and flexible financing to offset the loss of federal support, and continuing decreases in panel and equipment costs are helping to maintain some affordability.

Solar installations generally increase home resale value regardless of federal incentive availability, though the impact may vary. Homes with owned solar systems typically see higher property values because buyers benefit from reduced electricity costs without the initial investment. However, homes with leased systems or PPAs may be less attractive to some buyers due to contract transfer requirements. The recent funding cuts don't directly affect the value proposition of existing solar installations, but they may influence future buyers' decisions about installing solar on homes without existing systems. If you're considering solar primarily for resale value, owned systems typically provide better returns than leased arrangements.

SPS Editorial Team

Solar Permit Solutions

Solar Permit Solutions provides professional solar permit design services for residential, commercial, and off-grid installations across all 50 states. Our team ensures permit-ready plan sets delivered fast.

Related Articles

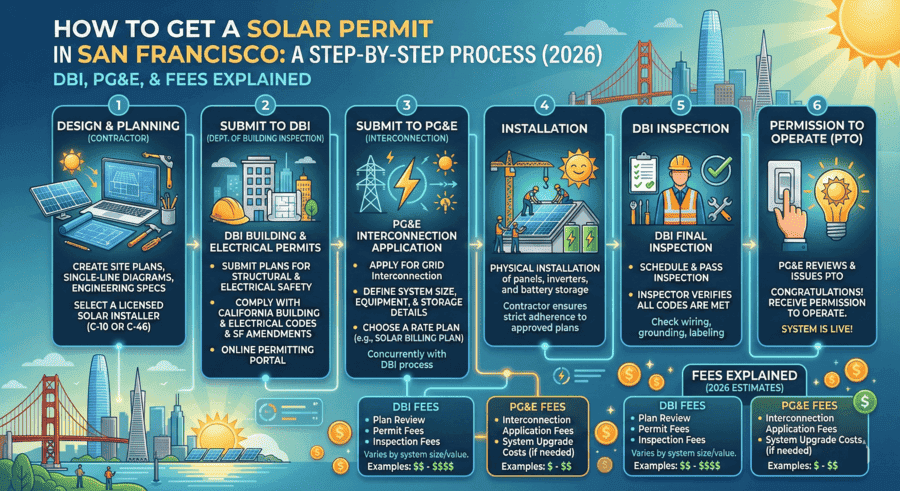

How To Get A Solar Permit In San Francisco: DBI, PG&E And Fees Explained (2026)

San Francisco solar permits require two separate approvals before your system ca...

Bifacial Solar Panel Installation And Permitting Guide

Bifacial solar panels generate 10 to 30 percent more energy than traditional mon...

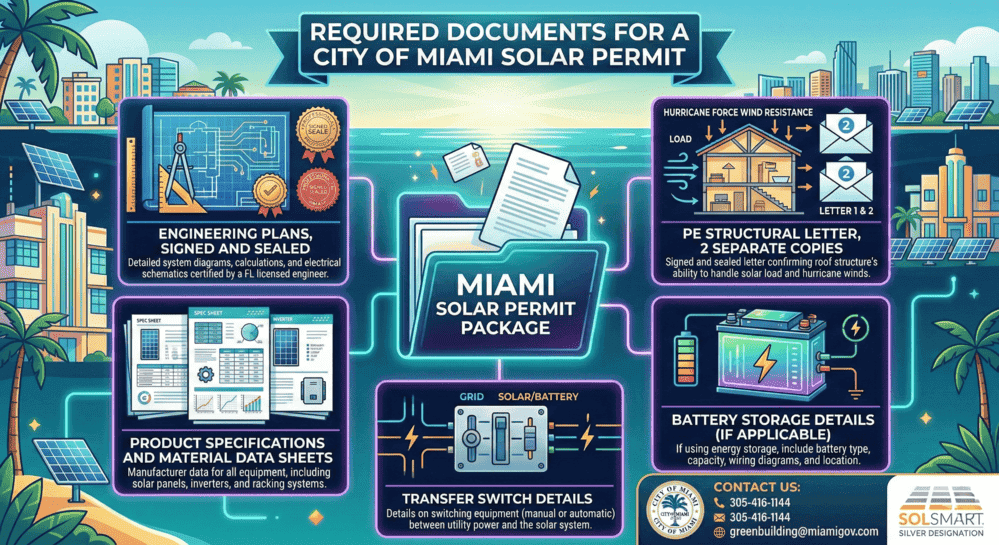

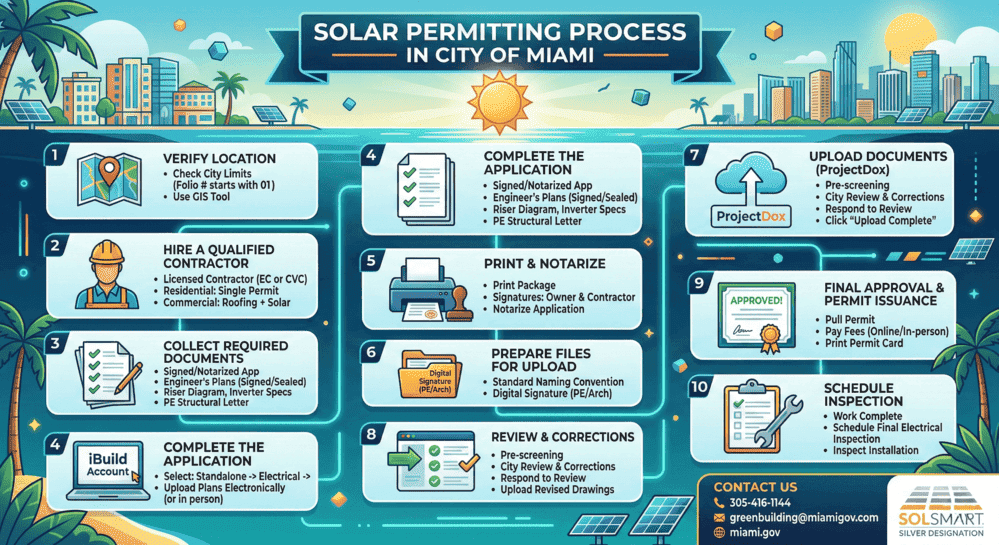

Solar Permit in Miami, FL: City of Miami vs. Miami-Dade County (2026)

Getting a solar permit in Miami requires two separate processes depending on jur...