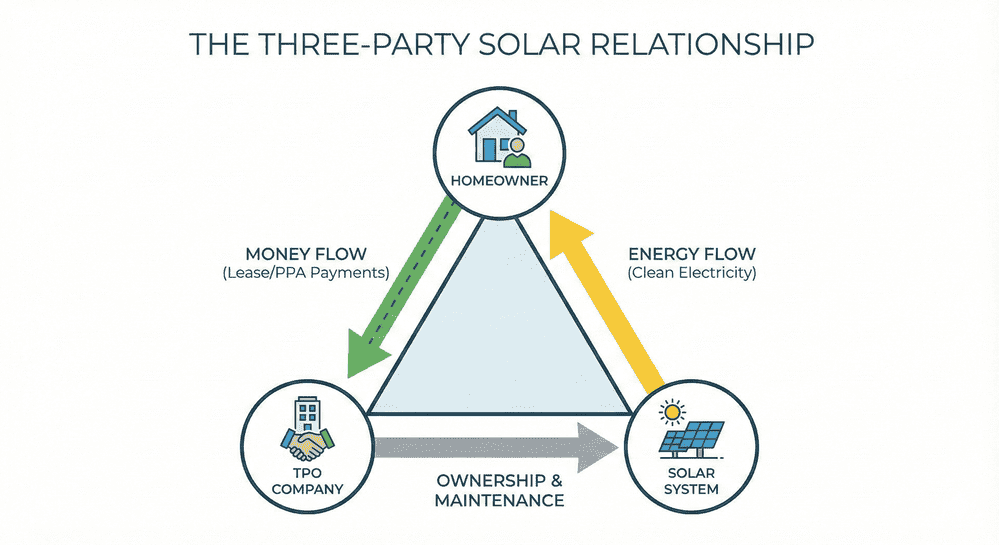

Third-party ownership (TPO) solar allows homeowners to install solar panels without purchasing the system outright. In TPO arrangements, a financing company owns, installs, and maintains the solar panels on your property while you pay either a fixed monthly lease payment or a per-kilowatt-hour rate through a Power Purchase Agreement (PPA). Following the December 31, 2025 expiration of the residential solar tax credit under Section 25D, TPO has become the primary pathway for homeowners to access federal solar incentives, as TPO providers can still claim the commercial 48E investment tax credit through 2027.

This guide explains how TPO solar works, the differences between solar leases and PPAs, which states allow third-party ownership, and how to determine whether TPO is right for your home in 2026 and beyond.

In This Article:

- What Is Third-Party Ownership (TPO) Solar?

- Solar Lease vs. PPA: Understanding the Difference

- How TPO Solar Works Step by Step

- TPO Solar After 2025: Critical Tax Credit Changes

- State-by-State TPO Availability

- Pros and Cons of TPO Solar

- Who Benefits from TPO Solar?

- Prepaid Solar Leases: The Emerging TPO Model

- TPO Solar Permitting: What Homeowners Should Know

- Selling Your Home with TPO Solar

- Major TPO Providers in 2026

- Is TPO Solar Right for You?

- Frequently Asked Questions

What Is Third-Party Ownership (TPO) Solar?

Third-party ownership refers to a solar financing arrangement where a company other than the homeowner owns the solar energy system installed on the property. Rather than purchasing solar panels outright or financing them through a loan, homeowners enter into an agreement that allows a third-party company to install, own, and maintain the solar system while the homeowner benefits from the electricity it produces.

The third-party company handles all aspects of system ownership, including equipment costs, installation expenses, permitting requirements, utility interconnection, ongoing maintenance, and system monitoring. In exchange, homeowners make regular payments either through a fixed monthly lease or by purchasing the electricity generated at a predetermined rate.

According to U.S. Energy Information Administration data, TPO currently accounts for approximately 45% of all residential solar installations in the United States, with industry analysts projecting this figure to reach 60-69% market share by 2026. This shift toward TPO is driven largely by changes to federal solar incentives that make third-party ownership increasingly attractive compared to direct system ownership.

The TPO model removes the two largest barriers that prevent homeowners from adopting solar energy: high upfront costs and maintenance responsibilities. By eliminating these obstacles, TPO has made solar accessible to millions of households that might otherwise be unable to participate in the clean energy transition.

Solar Lease vs. PPA: Understanding the Difference

TPO solar agreements come in two primary forms, each with distinct payment structures and considerations for homeowners. The Solar Energy Industries Association provides detailed resources on both financing models.

Solar Lease

A solar lease involves paying a fixed monthly fee to use the solar energy system on your property. This payment remains consistent regardless of production. Monthly lease payments typically range from $50 to $250 depending on system size and location.

Lease payment predictability makes budgeting straightforward. Most solar leases include an annual escalator clause that increases payments by 1-3% each year.

Power Purchase Agreement (PPA)

A Power Purchase Agreement differs from a lease in that you pay only for electricity produced, measured in kilowatt-hours (kWh). The SEIA PPA guide explains that PPA rates are typically lower than utility rates, providing immediate savings.

With a PPA, monthly costs fluctuate based on system production. High-output months result in higher payments, while reduced generation means lower costs. PPAs also include annual escalator clauses designed to remain below projected utility rate increases.

Key Differences at a Glance

Both lease and PPA contracts typically span 15-25 years. At contract end, homeowners can renew the agreement, purchase the system at fair market value, or have the equipment removed at no cost.

How TPO Solar Works Step by Step

Understanding the TPO process helps homeowners know what to expect when pursuing this financing option.

Step 1: Site Assessment and System Design

A solar installer evaluates your property for solar viability, analyzing roof condition, orientation, pitch, shading, and available space. The installer reviews your electricity usage to appropriately size the system.

Step 2: Agreement and Contract Signing

Once the assessment confirms your home is suitable, you sign a contract with the TPO company outlining payment terms, contract duration, escalator rates, maintenance responsibilities, performance guarantees, and end-of-term options.

Step 3: Permitting and Approvals

The TPO company handles all permitting requirements with your local Authority Having Jurisdiction (AHJ). This includes building permits, electrical permits, and engineering stamps. Solar Permit Solutions’ guide on solar engineering requirements details AHJ standards and compliance.

Step 4: Installation

Professional installers mount the solar panels, install inverters and electrical components, and connect the system to your home’s electrical panel. Residential installations typically complete within one to three days.

Step 5: Inspection and Interconnection

After installation, local building inspectors verify the system meets all code requirements. The installer then submits interconnection applications to your utility company. Our solar interconnection agreement guide details this process. Once approved, the utility installs a net meter and grants Permission to Operate (PTO), allowing you to begin generating solar electricity.

Step 6: System Activation and Monitoring

With PTO granted, your solar system begins producing electricity. The TPO company monitors performance remotely, tracking production and identifying issues. This monitoring ensures optimal operation throughout the contract term.

Step 7: Ongoing Maintenance

Throughout the agreement, the TPO company maintains responsibility for system upkeep including cleaning, repairs, inverter replacements, and equipment failures. Homeowners enjoy solar benefits without maintenance concerns.

Solar Permit Solutions

Need Solar Permit Plans?

Professional, permit-ready solar plan sets delivered fast. Residential and commercial projects across all 50 states.

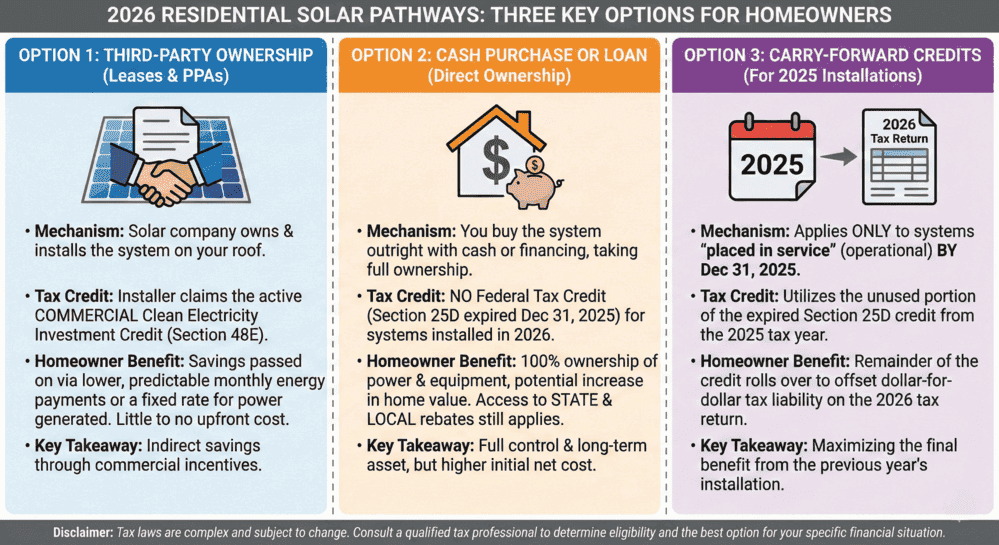

TPO Solar After 2025: Critical Tax Credit Changes

The solar financing landscape changed dramatically with the passage of the One Big Beautiful Bill Act, making TPO more important than ever for homeowners considering solar in 2026 and beyond.

Section 25D Expiration

The residential clean energy tax credit under Section 25D of the tax code expired on December 31, 2025. This means homeowners who purchase solar systems outright or finance them through loans can no longer claim the 30% federal investment tax credit (ITC) that previously offset a significant portion of installation costs. The solar tax credit deadline marked a major shift in solar economics.

For a typical $30,000 solar installation, the expired tax credit represented $9,000 in direct tax savings. Without this incentive, the economics of solar ownership have shifted considerably.

Section 48E Remains Available for TPO

While homeowners lost access to the residential tax credit, the commercial investment tax credit under Section 48E remains available for TPO providers. Solar companies that own and lease systems to homeowners can claim the 30% credit on installations placed in service before January 1, 2028, provided construction begins by July 4, 2026.

This distinction is crucial. TPO providers incorporate their tax credit savings into customer pricing, offering lower lease payments and PPA rates than would otherwise be possible. In effect, homeowners still benefit from federal incentives indirectly through reduced TPO costs.

FEOC Compliance Requirements

Beginning January 1, 2026, new Foreign Entity of Concern (FEOC) rules affect TPO systems claiming the 48E credit. To qualify for the full credit, at least 40% of total project costs must come from non-FEOC sources, with this threshold increasing over time.

Individual components must meet specific FEOC source ratios: 50% for solar panels and inverters, and 60% for battery storage systems. These requirements are driving TPO providers toward domestic content and non-Chinese supply chains, which may affect equipment availability and pricing in certain markets.

What This Means for Homeowners

For homeowners exploring solar in 2026, TPO represents the most accessible path to federal incentive benefits. While you cannot directly claim tax credits under a lease or PPA, the TPO company’s ability to capture these credits translates to more competitive pricing than purchasing a system without any federal support.

State-by-State TPO Availability

Third-party solar ownership is not universally available across the United States. State laws and regulations determine whether TPO arrangements are permitted. The DSIRE database provides comprehensive information on state-specific solar policies and incentives.

States Allowing Full TPO (PPAs and Leases)

Twenty-eight states plus the District of Columbia and Puerto Rico permit both solar leases and power purchase agreements. These states have regulatory frameworks that enable TPO companies to operate and offer financing options to residential customers.

States with full TPO availability include California, Colorado, Connecticut, Delaware, Hawaii, Illinois, Maryland, Massachusetts, Michigan, Minnesota, Nevada, New Hampshire, New Jersey, New Mexico, New York, Ohio, Oregon, Pennsylvania, Rhode Island, Texas, Vermont, Virginia, Washington, and Wisconsin, among others. Solar permitting timelines vary by state, so understanding local approval timeframes helps set realistic expectations.

States with Lease-Only Options

Six states allow solar leases but prohibit or restrict power purchase agreements: Arizona, Florida, Louisiana, Mississippi, North Carolina, and South Carolina. In these states, homeowners can enter fixed-payment lease arrangements but cannot purchase electricity directly from a third-party provider. Recent Florida solar permitting reforms have streamlined approvals even under these restrictions.

States Without TPO Options

Seventeen states currently have no residential TPO offerings due to legal restrictions or lack of provider presence. These states include Kentucky, Oklahoma, Wyoming, Arkansas, South Dakota, North Dakota, Nebraska, Idaho, Montana, West Virginia, Alabama, Tennessee, Indiana, Iowa, Kansas, Missouri, and Georgia (though Georgia recently passed legislation that may expand TPO availability).

Homeowners in states without TPO options face more limited solar financing choices, particularly following the expiration of the residential tax credit. If you live in one of these states, purchasing a system outright, financing through a solar loan, or participating in community solar programs may be your primary alternatives.

State-Level Incentives

Beyond TPO availability, state solar incentives can significantly impact solar economics. States like California, New York, Massachusetts, and Illinois offer substantial rebates, performance-based incentives, and favorable net metering policies that enhance solar savings regardless of ownership structure.

Pros and Cons of TPO Solar

Understanding both the advantages and limitations of TPO helps homeowners make informed decisions. The Department of Energy’s solar financing guide provides additional context on weighing these factors.

Advantages of TPO Solar

No Upfront Investment Required

TPO eliminates the $15,000-$50,000 upfront cost typically required to purchase a solar system. Homeowners can begin generating solar electricity with little or no money down, making solar accessible to households without significant savings or borrowing capacity.

Maintenance-Free Operation

All system maintenance, repairs, monitoring, and equipment replacements are handled by the TPO company throughout the contract term. Homeowners avoid unexpected costs and technical responsibilities associated with system ownership.

Immediate Monthly Savings

TPO rates are structured to provide savings compared to utility electricity from day one. Unlike purchased systems that require years to recoup initial investment, TPO delivers immediate reduction in energy costs.

Performance Guarantees

Most TPO providers offer production guarantees ensuring the system generates a minimum amount of electricity. If production falls short, homeowners may receive credits, reduced payments, or other compensation.

Access to Federal Incentives (Indirect)

Although homeowners cannot claim tax credits directly, TPO companies pass incentive savings through via lower pricing. This maintains some federal support for solar adoption despite the residential credit expiration.

Budget Predictability

Fixed lease payments and stable PPA rates provide predictability that helps households plan monthly expenses. Even with escalator clauses, increases are known in advance and typically remain below utility rate hikes.

Disadvantages of TPO Solar

No Ownership Equity

TPO homeowners never own the solar system and cannot build equity in the equipment. Unlike purchased systems that become assets, TPO represents an ongoing expense throughout the contract term.

Lower Lifetime Savings

While TPO provides immediate savings, total lifetime savings are typically lower than ownership. Purchased systems eventually pay for themselves, after which electricity is essentially free. TPO payments continue for 15-25 years.

No Direct Tax Credit Access

Homeowners cannot claim federal or state tax credits, which pass to the TPO company instead. For those who installed systems before the deadline, our IRS Form 5695 guide explains how to claim available credits.

Long-Term Contract Commitment

TPO agreements lock homeowners into 15-25 year contracts. Early termination may involve fees or buyout costs, and transferring contracts when selling your home adds complexity to real estate transactions.

Escalator Clauses Reduce Savings Over Time

Annual payment increases of 1-3% compound over the contract term. While designed to remain below utility rate growth, escalators gradually erode the savings margin between TPO and grid electricity costs.

No Property Value Increase

Studies indicate homes with owned solar systems sell for 4-6% more than comparable homes without solar. TPO systems do not provide this property value premium, as the equipment belongs to a third party. Research from Lawrence Berkeley National Laboratory and NREL solar financing studies provides detailed market analysis.

Who Benefits from TPO Solar?

TPO creates value for multiple stakeholders in the solar ecosystem, each benefiting in different ways.

Homeowners

Households that benefit most from TPO include those who want immediate electricity savings without upfront investment, cannot qualify for solar loans due to credit requirements, lack sufficient tax liability to benefit from ownership incentives, prefer hands-off maintenance arrangements, are uncertain about long-term home ownership plans, or simply want the simplest path to solar adoption.

TPO is particularly valuable for retirees on fixed incomes, renters in states where TPO applies to rental properties, and households prioritizing monthly cash flow over long-term wealth building.

TPO Financing Companies

Third-party owners benefit from steady, predictable revenue streams over 15-25 year contract terms. They capture federal tax credits, accelerated depreciation benefits, and state incentives that significantly enhance investment returns. The ability to deploy capital across thousands of rooftop installations creates portfolio diversification and economies of scale.

Solar Installers

Installers partnering with TPO providers expand their addressable market by offering financing options that remove customer affordability barriers. TPO arrangements often include streamlined sales processes, reduced customer acquisition costs, and steady project pipelines. For many installation companies, TPO partnerships represent a significant portion of annual revenue.

Prepaid Solar Leases: The Emerging TPO Model

A newer TPO structure gaining traction is the prepaid solar lease, which combines elements of ownership and traditional third-party financing.

How Prepaid Leases Work

Rather than making monthly payments over 20-25 years, homeowners pay a lump sum upfront covering the entire lease term. The TPO company owns the system initially, claims available tax credits, and maintains responsibility for equipment performance.

After a predetermined period, typically 5-10 years, ownership transfers to the homeowner at no additional cost. This structure allows the TPO company to capture tax incentives during its ownership period while ultimately providing the homeowner with an owned asset.

Benefits of Prepaid TPO

Prepaid arrangements offer lower total costs than traditional monthly TPO agreements since there are no financing charges built into payments over time. Homeowners gain eventual ownership without navigating the complexity of directly claiming tax credits. The TPO company handles permitting, installation, and initial maintenance, simplifying the adoption process.

Considerations

Prepaid leases require significant upfront capital, though typically less than purchasing a system outright after accounting for tax credit pass-through savings. Homeowners should carefully review contract terms regarding ownership transfer timelines, maintenance responsibilities during and after the TPO period, and any conditions that might affect the transition.

Industry analysts note prepaid TPO adoption is accelerating faster than expected, particularly as homeowners seek alternatives following the residential tax credit expiration.

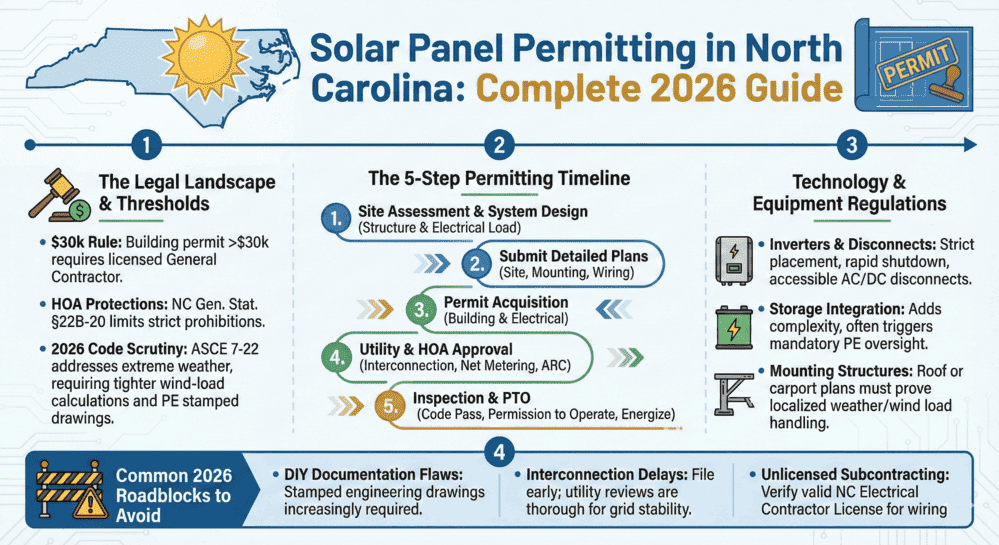

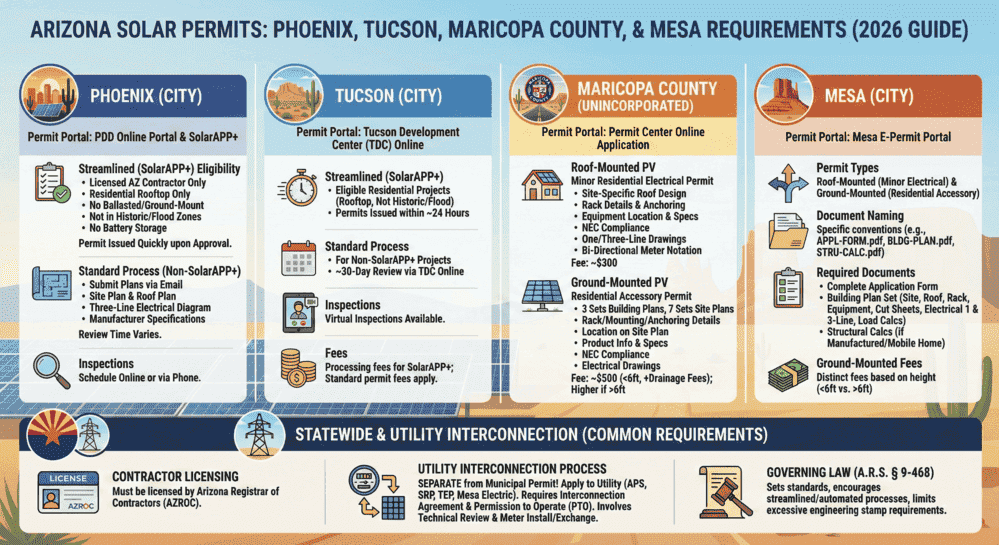

TPO Solar Permitting: What Homeowners Should Know

While TPO companies handle permitting responsibilities, understanding the process helps homeowners know what to expect and avoid potential delays. Solar Permit Solutions provides comprehensive solar permit services for installers and homeowners nationwide.

Permitting Requirements

Solar installations require permits from local authorities having jurisdiction regardless of ownership structure. Typical requirements include building permits verifying structural adequacy for panel weight and mounting, electrical permits ensuring proper wiring and code compliance, and, in some jurisdictions, fire safety permits addressing equipment placement and access pathways.

Permit applications include detailed plan sets showing system layout, electrical schematics, structural calculations, and equipment specifications. Many jurisdictions require professional engineering stamps. Understanding NEC 2023 Article 690 requirements ensures systems meet electrical standards.

TPO Company Responsibilities

Under TPO arrangements, the financing company or its installation partner manages all permitting tasks. This includes preparing applications, submitting documentation, scheduling inspections, and obtaining approvals.

Homeowners generally need to provide property access for site assessments and inspections but are otherwise uninvolved in permitting procedures.

Utility Interconnection

Beyond local permits, solar systems require utility interconnection approval. The TPO company submits applications, coordinates meter installation, and obtains Permission to Operate from the utility. Timelines vary from days to several weeks depending on the utility.

Timeline Expectations

Total time from signed contract to system activation typically ranges from 4 to 12 weeks depending on permitting jurisdiction efficiency, utility interconnection processing speed, equipment availability, and installation scheduling. For specific state requirements, review our guides on California solar permitting and Texas solar permits.

Selling Your Home with TPO Solar

TPO contracts create considerations when selling a home that homeowners should understand before entering agreements.

Transfer Options

Most TPO contracts allow agreement transfer to home buyers. The new owner assumes the remaining lease or PPA payments and continues receiving solar electricity benefits. TPO companies typically require buyer credit approval before approving transfers.

Buyer Considerations

Some buyers may hesitate to assume TPO obligations, viewing ongoing payments as liabilities rather than benefits. Educating potential buyers about solar savings and contract terms can help address concerns. Real estate agents experienced with solar transactions provide valuable assistance navigating these discussions.

Buyout Alternatives

Sellers can often buy out remaining contract balances, transferring free-and-clear ownership to buyers. Buyout costs depend on remaining term length and contract provisions. In some cases, purchasing the system before sale allows capturing the property value premium associated with owned solar.

Property Value Impact

Research indicates TPO systems do not increase property values the way owned systems do. Appraisers typically do not assign additional value to leased equipment since it represents an obligation rather than an asset. Homeowners prioritizing property value enhancement may find ownership more advantageous.

Major TPO Providers in 2026

Several companies dominate the residential TPO market, each offering distinct programs and coverage areas.

Sunrun operates as the largest residential solar company in the United States, offering both lease and PPA options across numerous states. Their BrightSave program provides various contract structures with 25-year terms and comprehensive maintenance coverage.

Palmetto offers the LightReach TPO program integrated with major solar design platforms. Their offerings include both traditional monthly payment options and prepaid structures, with a strong presence in Southeast and Mid-Atlantic markets.

GoodLeap provides financing solutions, including TPO options, through its installer network. Originally focused on solar loans, has expanded TPO offerings in response to market shifts following tax credit changes.

Sunnova delivers solar and battery storage solutions through TPO arrangements, emphasizing energy storage integration alongside traditional solar offerings.

EnFin specializes in TPO financing for residential solar, partnering with installation companies nationwide to provide lease and PPA options.

When evaluating providers, compare payment rates, escalator terms, contract length, maintenance coverage, performance guarantees, transfer policies, and end-of-term options. Local installers can often access multiple TPO providers, allowing side-by-side comparison of available programs.

Is TPO Solar Right for You?

Determining whether TPO suits your situation depends on several personal and financial factors. Solar United Neighbors provides helpful consumer guidance on evaluating solar financing options.

TPO May Be Right for You If:

You want solar without large upfront costs or loan debt. You cannot fully utilize tax credits due to insufficient tax liability. You prefer professional maintenance and system monitoring. You value immediate monthly savings over long-term wealth building. You are uncertain whether you will remain in your home for 10+ years. You prioritize simplicity and minimal involvement in system management.

Solar Ownership May Be Better If:

You have capital available for system purchase or strong credit for favorable loan terms. You have sufficient tax liability to capture available credits (though federal residential credits have expired). You plan to remain in your home for 15+ years and want maximum lifetime savings. You want to increase your property value. You prefer owning assets rather than paying ongoing fees. You are comfortable managing occasional maintenance needs.

Questions to Ask Yourself:

How long do I plan to stay in my current home? Do I have $15,000-$50,000 available for system purchase? Am I comfortable with 15-25-year contract commitments? Do I prefer predictable monthly costs or maximum long-term savings? How important is property value enhancement to my goals? Would I rather pay more overtime for convenience or less overall with more involvement?

Conclusion

Third-party ownership provides an accessible path to solar energy for millions of households. By eliminating upfront costs and maintenance burdens, TPO removes the primary barriers preventing solar adoption. Following the 2025 residential tax credit expiration, TPO has become even more significant as the primary vehicle for accessing federal incentive benefits.

Whether TPO suits your specific situation depends on your financial circumstances, homeownership plans, and priorities regarding immediate savings versus long-term value. Understanding how TPO works, what options exist in your state, and how agreements affect home sales empowers you to make informed decisions about your solar journey.

For homeowners ready to explore TPO options, consult with local solar installers who partner with multiple financing providers to compare available programs. The NREL System Advisor Model provides tools for analyzing TPO financial scenarios, and the DOE Homeowner’s Guide to Solar offers additional resources.

The transition to clean energy continues accelerating, and TPO solar ensures this transition remains accessible regardless of upfront capital availability. With careful evaluation of your options, solar energy can deliver meaningful savings and environmental benefits for your household.

FAQs

What is the difference between a solar lease and a PPA?

A solar lease involves fixed monthly payments regardless of production, while a PPA charges based on actual electricity generated. Leases provide payment predictability; PPAs tie costs directly to system output.

Need Solar Permit Plans?

Professional, permit-ready solar plan sets delivered fast. Residential and commercial projects across all 50 states.

Frequently Asked Questions

TPO (Third-Party Ownership) solar is a financing arrangement where a company owns and maintains solar panels installed on your property. You pay either a fixed monthly lease or per-kWh rate through a Power Purchase Agreement while benefiting from solar electricity without ownership responsibilities.

A solar lease involves fixed monthly payments regardless of production, while a PPA charges based on actual electricity generated. Leases provide payment predictability; PPAs tie costs directly to system output.

Homeowners cannot directly claim federal tax credits under TPO arrangements. However, TPO companies claim available credits and pass savings through via lower customer pricing. This represents the primary path to federal incentive benefits following the 2025 residential credit expiration.

TPO agreements typically span 15-25 years, matching expected solar equipment lifespan. Contract terms vary by provider and may include renewal, purchase, or removal options at term end.

Most TPO contracts allow transfer to home buyers, who assume remaining payments. Alternatively, sellers can buy out contract balances before closing. TPO companies require buyer approval before completing transfers.

TPO availability varies by state. Twenty-eight states plus DC and Puerto Rico allow full TPO options. Six states permit leases only, while seventeen states have no current TPO availability due to legal restrictions.

The TPO company maintains responsibility for all system maintenance, repairs, monitoring, and equipment replacement throughout the contract term. Homeowners are not responsible for maintenance costs or technical issues.

A prepaid solar lease involves paying a lump sum upfront rather than monthly payments. The TPO company owns the system initially, claims tax credits, then transfers ownership to the homeowner after 5-10 years.

All solar installations must meet rapid shutdown requirements and solar panel safety codes including AFCI and GFCI protection per NEC standards. TPO companies ensure all installations meet these requirements.

Net metering allows solar systems to receive credits for excess electricity sent to the grid. Under TPO, these credits typically reduce your electricity costs, with specific terms outlined in your lease or PPA agreement.

SPS Editorial Team

Solar Permit Solutions

Solar Permit Solutions provides professional solar permit design services for residential, commercial, and off-grid installations across all 50 states. Our team ensures permit-ready plan sets delivered fast.

Related Articles

New 2026 North Carolina Solar Permit Guide: Duke Energy & Storage Rules

Learn North Carolina solar panel licensing and permitting requirements. Discover...

Section 25D Expiration: Homeowner Options In 2026

The Section 25D Residential Clean Energy Credit, which covered 30% of residentia...

Solar Permits In Arizona: Phoenix, Tucson, Maricopa County, And Mesa Requirements (2026 Guide)

Arizona solar permitting at a glance: Arizona HB2301 now requires every municipa...