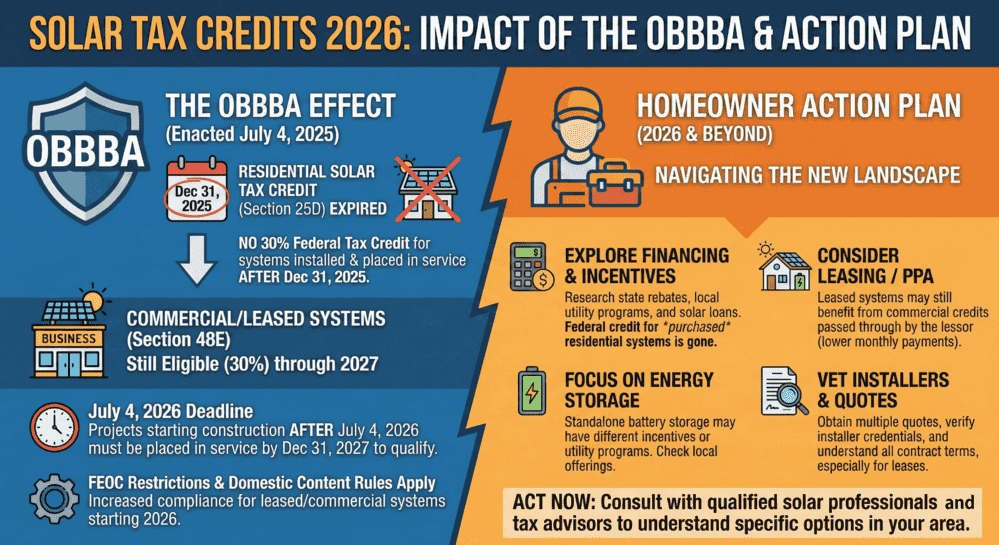

Summary: The federal residential solar tax credit (Section 25D) expired December 31, 2025, after the One Big Beautiful Bill Act eliminated it nearly a decade early. Homeowners who purchase solar in 2026 can no longer claim the 30% credit. Third-party ownership through leases and PPAs remains the primary path to federal incentives, and strong state programs continue to reduce costs.

The 30% federal solar tax credit for homeowner-owned systems ended on December 31, 2025. The One Big Beautiful Bill Act (OBBBA), signed July 4, 2025, terminated Section 25D nearly a decade ahead of its original 2034 expiration. In 2026, homeowners can still access federal solar incentives through third-party ownership arrangements where commercial credits remain available through 2027.

This guide covers exactly what changed, what options remain, which state incentives are still available, and how to make the best financial decision for your home in the post-tax-credit era.

What the OBBBA Changed for Residential Solar

The One Big Beautiful Bill Act made sweeping changes to clean energy tax policy. For homeowners considering solar, the most significant change was the early termination of Section 25D, the Residential Clean Energy Credit.

Under the Inflation Reduction Act of 2022, this credit was set to remain at 30% through 2032, then step down to 26% in 2033 and 22% in 2034. The OBBBA accelerated this timeline by roughly seven years, ending the credit entirely for expenditures made after December 31, 2025. There is no phase-down period and no partial credit available in 2026.

For a typical $30,000 solar installation, the expired credit represented $9,000 in direct tax savings. Without this incentive, the upfront economics of solar ownership have shifted considerably, though long-term savings from reduced electricity bills remain strong.

The OBBBA also terminated the Section 25C Energy Efficient Home Improvement Credit on the same date, affecting homeowners who planned energy efficiency upgrades alongside solar installations. Our solar tax credit deadline 2025 IRS documentation guide covers what homeowners who installed before the deadline need to know about filing.

| Credit / Provision | Before OBBBA (IRA Rules) | After OBBBA (Current Law) |

| Section 25D (Homeowner Credit) | 30% through 2032, phase-down to 22% by 2034 | Terminated December 31, 2025 |

| Section 48E (Commercial ITC) | Available through 2030s with gradual phase-down | Ends for solar placed in service after Dec 31, 2027 (safe harbor if construction begins by July 4, 2026) |

| Section 45Y (Production Credit) | Available through 2030s with gradual phase-down | Same deadline as 48E for solar and wind |

| TPO Residential Solar (Leases/PPAs) | Eligible through Section 48E, no immediate deadline | Still eligible through Section 48E until end of 2027 (with FEOC compliance) |

| Battery Storage (Standalone) | Eligible under 25D (homeowner) and 48E (commercial) | 25D expired; 48E available through 2032 for storage under TPO |

| FEOC Restrictions | Limited restrictions under IRA | Strict material assistance rules starting 2026 with increasing thresholds |

How Homeowners Can Still Access Federal Solar Incentives in 2026

While homeowners can no longer claim the residential tax credit directly, the commercial investment tax credit under Section 48E remains available for third-party owned solar systems. This distinction has reshaped the residential solar market in 2026, making third-party ownership (TPO) solar arrangements the primary pathway to federal incentive savings.

Solar Leases and PPAs: The New Default

In a TPO arrangement, a solar company owns, installs, and maintains the panels on your roof. You pay either a fixed monthly lease payment or a per-kilowatt-hour rate through a Power Purchase Agreement (PPA). Because the solar company owns the system, it claims the Section 48E credit and passes a portion of those savings to you through lower payments.

The commercial credit can be worth 30% to 50% of eligible project costs depending on available bonus adders, including the domestic content bonus. Many TPO providers in 2026 are accessing credits of 40% or higher through extended commercial and bonus credit pathways, which directly lowers the monthly payment or PPA rate offered to homeowners.

Key points about TPO solar in 2026:

Systems must begin construction before July 4, 2026, or be placed in service by December 31, 2027, to qualify for the Section 48E credit. TPO providers must comply with new Foreign Entity of Concern (FEOC) equipment sourcing rules starting in 2026. Twenty-eight states plus the District of Columbia and Puerto Rico permit both solar leases and PPAs, while some states restrict one or both options. Monthly PPA payments in 2026 are often lower than what homeowners would see with a solar loan at current interest rates, since loans no longer benefit from the tax credit offset.

Prepaid Solar Leases: A Growing Alternative

Prepaid solar products have emerged as a popular middle ground between full ownership and traditional leases. In this model, the homeowner pays roughly 70% of the system cost upfront while a third-party investor owns the system on paper, claims the tax credit, and maintains the equipment. After a set period (typically five to seven years), ownership transfers to the homeowner.

This structure provides the tax credit benefit without requiring personal tax liability, offers a path to eventual ownership, and often costs less than a direct cash purchase in 2026 since the financing partner absorbs the credit value upfront.

Cash Purchase and Loans: Still an Option

Buying solar outright or financing through a loan remains possible in 2026, though the financial profile has changed. Without the tax credit, the payback period extends and the initial cost is higher. However, ownership still typically delivers the highest long-term savings over 25 to 30 years because there are no ongoing monthly payments or escalators.

Solar loans in 2026 carry interest rates around 7% to 8% or higher depending on term length and lender. Previously, a loan paired with a $9,000 tax credit produced competitive monthly payments. Without that offset, loan payments are noticeably higher. In states with strong local incentives, particularly New York, New Jersey, Massachusetts, and Illinois, buying with cash or a loan can still make financial sense because state credits and performance payments partially replace the lost federal incentive.

The July 4, 2026 Safe Harbor Deadline

For commercial and utility-scale solar projects, including TPO residential installations, the OBBBA established a critical construction timeline. Solar and wind facilities placed in service after December 31, 2027, are ineligible for the Section 48E and Section 45Y credits unless construction began before July 4, 2026.

Projects that begin construction by this safe harbor date retain eligibility under the existing four-year continuity requirement, meaning they must be placed in service within four calendar years of starting construction. Projects that start after July 4, 2026, face the hard December 31, 2027, placed-in-service deadline.

The IRS defines “beginning of construction” through two tests. The Physical Work Test requires significant physical work of a significant nature at the project site or at a factory where components are manufactured. The Five Percent Safe Harbor requires the taxpayer to pay or incur at least 5% of the total cost of the facility. IRS Notice 2025-42, issued after the OBBBA’s enactment, restricts the Five Percent Safe Harbor to solar facilities with a maximum net output of 1.5 MW or less. Larger solar projects must use the Physical Work Test. For residential TPO installations, the 1.5 MW threshold is rarely a concern since most residential systems are well below this capacity.

This deadline matters for homeowners because TPO providers must begin construction on projects before this date to maintain access to the full credit. As July 2026 approaches, expect increased urgency from solar companies to secure contracts and commence work. Understanding the timeline for solar permits and the PTO requirements and timeline helps you plan accordingly.

Solar Permit Solutions

Homeowner Going Solar?

Get the permit-ready plan set your city requires — delivered fast so your solar project stays on schedule.

FEOC Equipment Sourcing Rules: What You Need to Know

The OBBBA introduced strict Foreign Entity of Concern restrictions that add complexity to solar installations claiming commercial tax credits in 2026 and beyond.

Under these rules, solar projects receiving “material assistance” from prohibited foreign entities, primarily companies with ties to China, Russia, North Korea, or Iran, face credit disqualification. Material assistance is measured through the Material Assistance Cost Ratio (MACR), which compares the cost of components sourced from prohibited entities against total project costs.

The minimum non-FEOC cost thresholds vary by technology and increase annually. For solar facilities beginning construction in 2026, the threshold starts at 40% and rises in subsequent years. The Department of the Treasury is required to release safe harbor MACR tables by December 31, 2026.

For homeowners, the practical impact is that TPO providers offering leases and PPAs in 2026 will typically only offer equipment that complies with FEOC manufacturing regulations. This may limit equipment choices but ensures the installation qualifies for the commercial credit. If you are considering a prepaid lease with the option to take ownership after several years, pay attention to the equipment specifications, as FEOC-compliant components are increasingly sourced from domestic or allied-nation manufacturers.

The FEOC rules represent one of the most complex compliance challenges in solar tax policy. Installers navigating AHJ requirements already manage significant documentation, and FEOC compliance adds another layer of verification for equipment sourcing.

State Solar Incentives Still Available in 2026

With the federal residential credit gone, state and local incentive programs now carry greater weight in the solar decision. Many states offer substantial support independent of federal policy.

| State | Key Incentive | Estimated Value | Net Metering |

| New York | 25% state tax credit (up to $5,000) + NY-Sun rebates | $5,000 to $10,000+ | Yes (VDER for new systems) |

| New Jersey | SREC-II at $85/MWh for 15 years + sales/property tax exemptions | $10,200 to $12,750 over 15 years | Yes (full retail rate) |

| Massachusetts | SMART program production payments + 15% state tax credit (up to $1,000) | Varies by utility territory | Yes |

| South Carolina | 25% state tax credit (carry forward 10 years) | 25% of system cost | Yes |

| California | SGIP battery rebates + NEM 3.0 export credits + property/sales tax exemptions | Varies; battery adders significant | NEM 3.0 (reduced export rates) |

| Illinois | Adjustable Block Program (SREC lump-sum payments) | Varies by block and system size | Yes |

| Texas | Property tax exemption + select utility rebates (Austin Energy up to $2,500) | Varies by utility territory | Limited (varies by utility) |

| Florida | Sales tax exemption (6%) + property tax exemption | $1,500 to $2,500 in sales tax savings | Yes (full retail rate) |

Beyond these highlighted states, nearly all states offer some combination of net metering, property tax exemptions, or utility rebate programs. The DSIRE database maintained by NC State University provides the most comprehensive and current directory of state and local incentives.

For homeowners in states with strong incentive programs, the combination of state credits, performance payments, and net metering can partially offset the lost federal credit. In New Jersey, for example, the Smart Solar Permitting Act is also reducing soft costs, while SREC-II payments provide ongoing revenue. Our state-specific permitting guides for California, Texas, and Florida cover the full permitting process in these major solar markets.

Why Solar Still Makes Financial Sense in 2026

The loss of the federal tax credit is significant, but it does not eliminate the case for solar. Several factors continue to drive strong economics for residential installations.

Rising Electricity Rates

Residential electricity rates have climbed 32% over the past decade according to EIA electricity data, and since 2022, rates have increased faster than inflation. In New Jersey alone, residential customers saw rate increases of 17% to 20% on June 1, 2025, driven by PJM capacity auction results and surging data center electricity demand. Every month a homeowner waits to install solar is another month paying elevated utility rates instead of generating their own power.

Declining Equipment Costs

Solar panel and inverter prices continue to fall as manufacturing scales. The cost per watt for residential solar has dropped steadily, and increased domestic manufacturing driven by FEOC compliance rules is expected to further improve component availability. Understanding the true costs of solar permitting helps homeowners plan realistic budgets beyond just equipment expenses.

25 to 30 Year Production Lifespan

Solar panels produce electricity for decades. A system installed in 2026 will generate power through the 2050s, accumulating savings that far exceed the initial investment with or without a tax credit. The financial question is not whether solar saves money over its lifetime, but how quickly the investment pays back, and in most markets, payback periods remain under 10 years even without federal incentives.

Battery Storage Value

Battery storage paired with solar is now standard on roughly 40% of residential installations nationwide, and attachment rates exceed 60% in some markets. Batteries provide backup power during outages, enable time-of-use rate optimization, and increase self-consumption of solar energy. Under TPO arrangements, standalone battery storage continues to qualify for the Section 48E credit through 2032, making battery-inclusive systems particularly attractive.

What Homeowners Should Do Right Now

If You Installed Solar in 2025

File your 2025 tax return with IRS Form 5695 to claim the 30% residential credit. The filing deadline is April 15, 2026 (or October 15, 2026 with an extension). Keep all documentation including itemized invoices, payment receipts, manufacturer certifications, and your Permission to Operate (PTO) letter dated 2025. If your credit exceeds your tax liability, the unused portion carries forward to future tax years.

If You Are Considering Solar in 2026

Evaluate your financing options carefully. In states with strong incentives like New York, New Jersey, South Carolina, and Massachusetts, cash purchase or loan financing may still provide excellent returns when state credits and performance payments are factored in. In states with limited local incentives, TPO arrangements through leases or PPAs typically offer the best immediate savings because they access the commercial tax credit.

Get quotes from multiple licensed installers in your area. Ask specifically about their experience with permits in your municipality, as permit timelines vary dramatically by state and even by city. Understanding the grid interconnection process helps you ask informed questions and avoid surprises.

Consider acting before the July 4, 2026 safe harbor deadline. While this deadline primarily affects commercial projects and TPO providers, it creates an industry-wide urgency that may affect installer availability and pricing as the date approaches. TPO providers need to begin construction on projects before this deadline to secure the full credit, so homeowners signing lease or PPA agreements in the first half of 2026 are better positioned than those waiting until late in the year.

If You Are a Solar Installer

The shift to TPO-dominated residential sales requires operational adjustments. Ensure your permit packages and single-line diagrams meet the documentation standards required by TPO financing partners. Verify that your equipment suppliers can provide FEOC compliance certifications. Familiarize your sales team with the lease, PPA, and prepaid product structures now available from major TPO providers.

Understanding current NEC 2023 Article 690 requirements and interconnection agreement processes ensures your installations qualify for both automated permitting platforms and commercial tax credit documentation requirements.

Timeline of Key Solar Tax Credit Dates

| Date | Event | Who Is Affected |

| July 4, 2025 | OBBBA signed into law | All solar stakeholders |

| September 30, 2025 | Clean vehicle credits (Sections 30D, 25E) expired | EV buyers |

| December 31, 2025 | Section 25D (residential solar credit) and Section 25C (home improvement credit) expired | Homeowners purchasing solar |

| January 1, 2026 | FEOC material assistance rules take effect for Section 48E projects | Commercial solar, TPO providers |

| April 15, 2026 | Tax filing deadline for 2025 returns (last chance to claim 25D credit) | Homeowners who installed in 2025 |

| June 30, 2026 | Section 30C (EV charging), Section 179D (commercial buildings), and Section 45L (new homes) expire | Commercial property, EV infrastructure |

| July 4, 2026 | Safe harbor deadline: solar/wind must begin construction to avoid Dec 2027 placed-in-service deadline | Commercial solar, TPO providers, utility-scale |

| December 31, 2027 | Section 48E and 45Y credits end for solar/wind placed in service after this date (unless safe harbor met) | All commercial and TPO solar |

Conclusion

The OBBBA fundamentally changed the residential solar incentive landscape. The 30% federal tax credit that drove two decades of solar growth is gone for homeowner-purchased systems, and the commercial credits that sustain TPO arrangements face their own sunset by the end of 2027.

But solar in 2026 is not about chasing a single incentive. It is about aligning the right financing structure, whether that is a lease, PPA, prepaid product, or cash purchase, with your goals, your state’s incentive landscape, and your utility reality. Rising electricity costs, strong state programs, proven technology, and 25-plus years of production make solar a sound long-term investment for most homeowners regardless of federal policy.

If you are planning a solar installation in 2026, start by understanding your local permitting requirements. Our guides for California, Texas, Florida, and Oregon cover state-specific processes. For a broader view of timelines, see our average solar permit timeline by state guide.

Solar Permit Solutions provides comprehensive residential solar design and commercial solar design services nationwide. Whether you are a homeowner navigating the new incentive landscape or an installer preparing permit packages for TPO-financed projects, our team delivers code-compliant designs with fast turnaround times.

References

NREL Solar Permitting Research

IRS Residential Clean Energy Credit

One Big Beautiful Bill Act (H.R. 1, Public Law 119-21)

SEIA Solar Industry Research Data

DSIRE: Database of State Incentives for Renewables and Efficiency

DOE Homeowner’s Guide to Solar Tax Credit

NYU Tax Law Center: Navigating OBBBA

Frequently Asked Questions

Homeowner Going Solar?

Get the permit-ready plan set your city requires — delivered fast so your solar project stays on schedule.

Frequently Asked Questions

No, not for homeowner-purchased systems. The residential Section 25D credit expired December 31, 2025. However, the commercial Section 48E credit remains available for third-party owned solar installations (leases and PPAs) through the end of 2027, provided construction begins by July 4, 2026, or the system is placed in service by December 31, 2027.

The One Big Beautiful Bill Act (H.R. 1, Public Law 119-21), signed July 4, 2025, ended the 30% residential solar tax credit nearly a decade ahead of its scheduled 2034 expiration under the Inflation Reduction Act. It also accelerated the sunset of commercial solar credits, introduced strict FEOC equipment sourcing rules, and eliminated credits for leased residential solar water heating and small wind energy property (though leased solar electric property was preserved).

Yes. Solar leases and PPAs qualify for the Section 48E commercial investment tax credit because the TPO company owns the system and claims the credit. Providers pass savings through to homeowners via lower monthly payments or reduced per-kilowatt-hour rates. This remains the primary path to federal solar incentives for residential installations in 2026. Learn more in our complete TPO solar guide.

The OBBBA denies tax credits to projects receiving material assistance from prohibited foreign entities, primarily companies with ties to China. Starting in 2026, projects must meet minimum non-FEOC cost ratios that increase annually. For solar facilities, the threshold starts at 40% for projects beginning construction in 2026 and rises to 60% by 2030. Energy storage technology has separate, higher thresholds starting at 55% in 2026 and reaching 75% by 2030. Treasury must publish safe harbor tables by December 31, 2026.

Commercial and utility-scale solar projects (including TPO residential systems) must begin construction by July 4, 2026, to avoid the hard December 31, 2027, placed-in-service deadline for Section 48E and 45Y credits. Projects meeting this safe harbor have four years from construction commencement to complete and place the system in service.

Many states offer incentives independent of the federal credit, including state tax credits (New York at 25%, South Carolina at 25%, Massachusetts at 15%), performance-based payments (New Jersey SREC-II, Massachusetts SMART, Illinois Adjustable Block Program), net metering, and property and sales tax exemptions. The DSIRE database provides the most current directory of all available programs.

Yes, for most homeowners. Residential electricity rates have increased 32% over the past decade, and solar panels produce power for 25 to 30 years. The combination of long-term energy savings, state incentives, TPO access to commercial credits, rising utility rates, and increased home value makes solar a strong investment even without the Section 25D credit. Payback periods vary by location but remain under 10 years in most major solar markets.

Yes. Systems placed in service by December 31, 2025, qualify for the 30% Section 25D credit. File IRS Form 5695 with your 2025 tax return by April 15, 2026 (or October 15, 2026 with an extension). The IRS defines "placed in service" as fully installed, operational, and capable of generating electricity. Unused credit carries forward to future tax years. Our IRS documentation guide covers the filing process in detail.

SPS Editorial Team

Solar Permit Solutions

Solar Permit Solutions provides professional solar permit design services for residential, commercial, and off-grid installations across all 50 states. Our team ensures permit-ready plan sets delivered fast.

Related Articles

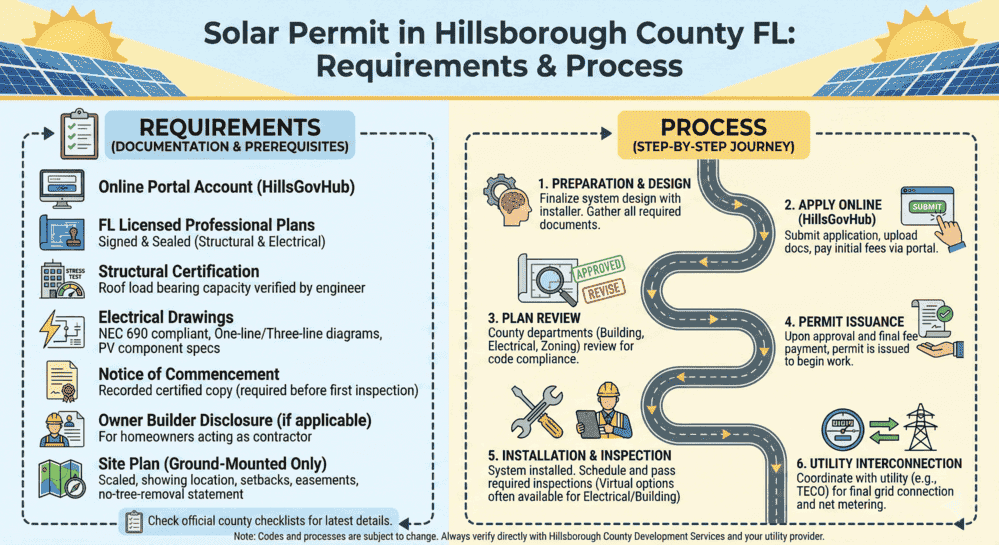

Solar Permit in Hillsborough County FL: Requirements & Process

Hillsborough County solar permits require either an Electrical Trade permit for ...

Solar Structural Engineering Calculations: A Complete Guide

Learn solar structural engineering calculations for safe, efficient installation...

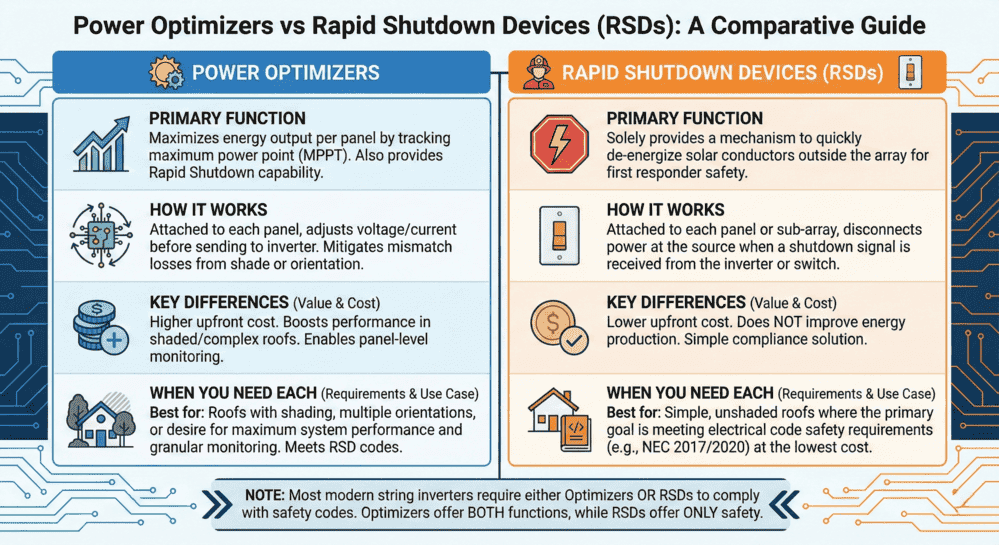

Power Optimizers vs Rapid Shutdown Devices: Differences, Requirements & When You Need Each

When planning a solar installation, understanding the difference between rapid s...